Are 401(k) Plans Spending $1 Billion in Unnecessary Fees to Mutual Funds?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Could plans save by purchasing the same assets through collective investment trusts?

My friend Francis Vitagliano paid me a visit to show that 401(k) plans are paying mutual funds $940 million in transfer agent fees for services they already receive through their record-keeper. He may well be right. The question, however, is how do 401(k)s improve their lot?

Defined benefit plans use collective-investment-trust (CIT) versions of mutual funds, which do not have transfer agent fees, are not regulated by the SEC and therefore involve less disclosure, and can be a much cheaper way to access the same investments. And some large 401(k) plans are moving in that direction. This may signal further good news on the fee front going forward.

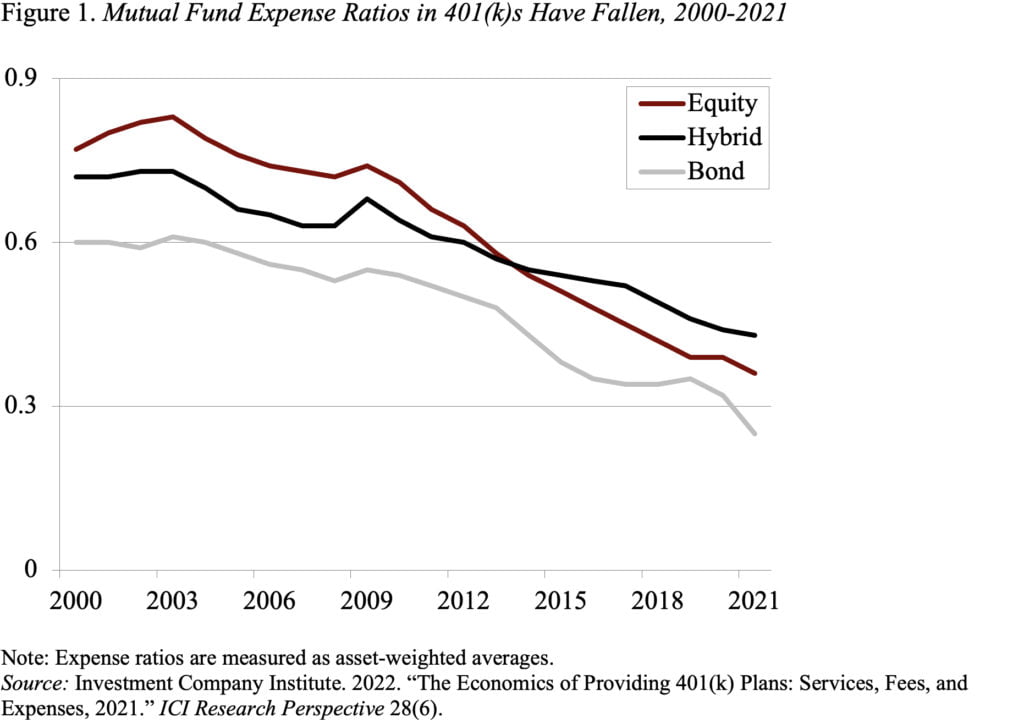

Indeed, overall mutual fund fees have declined a lot over the last 25 years. Even so, the asset weighted expense ratio for mutual funds in 401(k)s in 2021 was 36 basis points (the weighted average of the three lines shown in Figure 1).

Why so much? Are transfer agent fees, as my friend Francis suggests, really a big deal? Also, what’s the difference between transfer agents for mutual funds and record keepers for 401(k) plans?

Here’s what 401(k) record keepers do for 401(k) plans:

- Maintain individual accounts – accept contributions and process withdrawals.

- Calculate and report the balance in each participant’s account daily.

- Perform all plan disclosure requirements, such as Form 5500.

- Maintain website and perform all types of participant communications.

Transfer agent tasks for individual investors at mutual funds involve functions #1 and #2 above – maintaining the account and calculating the daily balance. Since 401(k) plans have one omnibus account at each mutual fund company, the transfer agent performs functions #1 and #2 for the plan as a whole, while all the processing for individual participants is done by the 401(k)’s record keeper.

So how much are 401(k) plans paying for these transfer agent functions? According to the Investment Company Institute, 401(k) assets amounted to $6.5 trillion in mid-2022; and 63 percent of these assets – $4 trillion – were in mutual funds. As noted, the average expense ratio for these funds is 36 basis points. We looked at the annual reports for 42 mutual funds offered by Fidelity and the Capital Group, and – for this sample – transfer agent fees accounted for 14 percent of the total expense ratio or 5 basis points. Applying 5 basis points to the $4 trillion in mutual fund assets suggests an annual cost of $2 billion – higher than Francis’ number!

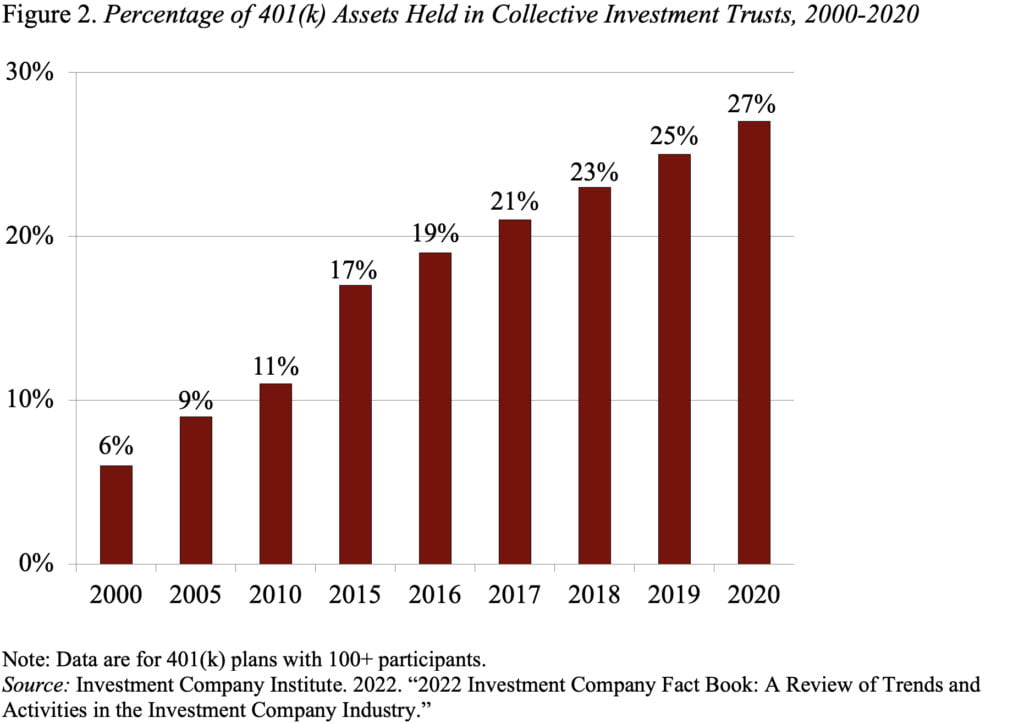

So, could 401(k) plans avoid these fees if they purchased the CIT version of the same mutual funds? The availability of CIT options certainly has been increasing. While a decade ago the 401(k) record keeping systems had data processing issues with collective trusts, today CITs are priced like traditional mutual funds and traded on the universal system. As a result, 401(k) record keeping systems can handle CITs as easily as mutual funds. Indeed, in 2020, 27 percent of 401(k) assets in large plans were held in CITs (see Figure 2).

CITs are not quite a silver bullet, however. They are not available for all investments, and significant cost savings often require a large commitment. But the shifting of 401(k) assets from mutual funds to CITs is a reason for optimism on the cost front. And lower fees mean higher net returns.