Closing the Coverage Gap

The Problem

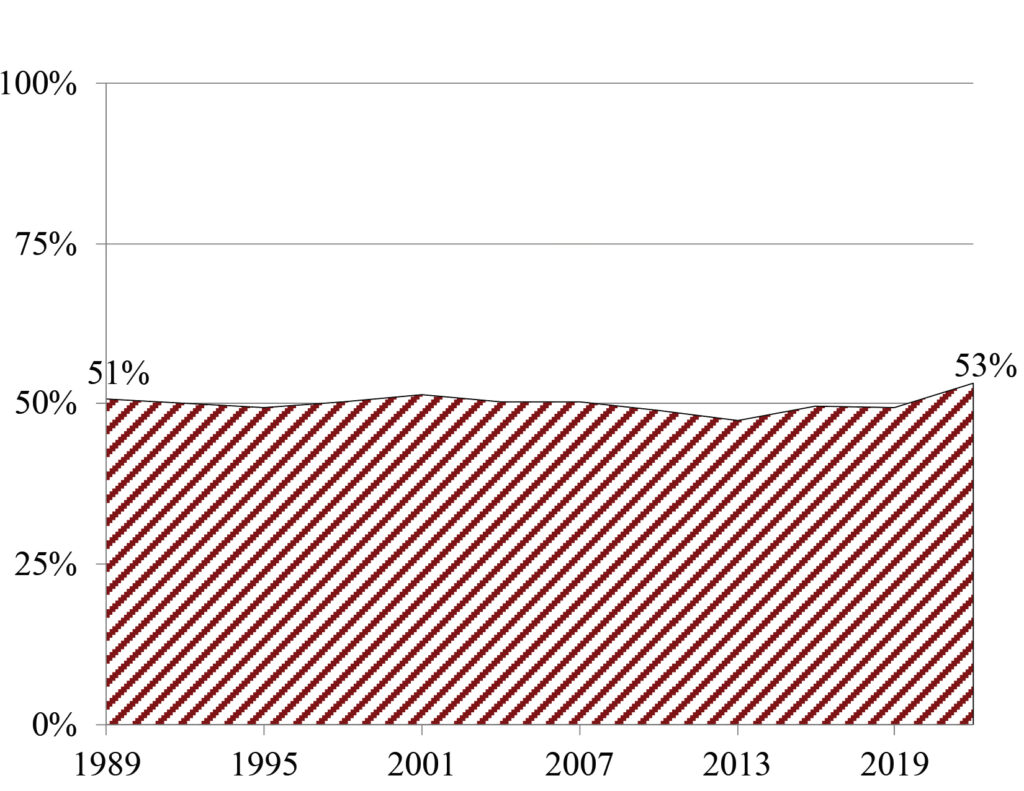

The main reason that U.S. workers end up with inadequate retirement savings is that, at any given time, only about half of workers ages 25-64 are participating in an employer-sponsored pension, mostly due to a lack of coverage (see Figure 1).

Figure 1. Percentage of Workers Ages 25-64 Participating in an Employer-Sponsored Pension, 1989-2022

Source: CRR estimates based on U.S. Board of Governors of the Federal Reserve System, Survey of Consumer Finances (1989-2022).

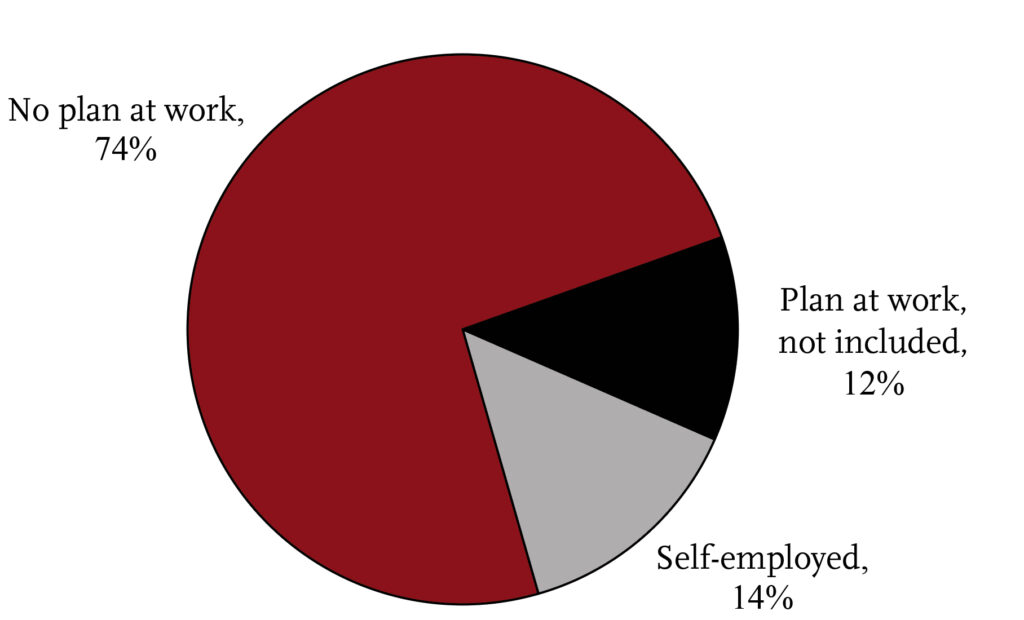

Workers can be uncovered in three ways: 1) their employer does not offer a plan; 2) their employer does offer a plan, but they are not included; or 3) they are self-employed. The first group accounts for three-quarters of all uncovered workers (see Figure 2). Initiatives to close the coverage gap generally focus on expanding coverage to the first group, but some also aim to eventually include the other groups.

Figure 2. Uncovered Workers by Reason Uncovered, 2018

Source: CRR analysis from U.S. Census Bureau, Current Population Survey (2019).

Federal Initiatives

At the federal level, several initiatives to address the coverage gap have been enacted over the years (see Table 1). These programs have relied on the voluntary participation of employers and therefore have had little impact.

Table 1. Federal Provisions Enacted to Address the Coverage Gap Since 1975

| Year | Provision |

| 1978- | SEP |

| 1996- | SIMPLE-IRA |

| 1999- | Payroll deduction IRA |

| 2001- | Small business tax credit |

| 2014-2018 | myRA |

| 2019 | “Open” MEP |

| 2022 | Starter 401(k) |

Source: CRR analysis of Internal Revenue Service (2022).

→ Learn More about Enacted Federal Provisions

Legislative proposals for mandatory programs are more likely the answer (see Table 2).

Table 2. Recent Federal Proposals to Close the Coverage Gap

| Year | Provision |

| 2009-2016 | The President’s budget included a national auto-IRA plan, conceptually similar to those that the states have adopted. |

| 2014 | USA Retirement Funds Act (S.1979) |

| 2016 | SAVE UP Act (H.R.5731) |

| 2017 | Automatic Retirement Plan Act of 2017 (H.R.4523) |

| 2019 | Automatic IRA Act of 2019 (S.2370) |

| 2021 | Automatic IRA provision (H.R. 5376: Build Back Better Act) |

| 2023 | Retirement Savings for Americans Act of 2023 (H.R.6065, S.3102) |

| 2024 | Automatic IRA Act of 2024 (H.R. 7293) |

Source: CRR analysis.

→ Learn More about Federal Proposals

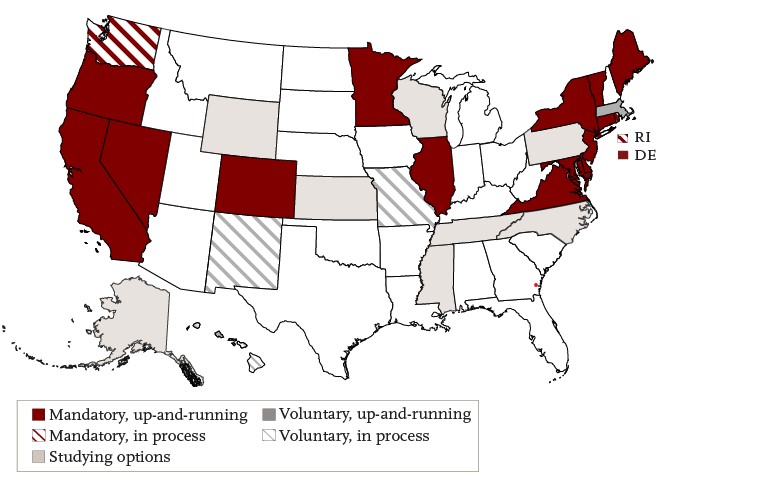

State Initiatives

In the absence of meaningful federal action, states have seized the issue (see Figure 3). The inclusion of a mandate for employers is a significant differentiator for state programs. Mandatory auto-IRAs require employers without a retirement plan to auto-enroll their employees in an Individual Retirement Account (IRA). Voluntary programs, which involve “marketplaces,” multiple employer 401(k)s, and voluntary auto-IRAs, allow the employer to choose whether to participate (see Table 3).

Figure 3. State Initiatives to Address the Coverage Gap, as of January 2026

Source: CRR analysis.

Table 3. Types of State Programs, by Account Type and Employer Role

| Employer role | IRA | 401(k) |

| Mandatory | Mandatory auto-IRAs (CA, CO, CT, DE, IL, MD,a ME, MN, NJ, NV, NY, OR, RI, VA, VT, WA) | |

| Voluntary | Voluntary for employers (NM)b Voluntary for workers (HI) | Retirement marketplaces (NM, WA) Multiple Employer Plans (MA, MO) |

a Maryland’s legislation requires employers without a plan to auto-enroll their employees, but imposes no penalties for failing to do so. Instead, it allows participating employers to avoid the annual $300 filing fee that ordinarily applies to businesses in Maryland.

b Once an employer decides to adopt the program, workers are automatically enrolled.

Source: CRR analysis.

The mandatory programs are showing potential in the early phases (see Table 4). In contrast, voluntary programs have had virtually no impact, with less than a 1-percent take-up rate.

Table 4. Summary of Mandatory Auto-IRAs, as of September 30, 2025

Up-and-running

| State | Initial rollout period | Status |

| Oregon | 2017-2021 | ➤ 8,481 employers facilitating payroll in last 90 days ➤ 148,146 workers with assets ➤ $445 million in assets |

| Illinois | 2018-2020 | ➤ 8,138 employers facilitating payroll in last 90 days ➤ 167,328 workers with assets ➤ $311.4 million in assets |

| California | 2019-2022 | ➤ 41,887 employers facilitating payroll in last 90 days ➤ 599,352 workers with assets ➤ $1,587.9 million in assets |

| Connecticut | 2022-2023 | ➤ 3,061 employers facilitating payroll in last 90 days ➤ 36,307 workers with assets ➤ $58.6 million in assets |

| Maryland | 2022-2023 | ➤ 1,871 employers facilitating payroll in last 90 days ➤ 16,799 workers with assets ➤ $27 million in assets |

Starting rollout

In process

| State | Initial rollover period | Status |

| Minnesota | TBD | Legislation passed in May 2023. |

| Rhode Island | TBD | Legislation passed in June 2024. |

Sources: OregonSaves monthly dashboard, Office of the State Treasurer (2025); Illinois Secure Choice performance dashboards, Office of the State Treasurer (2025); CalSavers reports, Office of the State Treasurer (2025); Connecticut Retirement Security Program reports (2025); and Maryland Small Business Retirement Savings Board reports (2025).

Fact Sheets on Up-and-Running Mandatory Programs:

Oregon

Illinois

California

Connecticut

Maryland

CRR Reports on State Initiatives

Other Resources

Georgetown University’s Center for Retirement Initiatives

Massena Associates

Pew Retirement Savings Policy Initiatives

Publications