The Uneasy State of U.S. Retirement Saving Today

This was 2022 in a nutshell: more people are saving for retirement but they’re not saving nearly enough.

Every year, Vanguard releases its report on the state of the nation’s habits around saving for retirement. Participation among workers with access to 401(k) plans has jumped over the past five years from 72 percent to 83 percent in 2022, according to the newest report on the 401(k) plans in Vanguard’s large client base.

Some credit goes to the growing popularity among employers of automatically enrolling workers in their plans. Under this corporate policy, employee participation in 401(k)-style plans is 93 percent, versus just 70 percent when they don’t get that nudge and are left on their own to decide whether to save. More states are also requiring employers to either set up an in-house 401(k) plan or automatically enroll their workers in a state-sponsored IRA, which may also be giving a very small boost to saving.

But a closer look at Vanguard’s data reveals a split between the haves and have-nots. People earning high incomes have very high participation rates but it’s lagging for low-income workers. Research does show that the state IRA programs are reaching more low-wage workers. Still, according to Vanguard, only about half of the people earning less than $30,000 were saving last year, compared with more than 90 percent of people earning over $100,000.

But even the workers who do regularly deposit money into their 401(k) accounts aren’t saving enough, and the drop in the stock market last year did a lot of damage.

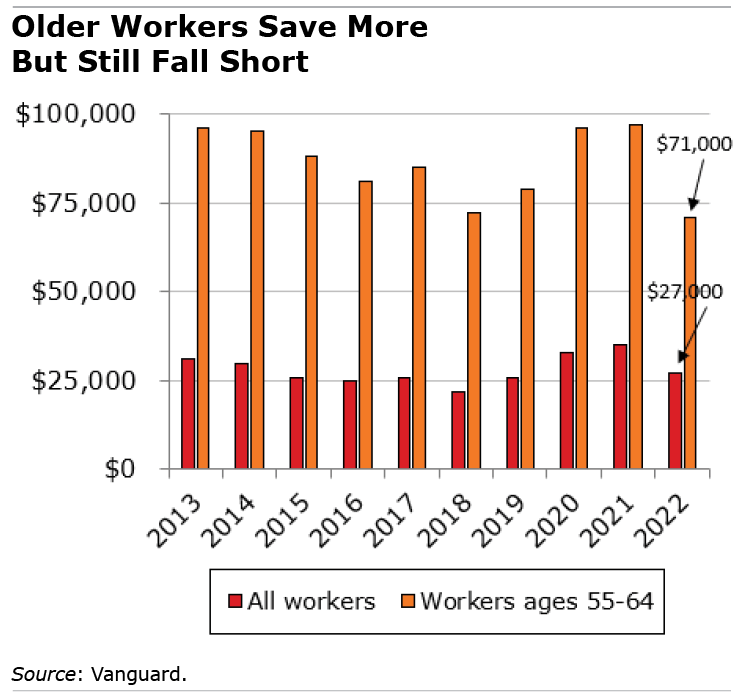

The Standard & Poor’s 500 market index lost nearly 20 percent in 2022, reducing the typical worker’s 401(k) balance to a paltry $27,400. That was down from an already-low $35,300 in 2021. A decade ago, the comparable balance was $2,000 more!

To be fair, the stock market has rebounded smartly this year. And the small 2022 balances are an imprecise gauge of how Americans are doing, because they include workers who are just starting their careers or have only recently started saving in a state IRA program and still have small account balances. The workers in Vanguard’s data also might have money in a IRA or former employer’s 401(k), or their spouse might have a 401(k).

So let’s see how things are going for the older labor force who should, by now, have hefty amounts in their retirement plans. The typical worker between 55- and 64-years-old, who is on the runway to retirement, has just $71,000 in a 401(k). That is the lowest level in that age group in more than 10 years of Vanguard data, and it won’t generate more than a few hundred dollars a month in retirement income.

Let’s hope Vanguard’s 2023 report will be better – and it might be. Four in 10 workers are putting a larger percentage of their paychecks into their 401(k)s, according to Vanguard, and the stock market rise will buoy workers’ balances.

It’d be tough to do much worse than 2022.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

One factor affecting the low savings rate is the ever-increasing costs of healthcare and the employee’s share of their health insurance coverage. The cost-of-living pay raises lag behind the annual increases in health insurance premiums and out-of-pocket costs that these employees pay. They get pay raises but after inflation and healthcare costs they are going backward financially.

I get very tired of these “studies”. It is obvious that higher-earning workers can save more than those that only make $30,000 per year. Where do these people think that the money will come from with lower-earning people needing to pay high inflationary prices just to get by? Many have student loans and the amount quoted with higher prices for mortgage interest and rent..this seems obvious. It does not take a rocket scientist to see that the less one earns the less they can save. In addition, many people have taken money from their accounts to also supplement daily living expenses.

No matter what your income, you have to ‘save for a rainy day’. If you’re not saving anything, regardless of income, you are doomed. Some folks don’t understand that saving something is much better than saving nothing. Start saving before paying bills and spending. It’s so trite to say pay yourself first, but it’s also so true.

Exactly!! People making less than $30k can barely keep the lights on! Saving money is awesome, but people first need to pay for rent or their mortgage, food, utilities, etc.

You should also mention that Social Security is steeply progressive on the benefit end. Low income workers receive Social Security benefits that are a substantially larger share of their working income, making it easier for them to continue with the same standard of living. Higher income workers receive Social Security benefits that are a much smaller share of their working income, making it harder to continue the same standard of living.