Federal Pandemic Relief Kept Low-wage Families Afloat

Now that COVID is fading, researchers looking back on the financial assistance passed by Congress during the pandemic are concluding that it helped millions of Americans get through a time of unprecedented distress.

That the assistance would be adequate was not obvious in the midst of the economic turmoil in 2020 as COVID unfolded. But a year into the pandemic, Americans were feeling better off after the infusions of cash from federal relief checks and more generous benefits for laid-off workers that included an extra $600 per month and – for people with assets – soaring house and stock prices.

When working-age adults were asked in 2021 how they perceived their finances, 36 percent said they would have trouble covering a $400 expense in an emergency. Back in 2019 – before the COVID assistance – 41 percent felt that way.

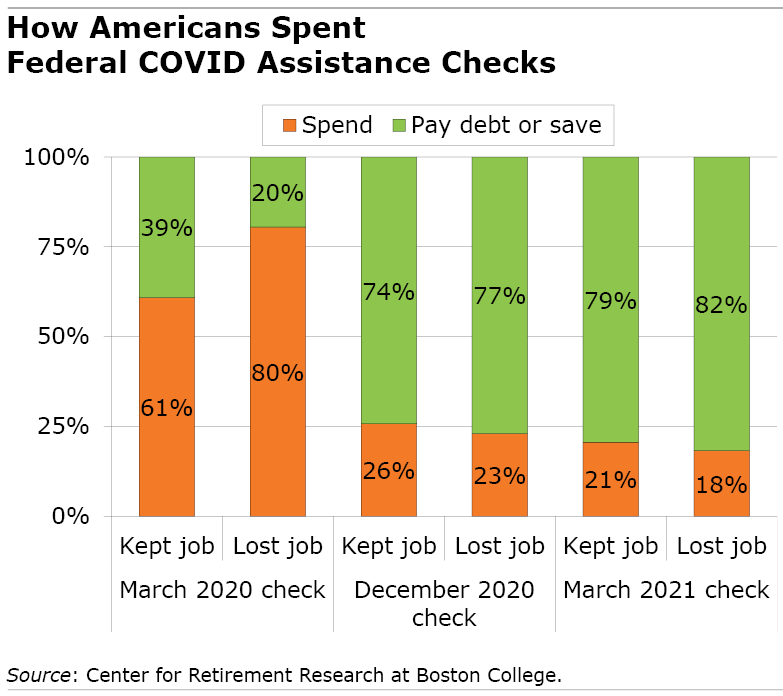

And although most people spent the first checks the government issued in March 2020, the vast majority felt comfortable depositing the two later checks in the bank or using them to pay off debt.

Perceptions that their finances were holding their own or improving, despite the pandemic, lined up fairly well with reality. But the dynamics were very different for each of the three wealth groups – low, middle and high – analyzed in a new study of changes in U.S. households’ net worth by the Center for Retirement Research at Boston College.

The federal relief was, for many, a significant infusion of cash. For example, married working couples earning less than $150,000 received as much as $6,400 in relief checks and child support.

However, individuals and families who entered the pandemic with low amounts of wealth or no wealth essentially broke even. And breaking even was a much better outcome than they’d experienced after the Great Recession – and more notable since they felt the brunt of the 2020 layoffs and lost income when unemployment soared to nearly 15 percent.

But administrative delays at the state level clogged the pipeline of unemployment checks, causing delays in distributing the benefits. Congress’ approval of enhanced jobless benefits was also sporadic. And families spent more on food and housing, partly due to rising prices.

Among families with low wealth levels, “the negative impact of earnings losses from bad labor market experiences and increases in consumption fully offset the stimulus payments,” the study concluded.

Families with middle and high levels of wealth also went through layoffs and pay cuts when businesses shut down, although to a lesser extent. They emerged from the worst of the pandemic with considerably more wealth than when they went into it.

Middle-wealth households increased their net worth by $38,700 in 2020 and 2021, thanks to rising asset prices and the federal assistance and benefits that went to people who’d lost their jobs. High net worth families’ wealth grew by $1.73 million over the two years, and the reason boiled down to surging stock and house prices that beefed up their already-hefty portfolios. These gains dwarfed the amount in their relief checks.

This study is a first look at the impact on wealth of the government’s COVID assistance, and more analysis will be needed to see whether the gains last through 2023’s high inflation. But the good news is that Americans apparently emerged from the turmoil in much better financial shape than after the Great Recession.

To read this research brief by Andrew Biggs, Anqi Chen, and Alicia Munnell, see “How Did the Pandemic Affect Household Balance Sheets?”

The research reported herein was derived in whole or in part from research activities performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, make any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

Actually, the infusions of cash emphasized the amount of money it actually takes to live in the USA. The amount to buy groceries, pay bills, and credit cards. The infusions of cash helped mid to low-income people to feel more comfortable no matter what their circumstances. It takes a lot of money to have a household in this country and that money made a big difference in the lives of many. Some spent the money to get on their feet and others saved it. Either way it made a huge difference and is missed now that inflation has taken over and the benefits are history.