Who’s Rich? Who’s Middle Class?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

The recently released Census publication Income, Poverty, and Health Insurance Coverage in the United States: 2010 revealed startling increases in poverty since the beginning of the Great Recession. The publication also contains fascinating information on the level and distribution of income. The numbers go to the heart of conversations about the “middle class” and the “rich.”

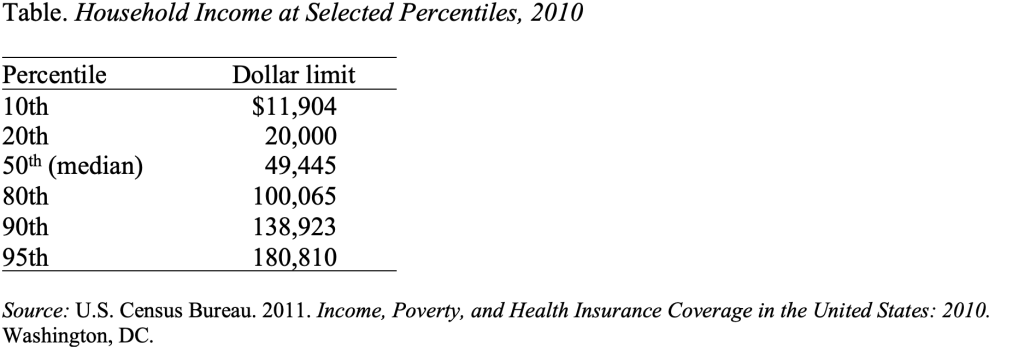

The table below presents the thresholds for being in different parts of the income distribution. For example, a household with income of $49,445 is at the 50th percentile mark – right in the middle of the income distribution. A household with an income of $138,923 is at the 90th percentile point, or in the top tenth of the income distribution. Even more amazing, a household with an income of $180,810 is at the 95th percentile, or in the top 5 percent.

The thresholds must be interpreted with caution because households include old and young, urban and rural, coastal and midland, and small and large. Yet, many of those with $138,923 of household income would be quite surprised to know that they are among the richest 10 percent.

These thresholds come into play in general conversation and in policy debates. When people refer to the middle class, are they really thinking of households with incomes of $49,445? When financial service providers characterize their target market as the mass affluent, are they referring to the 20 percent of households with incomes over $100,065 or are they thinking of a much smaller portion of the population?

In terms of the Social Security debate, many proposals suggest reducing benefits for the “affluent.” Since the maximum taxable earnings for 2011 are $106,800, presumably such reductions would kick in for those with household incomes between the median and the 90th percentile. Do we really believe that households with incomes below $138,923 are so rich that they don’t need current levels of Social Security benefits?

The other issue is the personal income tax. Here the debate has focused on those with incomes above and below $250,000. Clearly, given the Census data, this break occurs somewhere in the top 5 percent of the income distribution. A progressive tax system in which the high income pay a higher percent of their income in taxes is a laudable goal. But to the extent that higher taxes are going to be part of any budget solution, money is going to have to come from a much broader swath of the population than the top 2 or 3 percent of households. Thus, the President should allow the entire package of Bush 2001-2003 tax cuts to expire at the end of 2012.

Regardless of where people stand on the policy issues, they should cut out this little table that appears in the recent Census publication so when they talk about the rich, the middle class, and the poor they have a common household income figure in mind.