Why Do Late Boomers Have Less Retirement Wealth than Earlier Cohorts?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

And what’s the outlook for Gen-Xers and Millennials?

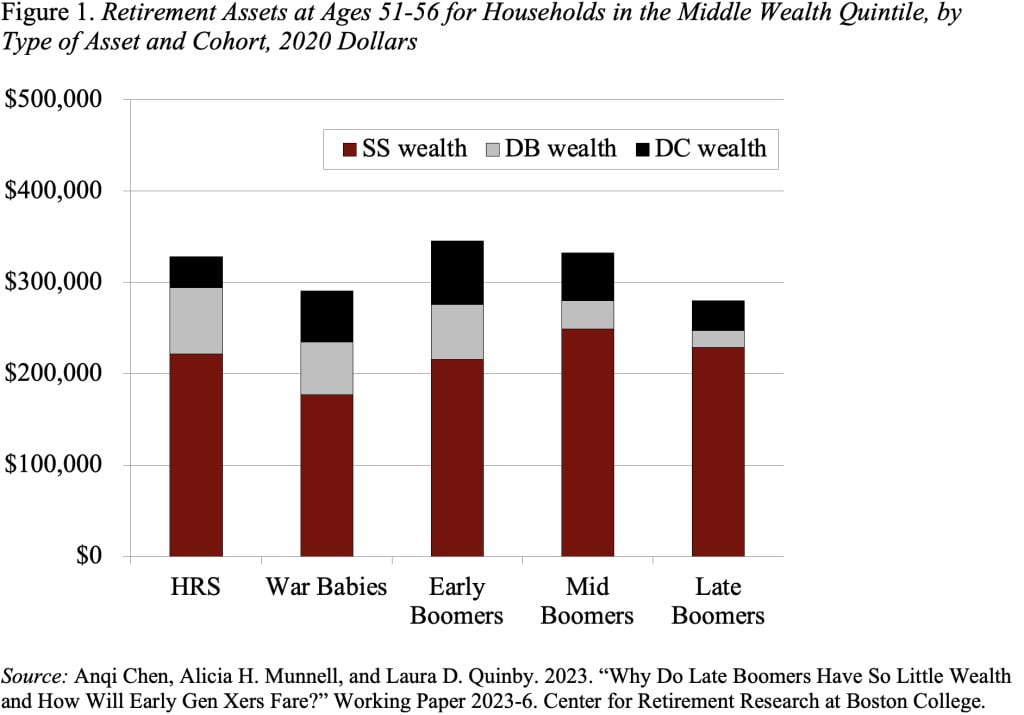

Late Boomers have low levels of wealth regardless of how it is defined – total wealth, retirement wealth, or 401(k)/IRA wealth. A decline in some wealth components had been expected as a result of the rise in Social Security’s Full Retirement Age, the shift from defined benefit (DB) to defined contribution (DC) plans, and a drop in housing values during the Great Recession. But increasing DC balances were predicted to offset the gap, since Late Boomers were the first generation where workers could have spent their whole career covered by a 401(k) plan. That did not happen; average DC wealth for those in the middle quintile dropped from $52,300 for Mid Boomers to $32,700 for Late Boomers (see Figure 1). In fact, declines occurred across all but the top quintile.

My colleagues and I have just completed a study to figure out why Late Boomers have so little retirement wealth and what the patterns imply for Early Gen-Xers and subsequent cohorts. We used a decomposition technique that sorts out the contribution from various sources. The findings indicated that two major factors were at play – a change in the composition of households and a weakening for Late Boomers of the link between work and wealth accumulation.

This is not a tale of the deteriorating status of Black and Hispanic households; indeed, the wealth of non-White households has increased relative to their White counterparts. But Black and Hispanic households still have less wealth than White households, so when they increase as a share of the total households, average cohort wealth will decline. Similarly, a decline in the percentage of households married or with a college degree will bring down the average. For total wealth and retirement wealth, the changing demographics accounted for 24-29 percent of the total decline.

The rest was attributable to shifting coefficients – the most important of which was the weakened link between work and wealth. This pattern is fully consistent with data from other surveys which show Late Boomers, who were in their 40s at the time, were hit hard by the Great Recession and never recovered. Even Late Boomers who had a job after the Great Recession earned less, were less likely to participate in a 401(k) plan, and accumulated fewer assets in those plans. Work, for Late Boomers, simply did not produce the boost to wealth accumulation that it had for previous cohorts.

This finding is potentially good news for the wealth holdings of future generations. While the demographic/education shifts will continue to bring down the average, these factors were not the major source of the decline. The big change was the weakening of the link between work and wealth accumulation for the Late Boomers as a result of the Great Recession. To the extent that the decline in wealth is a Great Recession story, some of the downward pressure on wealth holdings should abate.

Let’s hope we’re right!