2016 Survey of Consumer Finances Shows Increase in 401(k)/IRA Balances

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

The Federal Reserve recently released the 2016 Survey of Consumer Finances (SCF), a triennial survey of a nationally representative sample of U.S. households, which collects detailed data on their assets, liabilities, and demographic characteristics. It is considered the gold standard of information on income and wealth. Overall, this year’s report, unlike those in 2013 and 2010 surveys, is quite upbeat. For American households, both median income and median wealth have increased markedly since 2013.

But retirement is our game, so we turned immediately to combined 401(k)/IRA balances – particularly for those approaching retirement. The great advantage of the SCF is that it provides information not only on 401(k) balances, much of which is available from financial services firms, but also on household holdings in IRAs. While 401(k) plans serve as the gateway for retirement saving, more than half of the money collected now resides in IRAs. The relevant question is how much do households hold in these two sources combined.

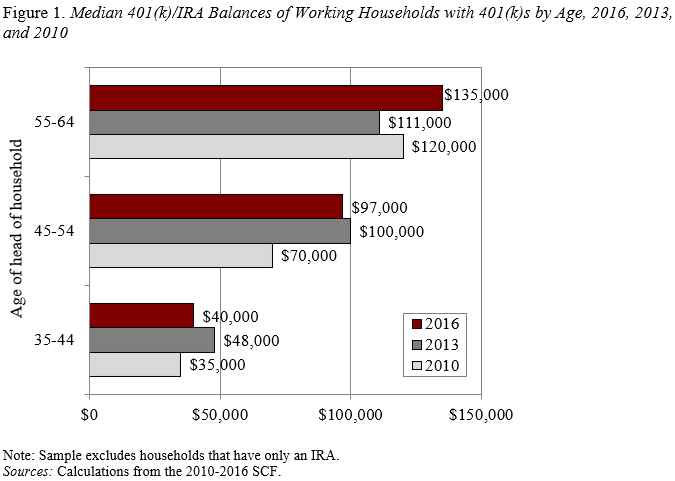

The 2016 SCF shows for working households ages 55-64 that 401(k)/IRA balances increased to $135,000 from $111,000 in 2013 (see Figure 1).

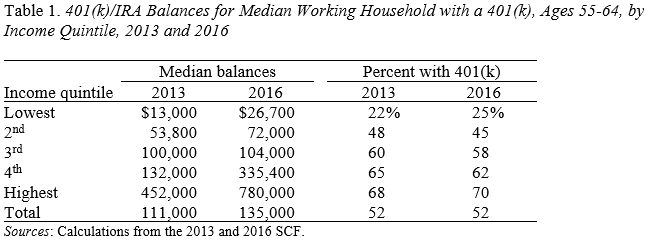

While the median for households approaching retirement was $135,000, the amount and pattern of increase varied significantly by income. Balances for the highest quintile were $780,000 in 2016, a dramatic increase from $452,000 in 2013, and the share of high-income households with 401(k) balances rose to 70 percent (see Table 1). In contrast, for the lowest quintile, even with rapid growth, balances amounted to only $26,700 and only 25 percent of households had a 401(k). Retirement accounts appear to serve as a meaningful source of saving only for the upper three quintiles. Even there, however, a significant percentage of households have no 401(k) balances.