New Proposal Aims at Better-Funded State and Local Pensions

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Separating “legacy debt,” changing the discount factor, and improving accounting offers a more rational approach.

In an earlier study, my colleague JP Aubry identified the importance of “legacy debt” in public pension plans. This debt arises because many of the retirement systems have been providing benefits since the early 1900s, but the benefits were not funded using modern actuarial practices until much later. The impact of these unfunded liabilities from a bygone era is still felt today, because the shortfall keeps getting passed forward.

Moreover, public plan unfunded liabilities grew significantly even after plans shifted to modern actuarial funding, because of insufficient contributions, poor investment returns and a number of other factors. As a result, legacy debt for the sample of 13 plans in six states averaged more than 40 percent of unfunded actuarial accrued liability.

In a recent study, JP highlights the role of legacy debt and two other factors that impede sponsors’ abilities to manage the current financing of their state and local plans. Specifically, the current approach for managing pension liabilities suffers from three problems:

- It does not recognize the unique aspect of legacy liabilities. The current actuarial funding approach allocates the costs of pension benefits to the period when the benefit was promised/earned, which limits the spillover costs from one generation to the next. Legacy liabilities do not fit this framework. Choosing any single future generation to bear the full cost of legacy liabilities is totally arbitrary.

- It uses assumed investment returns to value future benefits. Using the assumed return to value benefits understates their cost and likely pushes some of their cost onto future generations. Modern finance theory contends that the value of a government’s promise to pay future benefits should resemble the value of other similar government promises to make future payments. The obvious candidate is municipal bonds, under which issuing governments promise to make payments to bondholders.

- It attributes the costs associated with historical liabilities to current workers. Actuarially required pension contributions consist of two parts: 1) the cost of benefits earned due to continued employment (normal cost); and 2) the cost of unfunded benefits from the past (amortization payment). The first part is a variable cost; the second is a fixed cost. To improve resource allocation and decision-making, managerial accounting generally differentiates between fixed and variable costs. However, both the fixed and variable components of pension cost are often viewed as a single variable cost by government managers.

To address these issues, JP suggests a new approach that:

- separates legacy unfunded liabilities from other liabilities and spreads their costs over multiple generations,

- adopts modern finance techniques by using the average yield on investment-grade municipal bonds (after adjusting for the tax exemption) to calculate liabilities and required contributions; and

- treats unfunded liabilities and normal costs as fixed and variable costs, respectively.

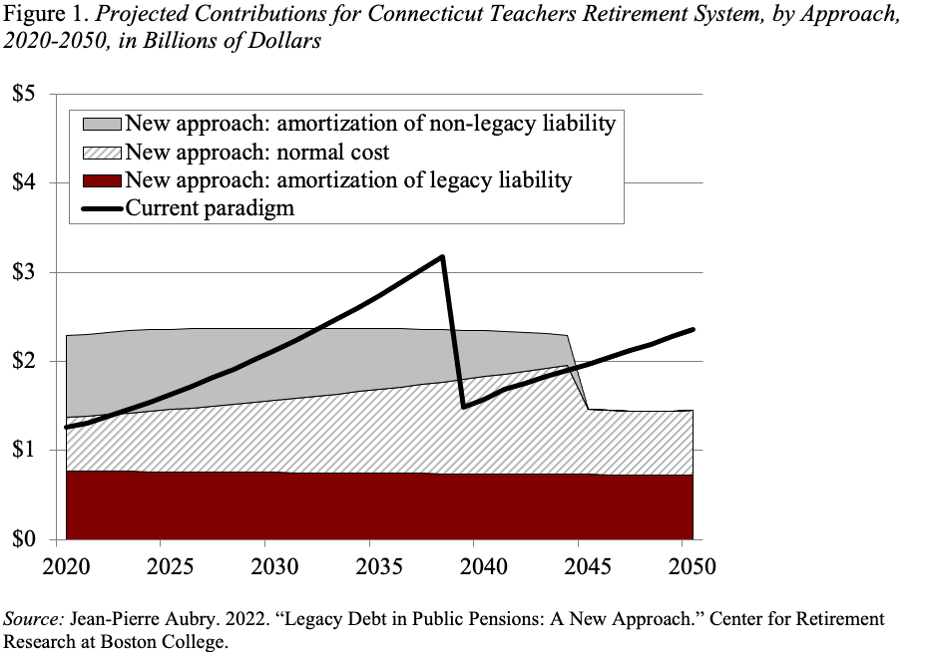

At a high level, the new approach presents a trade-off. On the one hand, spreading the cost of legacy liabilities over multiple generations reduces annual pension costs. On the other hand, adopting modern finance techniques increases pension costs by appropriately valuing promised benefits to limit unintended generational spillover. Projections suggest that contributions under the new approach are initially higher but ultimately lower and much more consistent. (For an example, see Figure 1.)

JP, and I, hope that the new approach provides a clearer way forward for government employers, employees, and taxpayers. While it will increase costs somewhat, it involves a more rational definition and allocation of costs that results in improved intergenerational fairness, better resource allocation by government, and – ultimately – greater public credibility. We’ve made virtually no progress on funding public pensions over the last two decades; maybe a new approach will shake things loose.