Could Annuities Be More Valuable When Rates Are Low?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Are annuities more valuable when interest rates are low? That seems counterintuitive. After all, annuities produce higher monthly incomes when interest rates are high. But consider the extreme case of a zero interest rate. That scenario eliminates the option of living off the income from investments in retirement. The choices come down to various alternative ways of drawing down principal. And assume in such an environment that people give up on the notion of leaving a bequest.

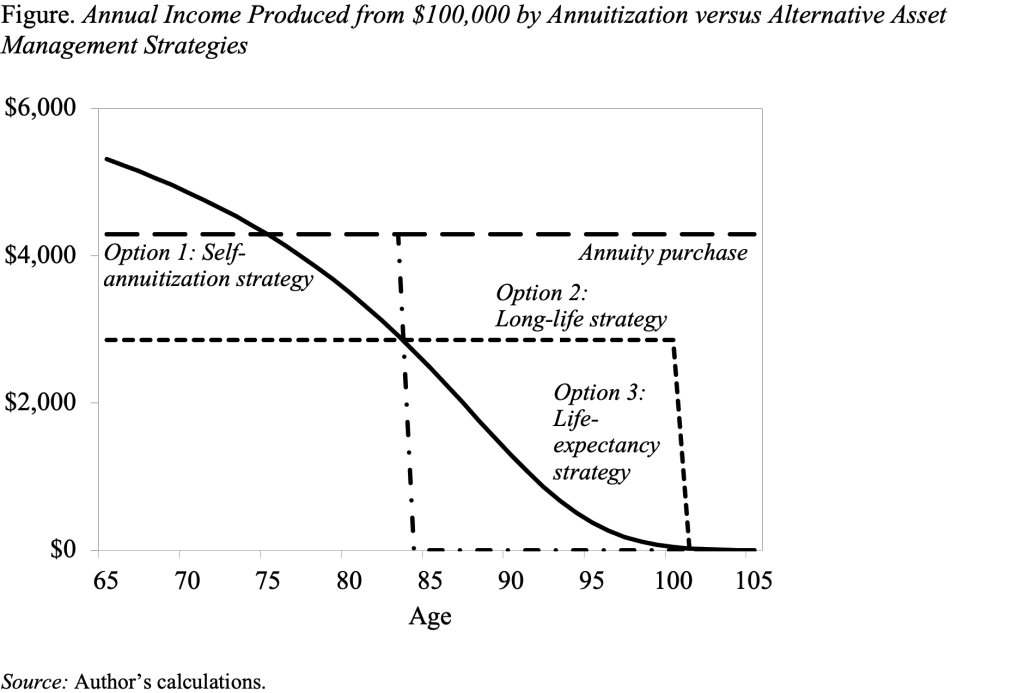

As shown in the Figure, a sixty-five-year-old male could expect to receive $5,048 each year for the rest of his life from annuitizing $100,000, assuming a zero-percent return. This calculation also assumes that the actuarially-fair annuity amount is reduced by 15 percent to cover marketing costs, etc.

But people often think that they can do better managing their own investments and withdrawing money from those investments over time. However, that does not turn out to be true. Consider three alternative options.

Option 1 is self-annuitization. That is, the retiree withdraws $5,048 each year, just as if he annuitized. This option works well for a period of time. But the assets are depleted after 18 years (as illustrated in the Figure by the abrupt drop at age 83), and the retiree still has a 54-percent chance of being alive.

Option 2 would be a long-life strategy. That is, the retiree selects some distant age such as 100 and spends down assets evenly over this period. The problem here is that the retiree would be able to spend only $2,857 each year over the 35-year period and would have no resources to support himself should he live beyond 100.

Option 3 is a strategy based on life expectancy. Under this option, the retiree spends a fraction of assets each year based on expected remaining years of life. For example, average male life expectancy at age 65 is 19 years, so the person would spend one-nineteenth of the $100,000, or $5,263. Income under this option is initially higher than that provided by an annuity, but the withdrawals fall with age, creating a significant chance of impoverishment in old age.

Looking at the alternative options shows that the gains from annuitization are substantial, even assuming that interest rates are at zero and that the provider takes a 15-percent cut off the fair annuity value. The gains arise because insurance companies pool experience and use assets from deceased annuitants to pay those who survive – producing a “mortality premium.”

This simple exercise raises two questions in my mind. I, like most other human beings, really don’t like the idea of traditional annuities for the array of rational and irrational reasons cited in numerous studies. But I’m wondering if I should reconsider. Second, I’m wondering if researchers have done a study showing how the value of annuities varies by the level of market rates for people at various points in the income distribution. I’m going to check.