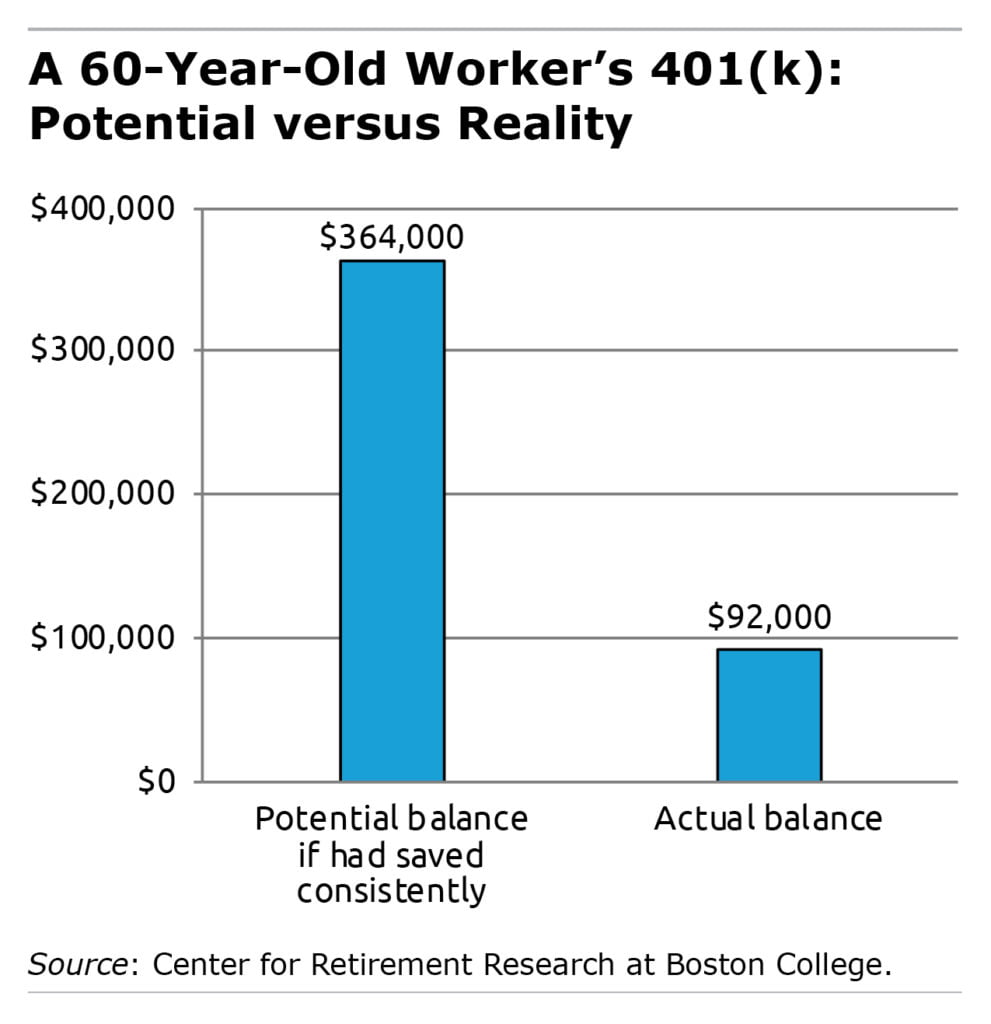

401k Balances are Far Below Potential

If a 60-year-old baby boomer started saving consistently at the beginning of his career back in the 1980s, he would have some $364,000 in his 401(k)s and IRAs today.

How much does he actually have? One-fourth of that, according to a new study from the Center for Retirement Research at Boston College (CRR).

One obvious explanation for the enormous gap is that the 401(k) system was in its infancy in the 1980s, and it took time for employers to widely adopt the plans and for young adults to get into the habit of saving for retirement.

Another likely reason is the large share of workers who do not have any type of employer-sponsored retirement plan. This coverage gap, which predates the introduction of 401(k)s, persists today and leaves about half of private-sector workers without a plan at any given point in time.

And this gap isn’t just a problem for baby boomers. A majority of young workers are not saving in a retirement plan, despite their advantage of having entered the labor force after the 401(k) system was more mature.

Most of the people who aren’t saving are working for employers that don’t have a 401(k). The rest either choose not to participate in their existing employer’s 401(k) or aren’t eligible to do so, often because they’re part-time.

As for the 60-year-old, the lack of universal coverage explains 41 percent – or $112,000 – of that $272,000 shortfall between what he could have in savings and what he actually has, according to the CRR study conducted as part of the Retirement and Disability Research Consortium. This is comparable to the impact of the immature system in his early career, which accounts for another

43 percent of the gap.

A smaller share – 11 percent – has leaked out of 401(k)s and IRAs over time, as individuals have made withdrawals for financial hardships or have left employers and cashed in their account balances. And

5 percent is lost to investment and administrative fees, which were much higher when baby boomers were younger but have come down recently.

Outside of Social Security, 401(k)s and IRAs will be workers’ main source of retirement income. Finding a way to cover everyone with a workplace-based plan would help people improve their retirement security.

To read this study, authored by Andrew Biggs, Alicia Munnell, and Anqi Chen, see “Why are 401(k)/IRA Balances Substantially Below Potential?”

The research reported herein was derived in whole or in part from research activities performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, make any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

Our 401(k) plans worked well for us. We started saving (slowly at first) in 1987; we retired in 2010. At retirement my wife had $392K in her 401(k); I had $297K in mine. Many of our coworkers had similar balances (or more). (Our “game” – in the retirement advisory committee we started – was to see who could most maximize contributions.)

Even without an employer-sponsored retirement plan, and outside of of Social Security and IRAs, private (as well as public) sector employees can choose for themselves to save for retirement in other non-pension related investment vehicles that are widely offered.

At some point excuses have to stop keeping people from doing what they know needs to be done. It almost always comes down to personal choices, not just in how much is saved, but also in the occupation chosen, which directly determines how much is available to save.

Choose well.

It’s interesting to see the impact of expenses in 401(k) plans. It’s become conventional wisdom – and it’s correct – that you’d have to be an idiot today to pay what we used to have no choice but to pay.

I find that one notable reason for diminished balances in the average 401k plan today reflects back to 2008 and 2009, when an average 401k plan lost 40-50% of it’s value in a short time period.

Many investors feel they “recovered their losses” in 2010 and later when a conceived recovery took place, bringing many balances back to pre-2008 “normal.”

What isn’t understood is the fact that you never really recovered the losses you sustained at that time… the market recovered, and as a result your balances returned to pre-2008 crisis status, but the extensive losses still existed.

By adding those losses into today’s average balances as gains, the “historical” balances would have been substantial had the 2008 crisis never occurred.