Criticisms of Medicare Advantage Marketing Continue

A recent blog about advertisements for Medicare Advantage policies brought a torrent of criticisms from our readers that the ads flooding the airwaves and mailboxes are too vague and even misleading.

“What we do to seniors – most of whom have contributed for years to fund Medicare – should be an embarrassment to us, as a nation,” one reader wrote about the tactics used to sell Advantage plans. A common complaint from another reader: “How do I get them to quit calling sometimes ten times a day?”

The sales pitches are also getting the attention of the federal government and research and advocacy organizations, because Advantage plans have grown to half of the market for Medicare insurance policies. Two newly released reports by researchers found support for older Americans’ complaints that the high-pressure sales tactics are both misleading and fail to provide information about two crucial aspects of their coverage: out-of-pocket costs and benefits.

(The average out-of-pocket deductible for an Advantage plan is $4,835 in 2023. People who need help finding the right plan can contact their state’s SHIP program, which has volunteers to sort through the many plan options available.)

Last November, the Senate Finance Committee reported a doubling between 2020 and 2021 in consumer complaints about the Medicare Advantage telemarketers and ads in 14 states that tracked them. “Beneficiaries are being inundated with aggressive marketing tactics as well as false and misleading information,” the committee concluded.

To be fair, some retirees prefer Advantage plans over an expensive alternative: Medigap policies. While some studies show that Medigap may have lower out-of-pocket costs for seriously ill retirees, many retirees can’t afford the monthly premiums. And unlike Medigap, Advantage plans usually include prescription drug coverage and often do not charge a premium. Retirees are still responsible for paying the government’s Medicare Part B premium.

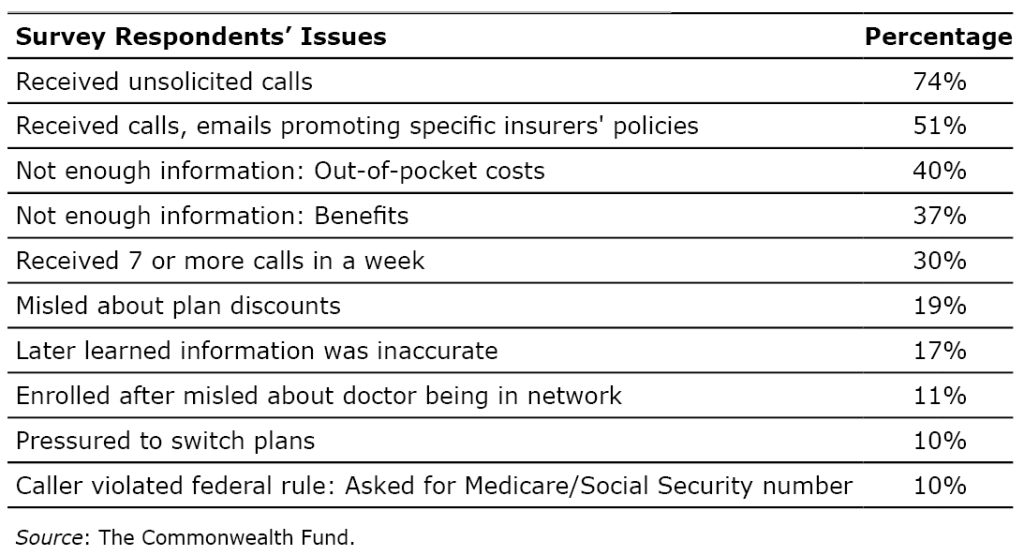

But in a Commonwealth Fund survey, 2,000 consumers identified an array of issues with Advantage plan marketers:

In a second report by KFF, retirees in focus groups said they didn’t trust claims that some benefits are “free.” And KFF researchers, who watched 1,200 television ads, found evidence of misleading information. One in four ads gave the impression the plans are somehow affiliated with the federal Medicare system by using images of an official Medicare card or providing a toll-free “Medicare hotline.”

To eliminate confusion, the Biden administration recently approved a couple of regulations. One banned Advantage plans and insurance brokers from using Medicare’s logo or any images that resemble it. Another regulation bans ads that aren’t about specific policies in an attempt to eliminate “overly general” ads that “confuse and mislead” seniors.

In the Commonwealth survey, only a minority of retirees criticized any one issue in particular. But their myriad complaints about Advantage plan marketing, taken together, suggest there is enough to warrant doing more to inform and protect older Americans.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

My mom has gotten savvy about these unsolicited calls. She immediately tells them she is 92 (true), and then they hang up.

Something worth mentioning is that higher initial and renewal commissions are earned by agents for selling Medicare Advantage plans rather than Medigap plans (see https://nccagent.com/blog/retire-selling-medicare).

Given that insurance agents are held only to a suitability standard rather than the more stringent fiduciary standard, it is not surprising that agents may lean toward selling an Advantage plan over a Medigap plan.

While I have received countless pitches to purchase an Advantage plan, I have yet to see an appeal from any insurer to sell me a Medigap plan. Draw your own conclusions.

A woman I saw frequently at a gym told me she wanted to drop her Medicare Advantage for a Medigap plan due to an upcoming knee replacement. She was really upset to learn you cannot switch from MA to Medigap. “They never explained that!’ she exclaimed. Because MA reps are salespeople, you cannot sue them for misleading you. People want dental and forget they may need transplants, rehab or joint replacements. It won’t happen to me!

Why do some nursing/rehab facilities not take Medicare Advantage?

Medicare Advantage plans are HMOs. A particular facility might choose not to accept a particular plan.

Sorry to have to break the news to you but most MA plans offer both PPO and HMO plans. If you check out Medicare.Gov, you would see that. You would also have the ability to study all plans and make comparisons as to what would work best for you, but many people simply rely on word of mouth and that is not good.

Ask friends in the community for a referral to a local independent agent. I have been a licensed agent for 15 years, representing several carriers I always present, especially at initial eligibility, both Supplements and MAPD. It always surprises me that majority select MAPD. I tell the client pros, cons, and address all concerns with truth. Available all year for service issues or questions. Commercials and 800 numbers should be carefully evaluated.

I have traditional Medicare with a plan F supplement and it cost me some money but I am not changing it. I ran into a few medical problems the past 5 months. I think if I had an advantage plan I would have been up a creek without a paddle.

I’m one of those seniors, who sit on the fence, having a broker find me what’s right for me & my needs. I’m a fairly young healthy widow, in government ruling, my choices are slim making me a small percentage on their “sliding scale” so to speak. I don’t see how widows expect to survive financially. The Bible says widows & children is subject to mistreatment and should be offered more respect.

The average Medicare Advantage Plan does NOT have a $4835 deductible!! That’s the maximum out-of-pocket in a calendar year. While you are correct in the fact that the illegal marketing of these plans is annoying (it happens “offshore”), please be accurate. A deductible is what you pay out of pocket before the plan ever pays anything. Most plans have a zero deductible.

When you call them either to sign up, for anything, you then will get unsolicited calls 10 or more times per day. I am sick of this… I block these calls and as I don’t know if they are from Medicare for sure, this practice of blocking calls is dangerou. I can’t stand this calling. I block them constantly yet they continue to come and my continual blocking new numbers continue…

Medicare advantage plans are notorious for “cherry picking” healthy seniors, using things like discounted gym memberships that will attract healthier, younger enrollees. Some even put their enrollment centers up a steep flight of stairs. Of course they then, often with the help of special consultants, comb records for diagnoses they can then use to make their enrolled population look sicker to justify higher payments from Medicare. Anything for a buck!

Those Medicare advantage plans are a scam. Keep your original Medicare! These companies offer freebies but get you if you have to be hospitalized! They deny anything you need done and most don’t except them! Medicareschool/YouTube gives you examples!!

Everyone should have Medicare 100% from the government that’s what we have paid for. Not 80% like the insurance company’s lying lawyers take advantage of. Today an operation in a hospital is 50,000 + dollars. 20% is 10,000 dollars and we are on a fixed income. Remember that the rent, food, car insurance and house insurance has been going through the roof.

Too bad the government does not send out booklets as it had done in the past. You could look at all companies, and compare rates and coverage. Then you call and talk and decide what’s needed.

I can’t even go in and look without calls coming. If Obamacare is thrown out, it could help retirees and businesses just to get back to affordable coverage.

You can get comparison information on companies on the mymedicare.gov website. VERY useful stuff

Most stories and information in the media paint Advantage Plans in a negative light. My experience has been very positive. I have a PPO plan and can receive care anywhere that accepts this widely held insurance company. In the last 2 years I have had many procedures, specialists, and a hospitalization. I paid less than $1000 out of pocket. Customer service is wonderful with a person answering the phone within a minute. Using a broker and carefully researching Advantage plans can result in a very positive outcome. I receive zero marketing calls.

Why do we have open enrollment EVERY year? Original Medicare doesn’t change coverage but for some reason, Advantage Plans feel the need to change something and put us through their dog and pony show every year.

My question is, How many tax dollars from the “doomed” Medicare fund boils down to money spent on these insulting useless ads? It seems like they spend more than the political ads marketing the politicians who allowed this nonsense to happen to win elections. I’m more confused than ever!!

I wouldn’t have a problem with the commercials if they only ran during enrollment period. But the constant Medicare commercials ALL year long is ridiculous.