Will Unretirement Help Solve the Labor Shortage?

Introduction

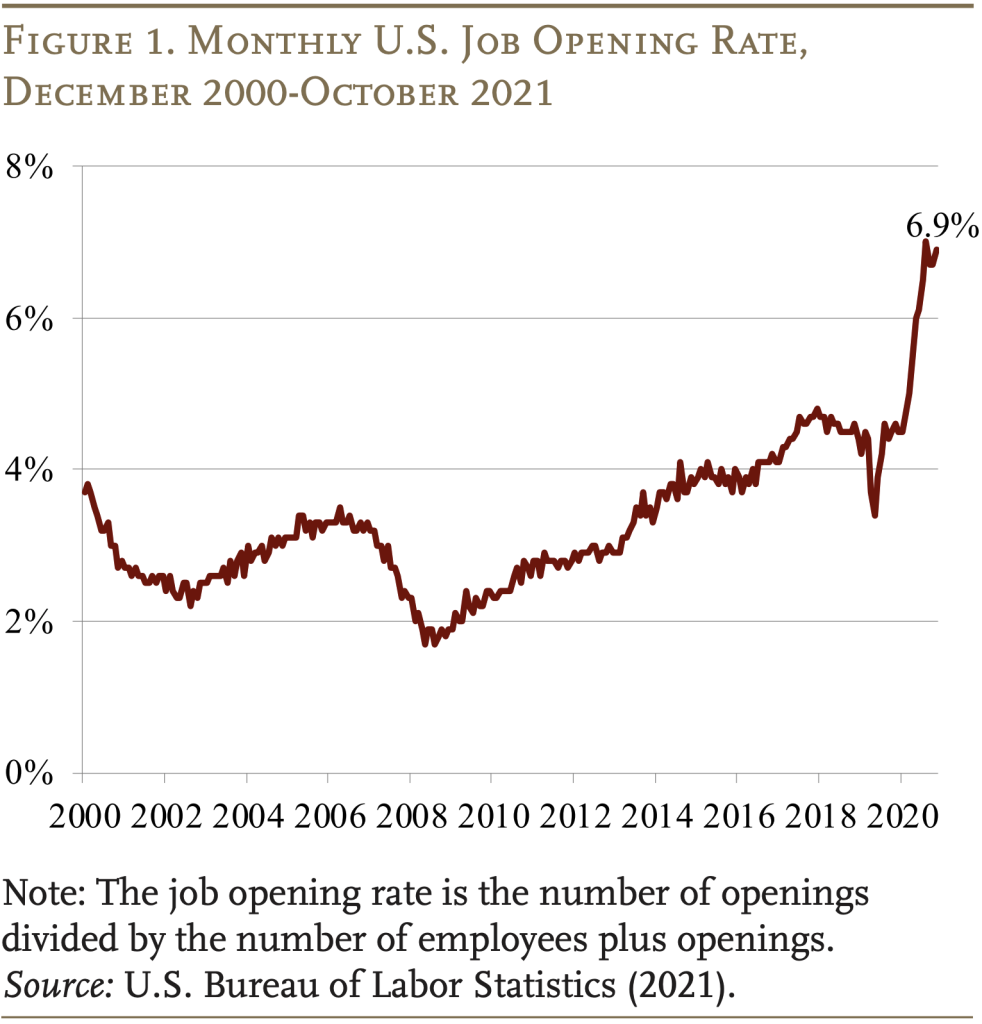

At any given time, a large pool of people ages 55-70 – over 15 million today – indicate they are retired. With the U.S. economy currently facing a labor shortage, the potential return of these retirees to the workforce is an important question. On the one hand, it seems likely that many retired workers could be enticed to return given that the job opening rate is at an all-time high. On the other hand, it is possible that retirement is not a choice easily undone.

To evaluate which scenario is likely to play out, this brief uses the Current Population Survey (CPS) to investigate the extent to which retired individuals reentered the labor force (“unretired”) over the last several decades, and how their response varied by labor market conditions.

The discussion proceeds as follows. The first section provides background on what we know about unretirement. The second section discusses the data and methodology. The third section offers evidence that the rate of unretirement is generally low but is somewhat responsive to a tight labor market, as indicated by high rates of job openings. The final section concludes that the number of retired workers reentering the labor force as the economy continues to recover is likely to be non-trivial, but small relative to the size of the labor shortage.

Background

Past research into unretirement among older workers offers a few lessons for the current situation. The most basic lesson is that, in any given year, few individuals who are retired return to the labor force.1See Burtless (2016), who finds rates of year-over-year return below 5 percent among those ages 62+. Of course, this fact does not necessarily mean retired workers will not come back in larger numbers today given the current economic recovery. After all, as Figure 1 shows, the nation’s current rate of job openings – the number of openings relative to the number of workers plus those openings – is the highest it has been since tracking began at the turn of the century.

Yet, even with so many available jobs, it is unclear whether retired workers will flood into labor markets. While prior research suggests that they are less likely to enter the workforce when the economy is tough – including during the COVID recession – it is not clear that they reenter when the situation improves.2For example, see Nie and Yang (2021) in the context of COVID and the Great Recession. Instead, studies tend to find that returning to work was often part of a plan right from the start, after taking time off from a prior job to recover from burnout.3For evidence that workers do not come back in response to financial conditions, see Nichols and Lindner (2013), Maestas (2010), or Coile and Levine (2006). For evidence that burnout plays a role, see Maestas and Li (2006) or Jacobs and Piyapromdee (2016). Still, given the importance of the issue today, it would be helpful to understand what recent historical data imply about unretirement among older workers and its relationship to tight labor market conditions.

Data and Approach

The analysis uses the March Annual Social and Economic Supplement to the CPS, which asks detailed questions about labor force participation and income sources in the prior calendar year.4The data source is Current Population Survey (CPS), March Supplement via Flood et al. (2021). Respondents are surveyed in each of four consecutive months; then are out of the sample for eight months; and then reenter the sample for another four months. This design means that an individual’s fourth and eighth months in the sample occur one year apart. With these data, it is possible to follow workers ages 55-70 from a year when they were retired into the next year to see if they rejoined the ranks of the employed, in order to construct an “unretirement rate.”

The study then explores how the unretirement rate has varied over the last four decades, and in particular how it has responded to tight labor market conditions. Labor market conditions are measured at the state level, using the job opening rate in the year after the person was observed retired – i.e., the year they could reenter the workforce.

The relationship between the job opening rate and unretirement is examined in two ways. The first is simply looking at patterns in the raw data – the share of retirees who unretire in a given year compared to the job offer rate. A positive relationship would suggest that as the labor market tightens, more retired workers reenter the workforce.

The second approach is a regression, which allows us to compare the prevalence of unretirement for similar people living in different states. This comparison would be useful if – for example – areas with a more-educated workforce also experienced larger gains in available jobs over the last several decades relative to those with a less-educated workforce. In addition to education, the regression controls for other factors that might affect the likelihood of return, such as age and Social Security receipt, as indicated in this equation:

Probability of Unretirement = ƒ (job offer rate, age, educ., SS receipt, gender, race)

Results

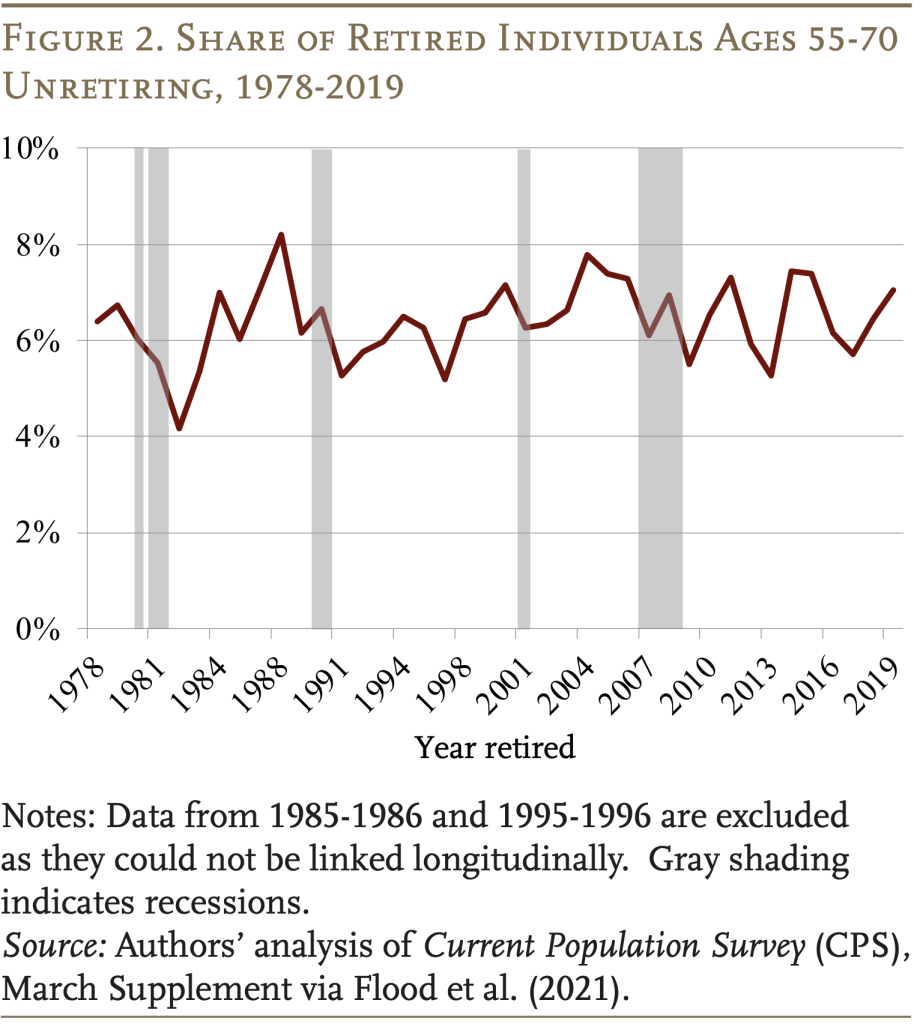

The rate of unretirement has been relatively low over the last four decades, averaging just over 6 percent (see Figure 2).5The analysis also looked at rates of return to the labor force when people were not working in the prior year, regardless of whether or not they said they were retired. Under this definition of not working, the rates of labor force return were very similar, with about 7 percent of these workers returning to the labor force in any year. It is also worth noting that unretirement does not appear to be very sensitive to labor market conditions. For example, in the three years prior to the Great Recession, when the job offer rate was relatively high for that era (see Figure 1), unretirement averaged 7.5 percent. In the three years after the Great Recession, the offer rate was lower, as was unretirement, but only slightly at 6.4 percent. The question is, does this pattern hold more generally – are unretirement rates fairly unresponsive to fluctuations in the labor market?

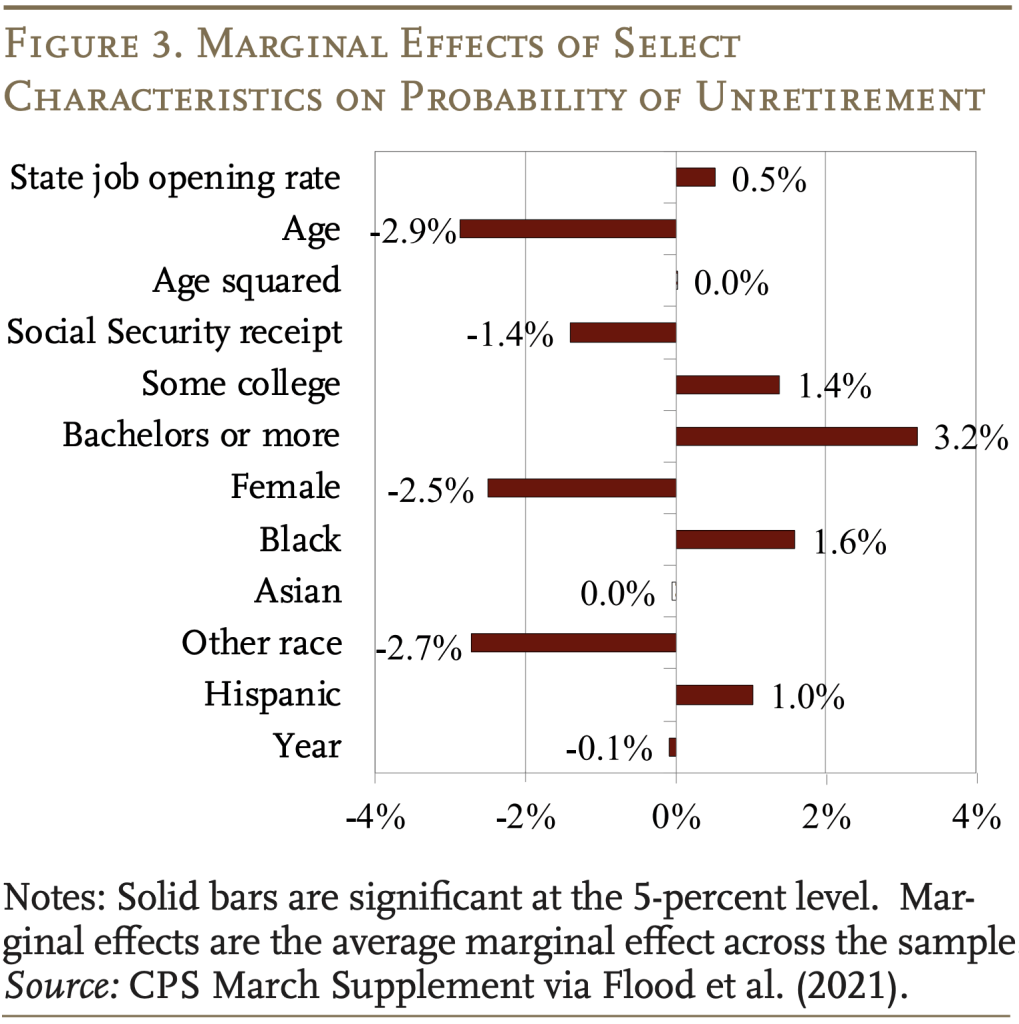

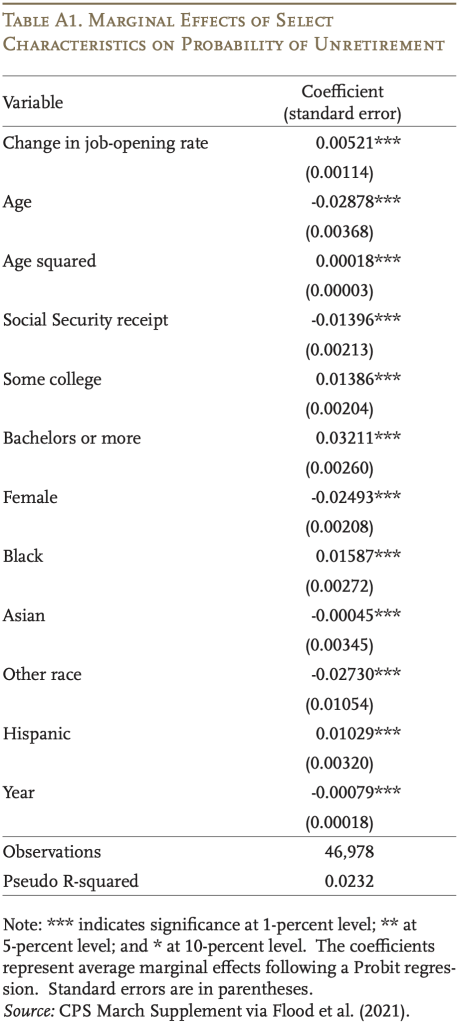

Here’s where regression analysis is useful, as it focuses on the impact of the job opening rate on labor force reentry controlling for other factors. These results show a slightly different picture than the general patterns discussed above. The effect of an increase in the job opening rate on unretirement is statistically significant, though relatively small (see Figure 3).6See Appendix Table A1 for full regression results. A 1-percentage-point increase, year-over-year, in a state’s job opening rate is associated with a 0.5-percentage-point increase in unretirement. The other coefficients imply that relatively younger workers, more educated workers, and men are more likely to reenter employment than others.

To illustrate what these results mean for today’s labor market shortage, note that the current job opening rate is about 3.6 percentage points above its two-decade average of 3.3 percent. Under the regression’s estimate, we could expect 1.9 percent more workers (0.52*3.6) to unretire than typically would during an economic recovery. Given that about 15 million workers ages 55-70 are currently retired, an increase of 1.9 percentage points would represent about 300,000 additional workers, or a little less than one-tenth of the 4-million worker shortage, based on the number of open jobs, relative to February 2020. Certainly, a non-trivial fraction but not a solution to the shortage either.

Still, an important caveat is in order. This regression is estimated using economic improvements from the past several decades, none of which were accompanied by a recovery from a major pandemic that has included a large-scale change in working conditions, particularly the ability to work remotely. So, if the ability to work remotely makes employment more attractive, the unretirement rate could be larger than anticipated based on past experience.

Conclusion

As the U.S. economy faces a labor shortage, one hope is that many currently retired individuals could unretire to help fill the need for workers. The current high rate of job openings should facilitate some of that return, but is likely to provide only a small fraction of the number of workers needed to solve the labor shortage.

A more meaningful reentry of retired workers into the labor market would represent a break in the pattern observed over the past several decades. Then again, in these strange times, when a labor market recovery could also be accompanied by more opportunities to work remotely, such a break does not seem impossible. Researchers should continue to keep on eye on this issue as the COVID situation plays out.

References

Burtless, Gary. 2016. “Labor Force Dynamics in the Great Recession and its Aftermath: Implications for Older Workers.” Working Paper 2016-1. Chestnut Hill, MA: Center for Retirement Research at Boston College.

Coile, Courtney C. and Phillip B. Levine. 2006. “Bulls, Bears, and Retirement Behavior.” Industrial and Labor Relations Review 59(3): 408-429.

Flood, Sarah, Miriam King, Renae Rodgers, Steven Ruggles, J. Robert Warren, and Michael Westberry. 2021. Integrated Public Use Microdata Series, Current Population Survey: Version 9.0 [dataset]. Minneapolis, MN: IPUMS.

Jacobs, Lindsay and Suphanit Piyapromdee. 2016. “Labor Force Transitions at Older Ages: Burnout, Recovery, and Reverse Retirement.” Working Paper. Washington, DC: U.S. Board of Governors of the Federal Reserve System.

Maestas, Nicole. 2010. “Back to Work: Expectations and Realizations of Work after Retirement.” Journal of Human Resources 45(3): 718-748.

Maestas, Nicole and Xiaoyan Li. 2006. “Discouraged Workers? Job Search Outcomes of Older Americans.” Working Paper 133. Ann Arbor, MI: Michigan Retirement Research Center.

Nichols, Austin and Stephan Lindner. 2013. “Why Are Fewer People in the Labor Force During the Great Recession?” Unemployment and Recovery Project Brief 16. Washington, DC: Urban Institute.

Nie, Jun and Shu-Kuei X. Yang. 2021. “What Has Driven the Recent Increase in Retirements?” KcFED Economic Bulletin. Kansas City, MO: Federal Reserve Bank of Kansas City.

U.S. Bureau of Labor Statistics. 2021. “Job Opening Rate.” Washington, DC. Accessed from https://fred.stlouisfed.org/series/JTSJOR on December 21, 2021.

Appendix

Endnotes

- 1See Burtless (2016), who finds rates of year-over-year return below 5 percent among those ages 62+.

- 2For example, see Nie and Yang (2021) in the context of COVID and the Great Recession.

- 3For evidence that workers do not come back in response to financial conditions, see Nichols and Lindner (2013), Maestas (2010), or Coile and Levine (2006). For evidence that burnout plays a role, see Maestas and Li (2006) or Jacobs and Piyapromdee (2016).

- 4The data source is Current Population Survey (CPS), March Supplement via Flood et al. (2021). Respondents are surveyed in each of four consecutive months; then are out of the sample for eight months; and then reenter the sample for another four months. This design means that an individual’s fourth and eighth months in the sample occur one year apart.

- 5The analysis also looked at rates of return to the labor force when people were not working in the prior year, regardless of whether or not they said they were retired. Under this definition of not working, the rates of labor force return were very similar, with about 7 percent of these workers returning to the labor force in any year.

- 6See Appendix Table A1 for full regression results.