Experiment Suggests Media Coverage of Social Security Affects Worker Behavior

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Scary press reports could induce people to grab their benefits early, but don’t lead to more saving.

The 2021 Trustees Report projects that Social Security’s Old-Age and Survivors Insurance (OASI) program faces a long-term financing shortfall and that the trust fund will deplete its reserves in little more than a decade, after which payroll tax revenues will cover only about three-quarters of scheduled benefits.

Yet, news coverage of the Trustees Report often emphasizes the trust fund depletion date and de-emphasizes the importance of the ongoing tax revenues. The question is, how do workers respond to this information?

To answer the question, a recent study used an online experiment with participants from the AmeriSpeak panel maintained at the University of Chicago. The participants, who were ages 21-61 and either in the labor force or fully insured for Social Security benefits, were interviewed in June 2021 when the COVID-19 crisis was (at least temporarily) receding. In general, the survey elicited a very high (98+ percent) response rate.

Survey participants were presented with a short news article about the future of Social Security’s finances. While the main text of the article was identical throughout, the headline, which was also repeated as the first line of the text, varied across groups.

The “Control” group saw a headline similar to the summary document for the Trustees Report:

Social Security Faces a Long-Term Financing Shortfall

“Social Security faces a long-term financing shortfall. The Social Security program provides retirement and survivors insurance benefits to workers and their families. Workers earn these benefits by paying into the system during their working years. The Social Security Trustees Report projects that the trust fund will deplete its reserves in 2034, at which point ongoing program revenues are projected to be sufficient to cover about three-quarters of current-law benefits.”

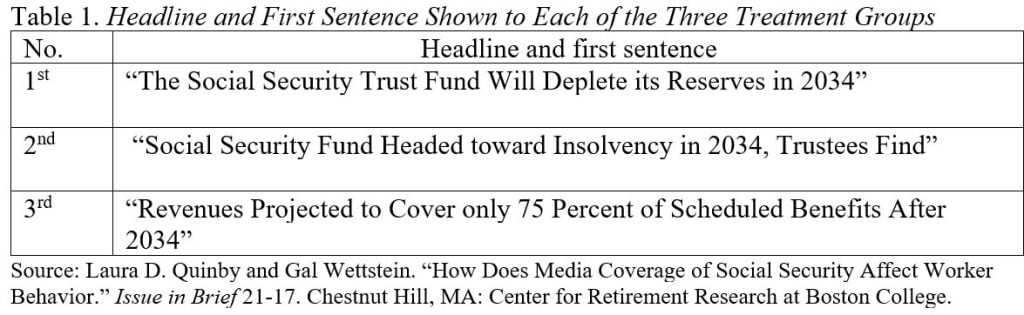

The “Treatment” groups saw three different versions of headlines emphasizing trust fund depletion (see Table 1).

The hypothesis is that, relative to the headline shown to the control group, the three headlines emphasizing the trust fund depletion will make respondents think that a policy change is imminent.

The first exercise assessed whether the headlines changed expected claiming ages from the mean of 66 reported for the control group. The results showed that all of the headlines referencing the trust fund led to earlier claiming than the headline used for the control group. Respondents who saw the first headline (“reserves depleted in 2034”) expect to claim half a year earlier, while those who saw the second headline (“trust fund headed toward insolvency in 2034”) expect to claim a full year earlier, and respondents who saw the third headline (“revenues cover 75 percent of benefits”) plan to claim 0.7 years earlier.

Claiming earlier means that these participants would lock themselves into actuarially reduced benefits. The question is whether participants planned to increase their saving to offset this benefit reduction. Despite the strong effects on claiming, the headlines did not alter respondents’ intended retirement savings rates going forward. Nearly three-quarters of respondents in the control group intend to make no change to their savings rate, and this response is similar across all of the headlines.

These findings suggest that media coverage of the trust fund depletion scares workers. Providing salient information about ongoing program revenues helps align workers’ expectations with a more likely scenario, but may not be sufficient to prevent workers from claiming early. If future beneficiaries follow through with their intention to claim a year earlier, they will lock in lower monthly benefits without increasing their saving to make up the gap.