Trump’s Policies Are Undermining Retirement Security

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Impulsive initiatives are putting Social Security, the stock market, and the economy itself at risk.

By attacking Social Security, crashing the stock market, and imposing unconscionable tariffs that will increase both unemployment and prices, Trump has taken aim at the retirement security of millions of American families.

The attack on Social Security is shameful. The initial foray was justified by the widely debunked claim that 20 million dead people were receiving benefits. Despite no evidence of widespread “waste, fraud, or abuse” and already-existing customer-service challenges, the agency has announced plans to cut 7,000 staff and close six regional offices; and more cuts may be on the way. As a result, millions of Americans will find it really hard to access benefits that they have earned over a lifetime of work.

Even more concerning, DOGE plans to rebuild Social Security computer’s code in months, where experts agree that rewriting that code safely would take years. It’s true that Social Security’s system, like those of many government agencies, contains code written in COBOL, a programming language created in the 1950s. It needs to be updated, but it’s hard to fix a bicycle while you’re riding it. The agency could never get all of the resources it needed to construct a whole new system and then migrate the files. Now might be the time to begin such an initiative, but take the time to do it properly. A rushed job will produce cascading failures, with people getting wrong benefits, waiting ages to get their benefits, or getting no benefits at all.

Crashing Social Security’s computer systems would be catastrophic, with more than 13 million Americans almost totally reliant on Social Security for retirement income. The fact that they might ultimately receive their promised amounts cannot compensate for the devastation that would be caused in the short run.

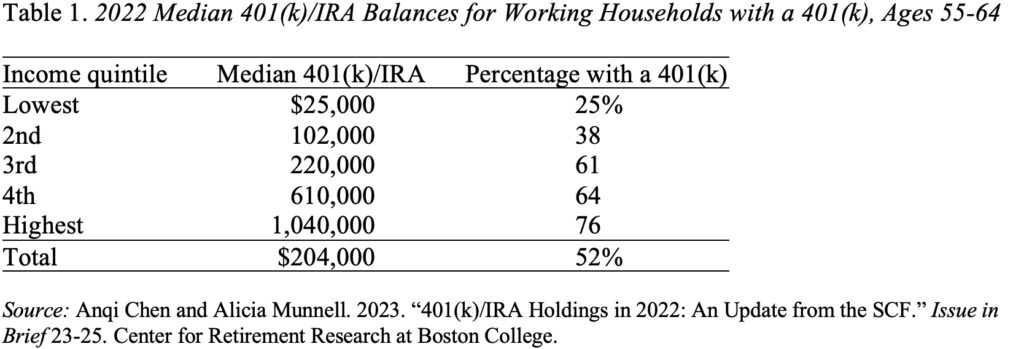

The damage to retirement security goes beyond the attack on the Social Security Administration. Many private sector workers and most new retirees now rely on the assets in their 401(k) plans (and rollovers to Individual Retirement Accounts) to supplement their Social Security benefits. The Federal Reserve’s Survey of Consumer Finances provides a comprehensive picture of the holdings in these accounts among households approaching retirement in 2022 – the most recent data available. These balances are modest for all but the top income quintile. Importantly, they are mostly invested in equities, and therefore very dependent on the performance of the stock market. In the wake of Trump’s tariff announcement, the indices declined by more than 10 percent. If the markets continue to tank, retirements will be at risk.

Finally, Trump’s tariff policies have the potential to hurt the broader economy both by increasing layoffs and prices. To the extent that workers lose their jobs, they will not be able to contribute to their 401(k) and may be forced to withdraw assets to support themselves. And to the extent that tariffs lead to higher prices, even those who stay employed will find they need to spend more to maintain their standard of living, making them less able to save. In addition, inflation will erode the value of existing assets.

The next update to the Center’s National Retirement Risk Index, which measures the percentage of today’s working households unable to maintain their standard of living in retirement, will be based on the Federal Reserve’s Survey of Consumer Finances for 2025. In 2022, primarily due to the appreciation in house prices, the news was good (see Figure 1). Only 39 percent of working households were projected to be at risk. Based on the economy’s current trajectory, the results for 2025 may well show an increase that approaches levels seen during the Great Recession – with more than half of households at risk in retirement.