COVID Hasn’t Pushed Boomers into Retiring

Three months into the pandemic, a few million older workers had been laid off or quit. But what happened next?

Three months into the pandemic, a few million older workers had been laid off or quit. But what happened next?

The rapid drop in employment due to COVID gave the Center for Retirement Research an unusual opportunity to study the labor force decisions of baby boomers, who are within striking distance of retirement age but may or may not be ready to take the leap.

Traditionally, older workers who left a job tended to retire. But there was little indication that the people who stopped working during the pandemic saw retirement as their best fallback option.

This conclusion by the researchers is consistent with the pre-COVID trend of boomers working longer to put themselves in a better financial position when they eventually do retire. In fact, many older workers have returned to the labor force as the economy has rebounded and vaccines have become widely available.

But in April 2020, job departures spiked before settling back down at a new, much higher level. The annual pace of departures increased from 15 percent of workers 55 and over in 2019, prior to COVID, to 23 percent in 2020.

But in April 2020, job departures spiked before settling back down at a new, much higher level. The annual pace of departures increased from 15 percent of workers 55 and over in 2019, prior to COVID, to 23 percent in 2020.

The researchers found a surprise when they looked at who stopped working. Although older people are vulnerable to becoming seriously ill from COVID, age wasn’t a big factor in their decisions. Boomers in their 60s were no more likely to leave their jobs than people in their mid- to late-50s, according to the analysis of monthly Census Bureau surveys.

The groups most likely to leave the labor force were women, Asian-Americans, and workers who either don’t have a college degree or don’t have a job that easily lends itself to working remotely.

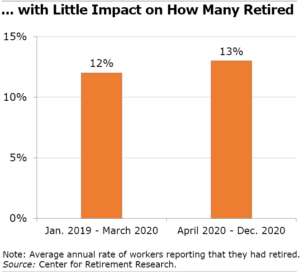

But among all of the age 55-plus workers in the study, the share reporting that they had retired barely increased, from an average of 12 percent prior to COVID to 13 percent last year.

The only people who left their jobs and retired in significant numbers during the pandemic were over 70. This finding reinforced what the researchers found in data from the U.S. Social Security Administration: the pandemic didn’t have a major impact on retirement because the share of workers between 62 and 70 who signed up for Social Security was relatively flat between April 2019 and June 2021.

Some of the unemployed boomers last year may have had no intention of retiring. Others may have been willing to retire, but have been living on stopgap sources of income, such as their unemployment benefits and federal relief checks – perhaps in an effort to delay Social Security and increase their monthly checks.

Expect a follow-up to this preliminary analysis after more time has passed. “It will be fascinating to see how this episode plays out,” the researchers said.

To read this brief, authored by Laura Quinby, Matthew Rutledge, and Gal Wettstein, see “How Has COVID-19 Affected Older Workers’ Labor Force Participation?”

The research reported herein was derived in whole or in part from research activities performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, make any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

Thanks to the increase in unemployment benefits, Boomers are better off claiming unemployment benefits than retiring and claiming Social Security. In fact, many were better off claiming benefits than working. Let’s wait and see what the data show for periods subsequent to the expiry of UI.