What’s Next for State and Local Pensions?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Changes to actuarial methods will have some effect on reported funded levels.

We have just completed an update on the funded status for our sample of 150 state and local pension plans. The ratio of total assets to liabilities for these plans remained at 72 percent between fiscal years 2012 and 2013. We never expected great results for 2013, because the actuaries value assets on a smoothed basis, generally averaged over five years. That process means that the horrible returns for 2009 are still included in the 2013 numbers. Thus, despite the fact that the stock market surged in 2013 and plans hold more than half of their investments in equities, the actuarially smoothed value of plan assets increased by only 2 percent over the same period.

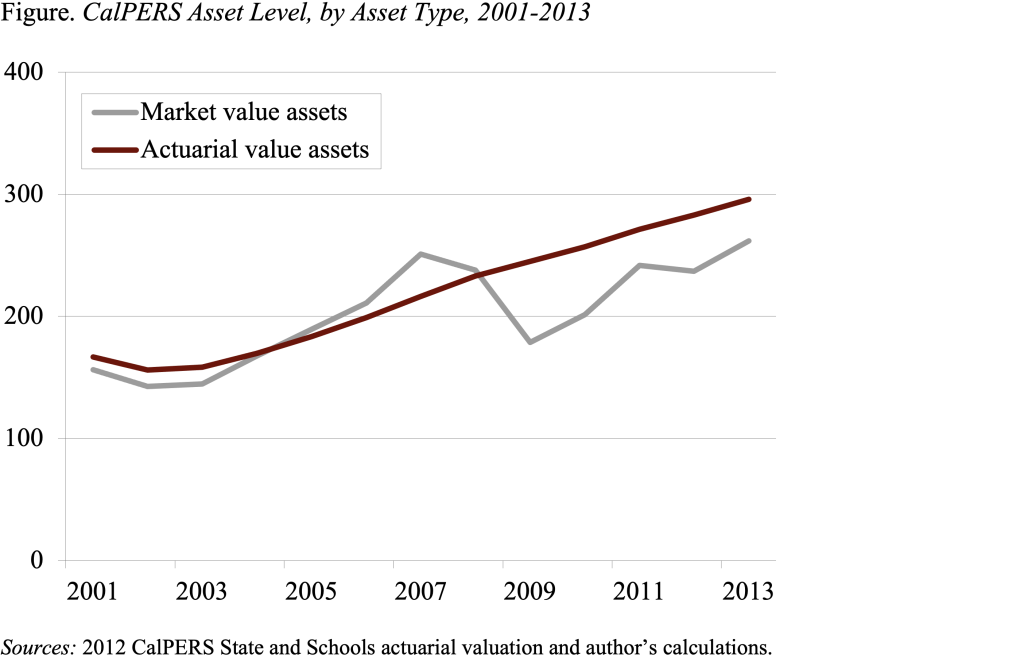

But another factor affected the 2013 numbers as well. The California Public Employees Retirement System (CalPERS), one of the largest plans in the nation, changed its assumptions and the way it values assets, reducing its funded ratio from 83 percent in 2012 to 70 percent in 2013. Roughly half of the change was due to new assumptions and half due to moving to market value of assets. CalPERS had essentially used a 15-year moving average – increasing asset values each year by the assumed return and then adjusting the projected value by one-fifteenth of the experience in any given year. That process meant that only one-fifteenth of, say, the 2009 returns ever entered the calculation. As a result, the actuarially smoothed asset values were much higher than the market values (see Figure), so the shift to market value reduced assets and the funded ratio. If CalPERS had retained its old method, the funded ratio for our sample plans would have increased to 73 percent.

Looking forward, funded levels were always expected to look better in 2014. The main reason is that 2009 rotates out of the actuarial calculation of assets. But things are changing in 2014 as the new standards from the Governmental Accounting Standards Board (GASB) for pension reporting go into effect.

The new GASB standards involve two major changes:

- First, assets will be reported at market value rather than actuarially smoothed. In 2013, market assets surpassed actuarial assets and are projected to continue to outpace actuarial assets in 2014, so the use of market assets should help 2014 funded ratios.

- Second, projected benefit payments will be discounted by a combined rate that reflects the expected return for the portion of liabilities that are projected to be covered by plan assets and the return on high-grade municipal bonds for the portion that is to be covered by other resources. This blended rate would be lower than the expected return (which is currently used to discount benefits) and, thus, would reduce reported funded levels.

It is unclear, though, the extent to which discount rates will really change under the new standard. GASB’s proposed rate requires a complicated calculation based on a number of assumptions, including future contributions from the government and from employees. Plan sponsors can easily assert that adequate contributions will be made and, therefore, assets will always be available to cover projected benefits. In this case, the relevant discount rate reverts to the plan’s expected long-run rate of return.

Of course, financial economists argue that liabilities should be calculated at something closer to a riskless rate to reflect the guaranteed nature of state and local pension benefits. A lower rate would reduce all the funded ratios commensurately. But a move to market assets should still produce an uptick. And, who knows, someday interest rates might even increase.