Increasing Immigration Can Improve the Finances of Social Security

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Are the Social Security Trustees too optimistic?

The 2025 Social Security Trustees Report confirms what has been evident for almost three decades – namely, Social Security is facing a 75-year financing shortfall that currently equals 1.3 percent of GDP. And, if no action is taken before 2033, the depletion of reserves in the retirement trust fund will result in an automatic 23-percent cut in benefits. Also, as widely noted, compared to last year’s report, the metrics are somewhat worse. The projected 75-year deficit rose to 3.82 percent of taxable payroll, compared to 3.50 percent in 2024.

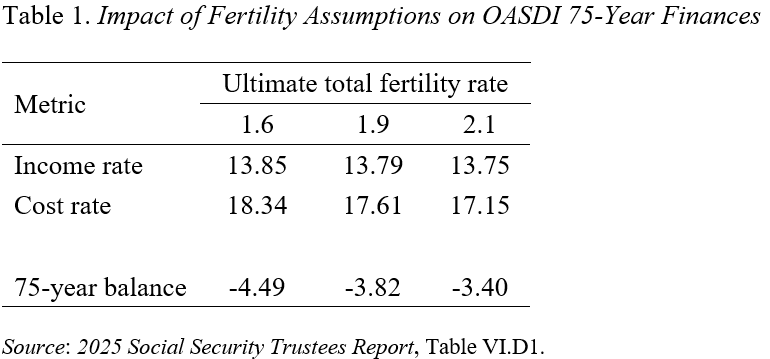

As always, the focus of the Trustees Report and subsequent discussion in the press is based on the Trustees intermediate assumptions. What happens to the cost of the program if the underlying assumptions are too optimistic? An earlier blog argued that our fertility rate – currently 1.63 children – is likely to remain low and result in a 75-year deficit of 4.49 rather than 3.82 percent of taxable payrolls (see Table 1).

The important thing to remember is that producing our own babies is not the only alternative; increasing immigration is a direct way to raise the worker-to-retiree ratio and improve the finances of Social Security. The problem is that we seem to be moving in the wrong direction.

Future patterns of immigration are notoriously difficult to predict; flows depend on economic and political conditions in both the emigrant country and the United States. The task here, however, is much simpler – assessing how the projected patterns could be affected by both current and future Administrations’ attitude towards immigrants and immigration.

Social Security’s immigration projections involve estimating net flows for two types of immigrants – lawful permanent residents and those present temporarily or unlawfully. Temporary/unlawful immigrants include those who entered legally but were only granted temporary authorization (such as students and foreign workers on visas) and those who overstayed their visas, as well as those who entered illegally.

In the 2025 Report, total annual immigration for the two groups – under the intermediate assumptions – averages 1,253,000 for the period 2035 through 2099. Of the total, 788,000 are lawful permanent residents and 465,000 are temporary/unlawful immigrants. The ultimate level of immigration assumptions remained unchanged from last year’s Report. The Social Security projections are fairly consistent with those from other federal agencies.

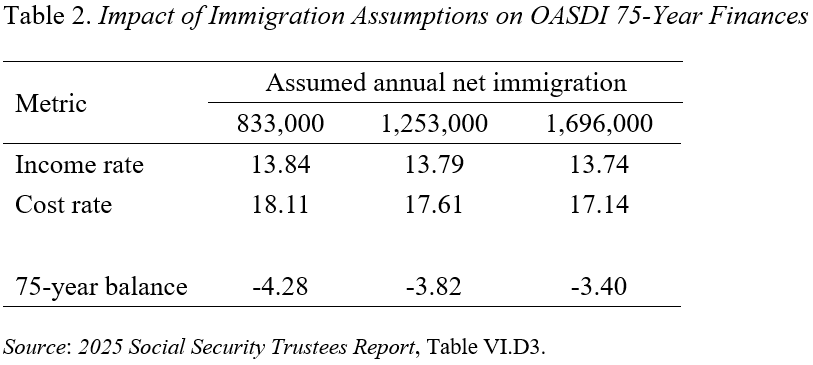

As with other assumptions, the Trustees present both a more optimistic (lower-cost) and more pessimistic (higher-cost) projection for immigration (see Table 2). Additional immigration helps Social Security finances in several ways. First, the cost rate decreases because immigration occurs at relatively young ages, thereby – at least in the short run – lowering the ratio of retirees to workers. Second, temporary/illegal immigrants often contribute to Social Security, but – without a change in their status – temporary immigrants generally do not qualify for benefits and illegal immigrants never do. Third, immigrants tend to have more babies than native-born Americans, thereby raising the domestic fertility rate, which further improves the outlook.

The Administration’s policy is to eliminate all illegal immigration, and its actions – such as, barring foreign students – will likely lead to less legal immigration. If future immigration flows end up closer to the pessimistic assumptions, the 75-year actuarial deficit would look closer to 4.28 percent of taxable payrolls than 3.82 percent.

In addition to reducing the flows of future immigrants, President Trump campaigned on deporting 15 to 20 million illegal immigrants currently in the United States. Recent research from the Pew Research Center and other scholars puts the number of immigrants here illegally at closer to 11 million. Nevertheless, should such an effort succeed, it would increase the number of beneficiaries per worker. The higher cost rate would further raise the 75-year deficit, and the immediacy of the impact would accelerate the depletion of the trust fund by about a year.

In short, at this point, policymakers do not appear interested in using immigration to offset the nation’s low fertility. Indeed, if we stay on the current path, a decline in immigration alone will push Social Security’s 75-year deficit higher.