Would 401(k) Participants Use a Social Security “Bridge” Option?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Recent experiment suggests they’re interested, and more information would increase participation.

Although annuities would ensure retirees higher levels of lifetime income, reduce their likelihood of outliving their resources, and alleviate some of the anxiety associated with post-retirement investing, the market for annuity products is miniscule. Explanations for the low demand include the high cost of private annuities due to adverse selection, a reluctance to hand over a pile of accumulated assets for a stream of future income, and a failure to understand the value of insurance against outliving one’s resources.

To address these impediments, employers could increase the availability of lifetime income by adopting a Social Security “bridge” strategy within their 401(k) plans. The bridge option would use 401(k) assets to pay retirees an amount equivalent to their Social Security benefits so they can postpone claiming benefits, thereby increasing their monthly payment when they do eventually claim.

To gauge the interest of 401(k) participants in an employer-facilitated bridge, my colleague and I engaged NORC from the University of Chicago to survey a representative sample of employees with 401(k) accounts. The “bridge” was briefly explained to them, and then they were asked whether they would participate and how much of their 401(k) balances they would like to allocate to the strategy.

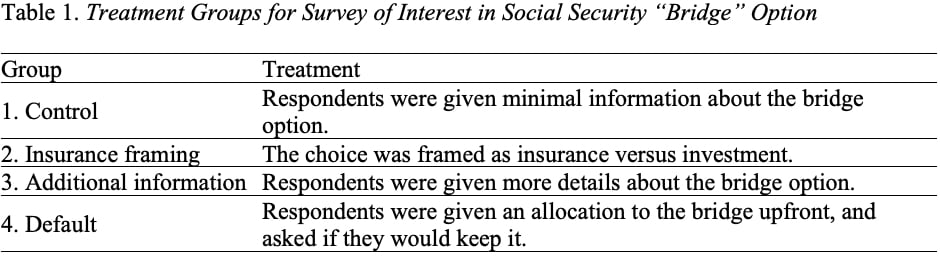

Respondents were presented with the bridge in different ways to assess potential barriers to adoption and how to overcome them. Respondents were randomly assigned to one of four groups as shown in Table 1. Each group was presented the choice of whether to participate in the bridge option, and how much of their 401(k) assets to allocate to that option.

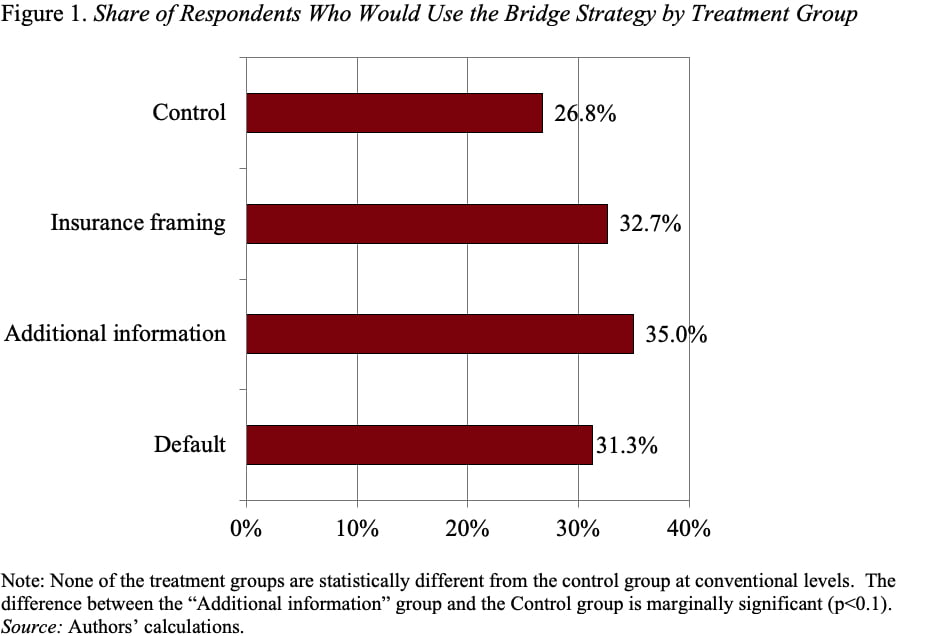

The results showed that, in the control group, 26.8 percent of respondents said they would use the bridge to some extent. Those in the additional information group were marginally significantly more likely to use the bridge than the control group, yielding a total of 35 percent of this group. The other treatment groups were between the control and additional information groups, at just under one third of each group, with none of the differences significant at conventional levels.

The substantial interest in the bridge strategy is noteworthy, given that the survey is likely the first time that respondents would have encountered the idea of drawing down their 401(k)s to postpone claiming Social Security. The results also compare favorably with the share of workers who choose annuities in existing plans that offer lifetime income options; for example, in 2018 only 30.5 percent of TIAA beneficiaries elected a lifetime income option. That any additional information seems to increase interest in the bridge approach suggests the popularity of the option would increase with additional exposure.