Lack of Coverage Is the Biggest Problem with Our Retirement System

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

New study helps clarify the challenge of counting the uncovered.

In my view, the lack of continuous coverage under a workplace retirement plan is the most serious problem with our nation’s retirement system. The result is that many end up with no retirement savings other than Social Security and others, who weave in and out of coverage, with remarkably small 401(k) balances.

For many years, we relied on coverage data from the Current Population Survey (CPS), the Census Bureau’s longstanding survey of labor-force participation activity and employment. In the March supplement to the monthly survey, the CPS asks detailed questions about prior year labor-force participation and earnings, including about whether an individual’s employer: 1) offered some type of workplace retirement plan; and 2) whether the individual participated in that plan. The advantage of the CPS is that coverage statistics were available for decades and offered extensive demographic details and locational information about the uncovered.

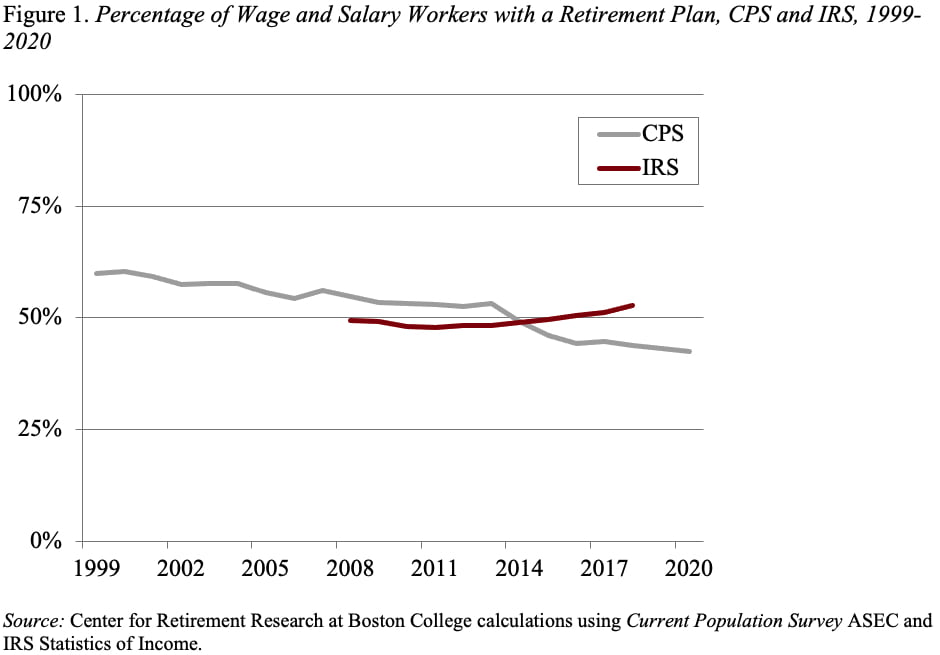

Two things happened that made the CPS no longer usable for coverage statistics. First, the Internal Revenue Service (IRS) began in 2013 to release data from W-2 filings on the percentage of total wage and salary workers who had: 1) either ticked a box saying they had coverage under an employer-sponsored retirement plan; or 2) contributed to a workplace retirement plan. These IRS numbers serve as an important benchmark for judging the accuracy of the CPS coverage statistics.

Second, the CPS coverage rates took a nose dive after a 2014 redesign (see Figure 1). Although the CPS coverage questions did not change, new questions were inserted before the coverage questions. The new questions – designed to get a better measure of income – asked about the existence of and withdrawals from retirement accounts and referred directly to several different types of accounts, including 401(k)s, 403(b)s, and various types of IRAs. In a recent paper, John Sabelhaus suggests that when the existing coverage questions were asked at a later point in the survey, some respondents might have perceived that they were asking about additional retirement plans. Regardless, the CPS is undercounting people covered by a workplace retirement plan.

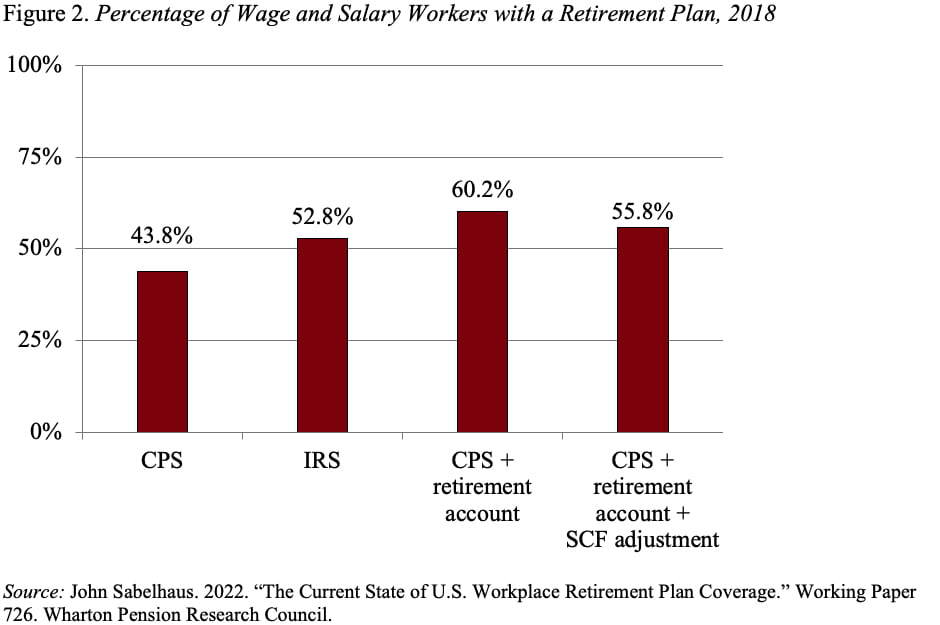

Sabelhaus and others suggest that the new questions from the CPS redesign might be helpful in getting a better measure of coverage. That is, a person providing an affirmative response to either the traditional coverage questions or to having positive account balances would be considered covered. The problem is that adding observed retirement accounts overcorrects for problems in the CPS. The likely issue is that some people with retirement accounts may no longer have retirement plan coverage through their current job. To solve that problem requires turning to the Federal Reserve’s Survey of Consumer Finances to calculate the percentage of those with balances who also have coverage at their current job and randomly assign coverage. Figure 2 shows that applying this two-step procedure for 2018 produces CPS coverage rates only slightly higher than the IRS data.

This whole reconciliation exercise was carried out looking at total wage and salary workers. My focus has always been private sector workers, because public sector workers are virtually all covered by a retirement plan. Fortunately, at the end of the paper he presents estimates for the percentage of private sector workers ages 18-65 covered by a retirement plan. His estimate is 52 percent for the period 2019-2021. That means 48 percent are not covered. And that remains a big problem.