After 50 Years of Progress, How Prepared Are Women for Retirement?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

A movement away from marriage does not appear to have undone economic gains.

We recently completed a study, using the Health and Retirement Study, to assess the retirement preparedness of women in the wake of Title IX of the Education Amendments of 1972, which prohibits sex discrimination in any educational activity receiving federal funding.

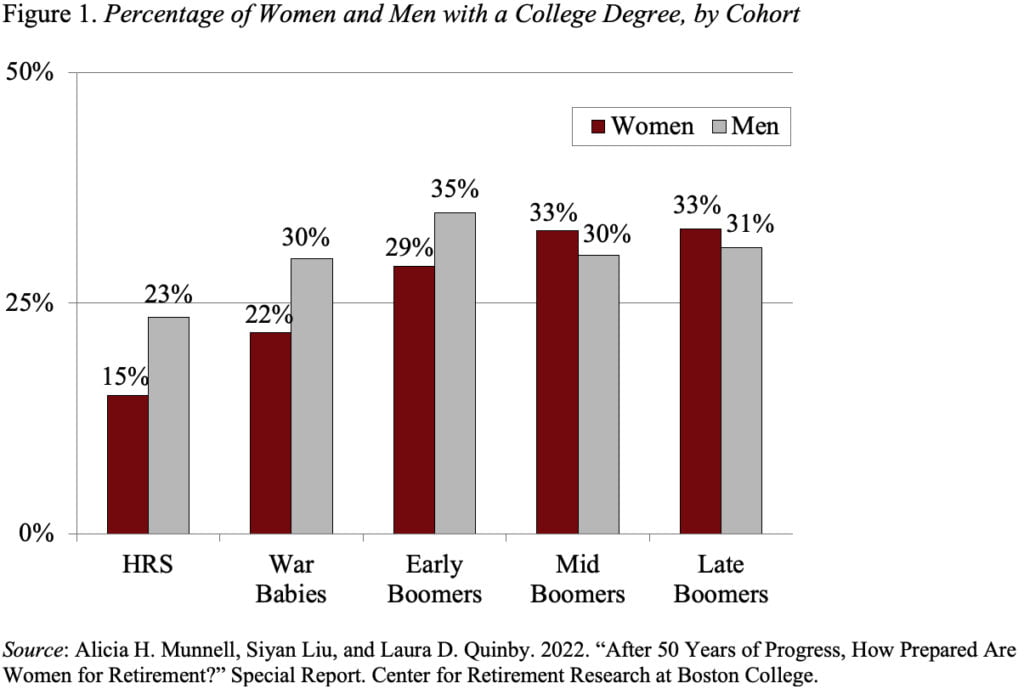

The gains for women as individuals over the last 50 years have been well documented. The percentage of women with a college degree has increased enormously, from 15% for those born in the 1930s to one third for late boomers, born in the early 1960s (see Figure 1). Higher education has translated into greater labor-force participation and a substantial reduction in the earnings gap between men and women.

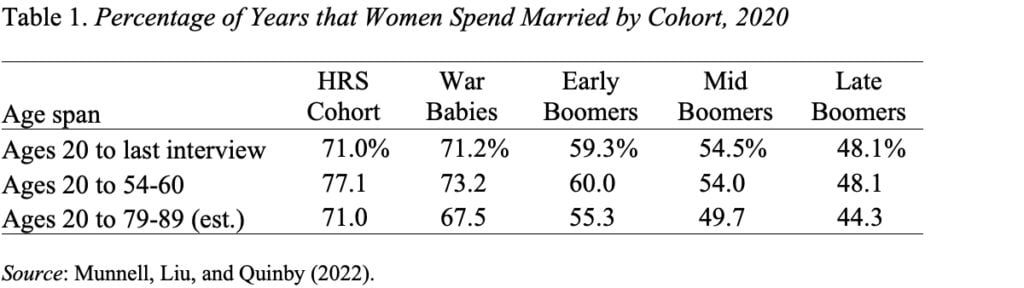

On the other hand, women have chosen to spend less of their adult life married (see Table 1). They married later, more are never married, and more got divorced.

The question then is how this decline in marriage combined with economic gains affected the retirement preparedness of women. Preparation for retirement is measured in two ways: wealth and replacement rates.

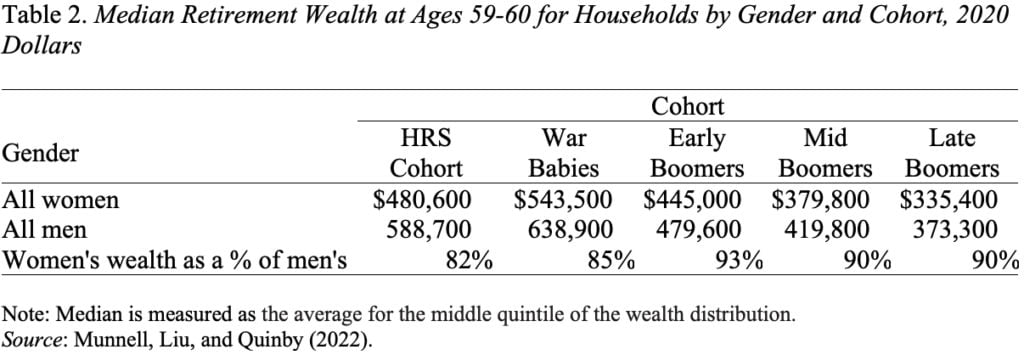

Table 2 shows how wealth has changed across cohorts for women and men. (This analysis assigns the couple’s full value to the woman and to the man.) For the earlier cohorts, women’s wealth equaled 82-85 percent of men’s; for the later cohorts, the comparable figures were 90-93 percent. Boomer men, who did not enjoy gains in education or earnings over time, appear to have been hit much harder than their female counterparts by the Great Recession.

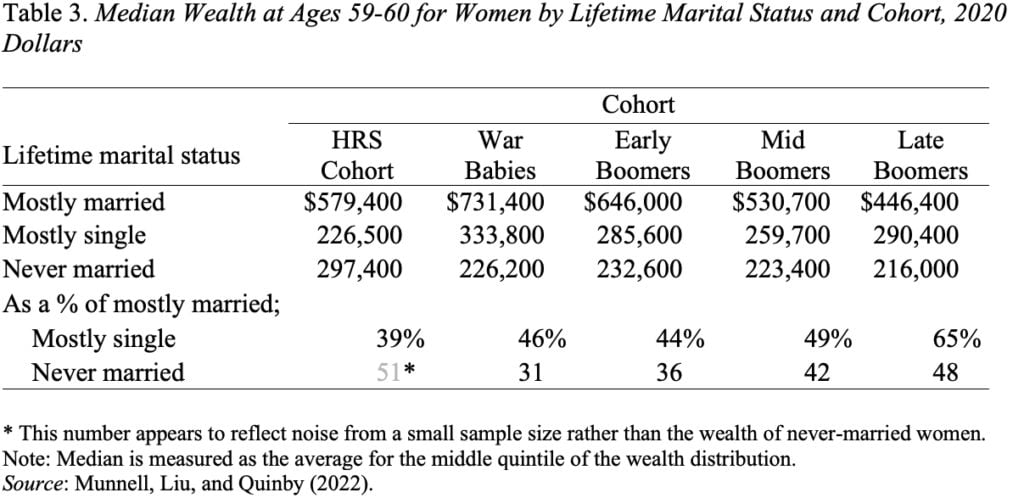

Table 3 shows how the overall improvement in women’s wealth relates to their marital status. The large decline in median wealth for women who spend their lives mostly married largely reflects declining fortunes for their husbands. Since the wealth of the mostly-single and never-married women has remained relatively stable, their holdings have increased sharply relative to the mostly married.

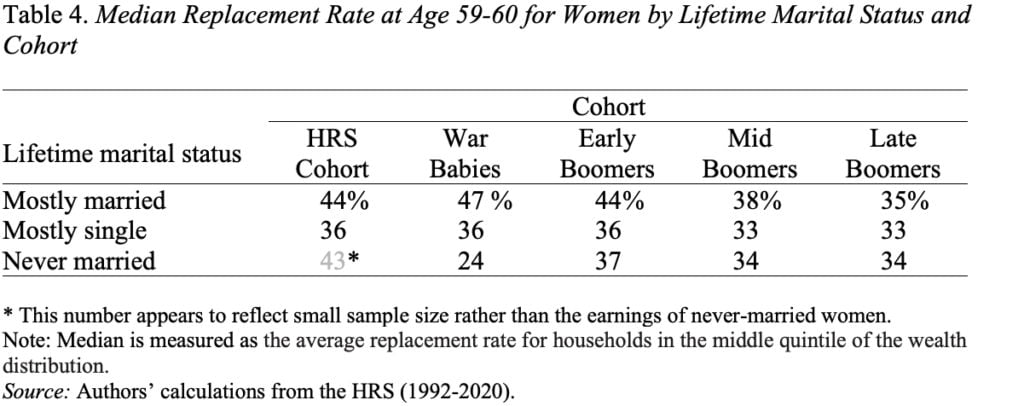

The ultimate purpose of retirement wealth, however, is to support people’s pre-retirement standard of living in retirement. So, the following repeats the exercise for replacement rates –projected retirement income as a percentage of pre-retirement earnings. The results show that never married and mostly single women are now as well prepared for retirement as their mostly-married counterparts (see Table 4).

The conclusion, then, is that women do not appear to have undone their economic gains since Title IX’s passage by opting to spend more time on their own. They have gained both income and wealth, and are as well prepared for retirement as married couples.