Why Enact Tax Cuts in the Face of Rising Deficits?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Future retirees will pay with lower Social Security and Medicare benefits.

Until recently, I have been totally focused on how Congressional tax proposals might affect retirement saving. I have been particularly concerned that forcing everyone to save through a Roth rather than a traditional 401(k) plan would seriously disrupt savings patterns and cause many workers – especially the lower paid and those who are liquidity constrained – to reduce their saving. For the moment, it seems that “Rothification” is off the table. This hiatus makes it possible to step back and look at the big picture. The story, in my view, is not the details of the House or Senate bill and whether the middle class comes out plus or minus a thousand dollars, but rather what tax cuts at this time do to our fiscal structure and their impact on Social Security, Medicare, and Medicaid down the road.

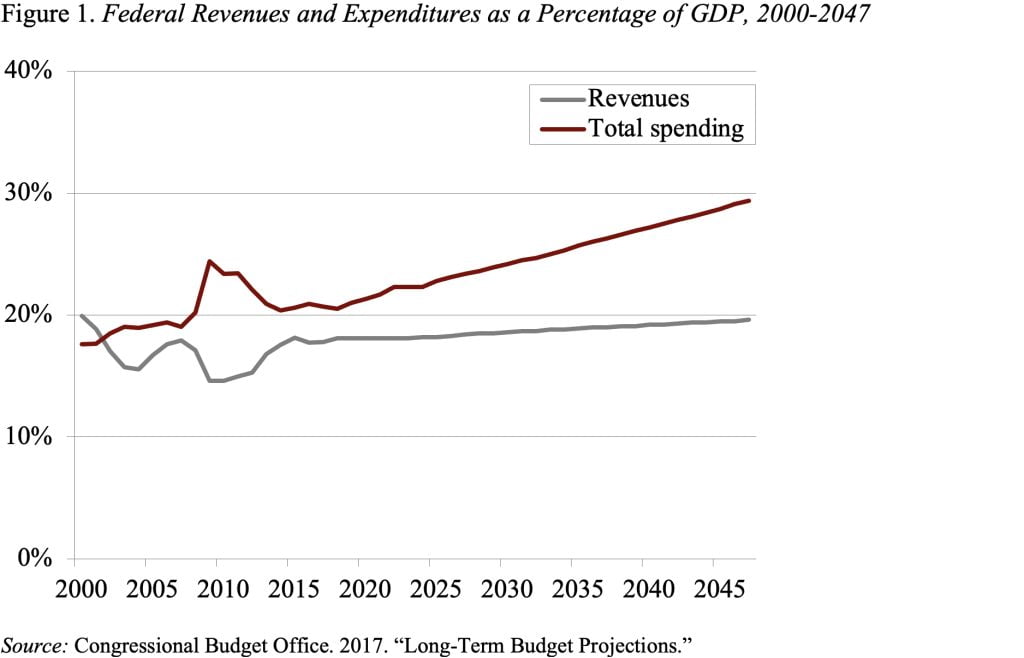

The tax-cutting exercise is being carried out at a time when the Congressional Budget Office projects ever increasing deficits. As shown in Figure 1, spending will exceed revenues by about 2 percent of GDP in 2018, rising to 10 percent of GDP in 2047. Since 2000, deficits have been driven by the Bush tax cuts on the one hand and increased spending due to the costs associated with the Iraq and Afghanistan wars, the response to the Great Recession, the impact of rising health care costs on Medicare and Medicaid outlays, and more Social Security benefits as the Baby Boom retires.

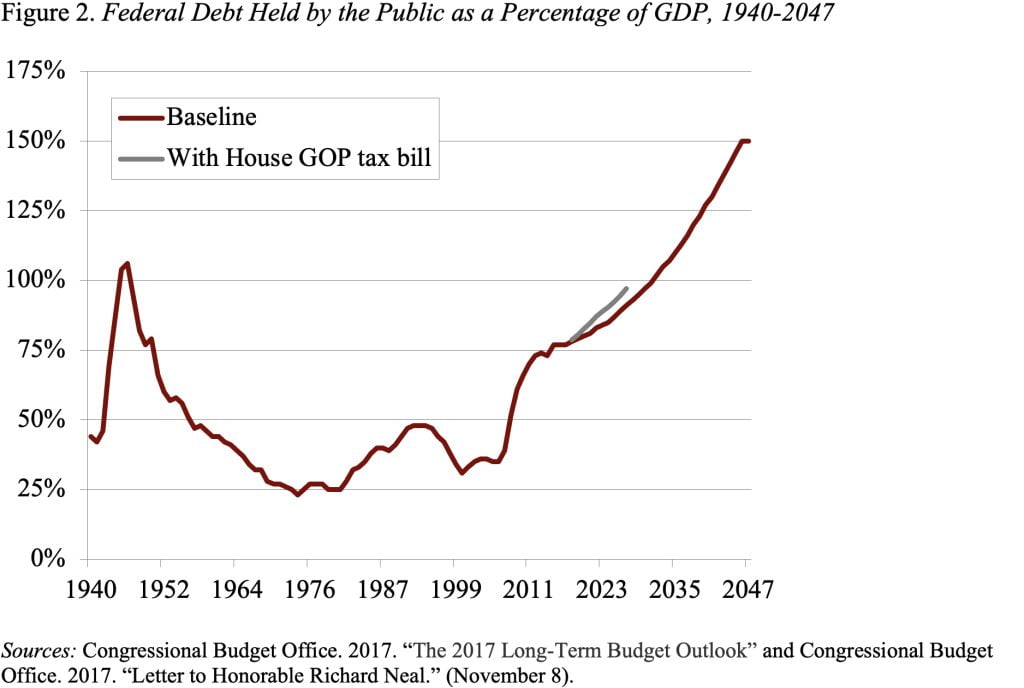

The projected deficits will produce a massive build-up in in public debt, leading to levels far in excess of those experienced during World War II (see Figure 2). And cutting taxes by $1.5 trillion over the next ten years is going to increase that debt by even more than the revenue loss reported for the tax bill because those deficits will require additional interest payments. The Congressional Budget Office estimates that the House bill would raise the level of debt to GDP in 2027 by 6 percentage points. Republicans maintain that the bill will likely pay for itself through faster economic growth but analysts of all stripes have run the numbers and find that the tax package would add to deficits and debt.

Middle-class families will lose far more from increasing deficits and debt than they gain from either the House or Senate tax cut bills. The deteriorating fiscal picture will put enormous pressure on precisely the programs that they need when they retire – namely, Social Security and Medicare. Congress has overridden a budget rule aimed at preventing increases in the deficit by adopting a budget blueprint that allows a $1.5 trillion tax cut. No one can seriously think this tax cut will pay for itself. Older Americans will pay for this tax cut with lower retirement benefits and inadequate health insurance.