Roth IRA and Roth 401(k): The World Would Be a Better Place without Them

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

They distort federal budgeting, enable billionaires to accumulate wealth tax free, and preclude making tax incentives fairer.

One can make a strong case for getting rid of the Roth version of both 401(k)s and IRAs. While having two forms of retirement saving is lovely for young professionals who know their tax rates will be higher in the future than today, this opportunity is swamped by the mischief they create. Let’s look at the three major issues.

Federal Budget Gimmick. In contrast to traditional forms of tax incentives where the worker can deduct contributions and defer taxes to retirement, the Roth version requires the participant to contribute after tax-income and then receive accumulations tax free in retirement. These provisions mean that with the traditional plans the Treasury takes an up-front hit but recoups the money when accumulations are withdrawn in retirement. With the Roth approach, the Treasury forgoes no revenues in the short run but sees no revenues from withdrawals at retirement. So switching from the traditional to Roth format boosts revenues in the near term and reduces them in the long term. The reduction in revenues that would occur outside the 10-year window does not count for budget scoring purposes

The most egregious conversation over “Rothification” occurred in 2017, when Congress considered requiring that all employee contributions to 401(k)s above $2,400 would go to a Roth. Although “Rothification” was not included in the 2017 legislation, it is alive and well today. The primary source of funding for the House’s bipartisan retirement bill (SECURE 2.0)

is the conversion of all catch-up contributions (post-age-50) to a Roth tax treatment.

Tax Dodge for High Rollers. Pro-Publica reported that billionaire Peter Thiel has a Roth IRA with a value of more than $5 billion. The problem is that Peter Thiel and other entrepreneurs are able to buy a large number of shares at a fraction of a penny per share and put them in a Roth IRA where they can grow in value untaxed. And, according to the Joint Tax Committee, roughly 28,615 taxpayers have IRAs with more than $5 million. Together these accounts hold $280 billion. Congress could solve this specific problem by banning all non-publicly traded shares from Roth IRAs and introducing a cap so that holdings in excess of, say, $5 or $10 million would no longer be eligible for tax-free appreciation. But nothing happens, so the abuse continues.

Obstacle to Fairer Tax Incentives. Most retirement saving occurs through traditional 401(k) plans, where as noted above, the participant takes an immediate deduction for contributions. This system is patently unfair and inefficient. It gives the biggest incentive to high earners who are the most likely to save on their own. If a single earner in the top income tax bracket contributes $1,000, he saves $370 in taxes. For a single earner in the 12-percent tax bracket, that $1,000 deduction is worth only $120.

In response, many academics have suggested changing the deduction to a credit. In fact, during the campaign the Biden team had a proposal to replace the current deductions with a credit that was estimated to be 26 percent – a revenue neutral change. With such a shift, both low and high earners would receive a tax credit of $260 for every $1,000 they contribute to a retirement plan.

However, the plan would not work in the current environment. As soon as the credit is introduced, any self-respecting high earner would shift contributions to a Roth 401(k). The result would be a loss to the Treasury as the high earners retain all their tax breaks and the lower paid get more. The only way to move from a deduction to a credit is to eliminate Roths. (Some movement from deductions to credits would also need to involve parallel changes to defined benefit (DB) plans or clever lawyers will construct DB alternatives for high earners).

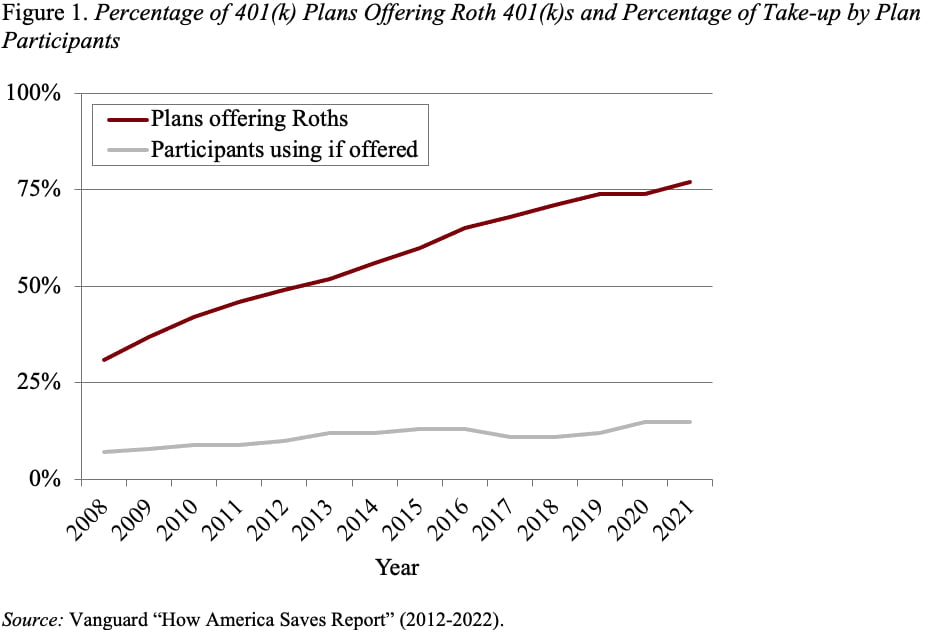

So, there you have it – three really good reasons to get rid of Roths. And now’s the time to do it. While the share of plans offering a Roth option has increased substantially, the percentage of participants offered an option that has accepted Roths has remained low (see Figure 1). It’s an easy fix – simply require that all contributions going forward be made to traditional 401(k)s and IRAs. The world would be a better place!