Delay Social Security? Not Everyone Can Do it

Financial advisers often encourage older workers to delay signing up for their Social Security as long as possible to maximize their monthly income.

But several of our blog’s readers point out, rightly, that this isn’t always possible for people in physically taxing jobs. Blue-collar workers are in a real Catch-22, caught between the unforgiving financial demands of retiring and a body that can’t take any more work.

“That’s me,” a reader named George L. commented on a recent blog, “The Psychology Behind Starting Social Security at 62.” Psychology had little to do with his decision to start Social Security. “I worked unskilled hard labor all my life so I was ready to retire at 62,” he said.

Another reader, Ellis, said he knows retired linemen, construction workers and truck drivers.

“They were just worn out by 62, and continuing to work in their occupations would be exceedingly taxing and dangerous due to declining abilities,” he said. “Work like that can take years off a life.”

But for another reader, financial security – his wife’s – was the primary consideration in deciding when to start Social Security. David Scarborough said he earns more than his wife and wants to make sure she has a large enough spousal benefit from his Social Security since “I am quite likely to die before she does.”

It is, he said, “in both of our interests for me to delay claiming.”

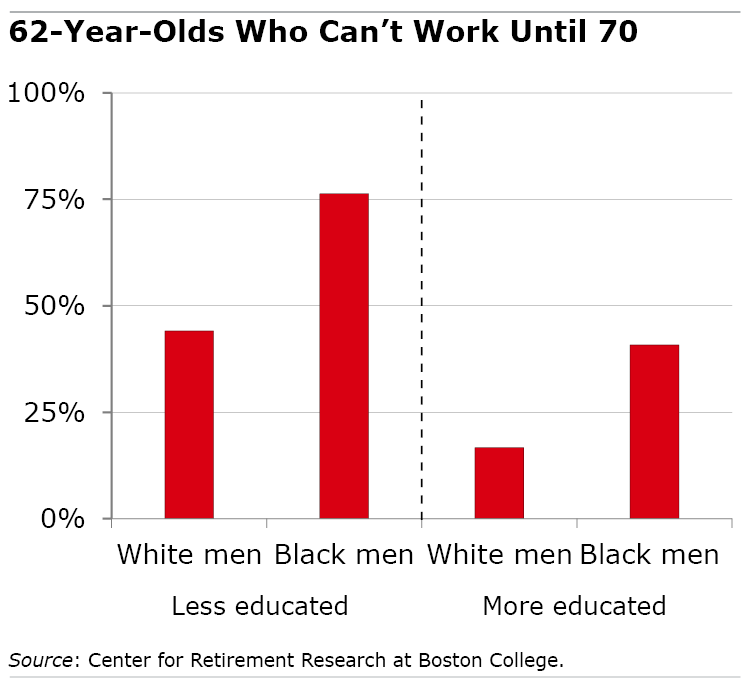

Research shows that how much someone earns is a big factor in when they decide to retire. People in physically demanding jobs, who may feel they can’t work any longer, also tend to earn less and might have a lot to gain from delaying their benefits – if only they could. Workers who have the luxury of delaying are often in relatively cushy or high-paying office jobs or are doing work that energizes them, rather than wearing them out.

“It is easy for an accountant or librarian to stay working full-time until 70,” Dr. Edward Hoffer said, “but not so easy for a roofer or custodian.”

A 2021 study revealed this deep socioeconomic gap, which runs along racial lines. Only one out of five college-educated White men wouldn’t be physically able to work until 70. At the other end of the spectrum, three out of four less-educated Blacks could not make it that long.

Although readers focused on the financial issues involved, some acknowledged one psychological aspect of deciding when to start Social Security: the expectation of how long they will live.

The research featured in this blog shows that people who expect to live longer delay claiming their benefits. The contrast is with people who hold the opposite view – that “life is short” – and feel that it’s important to grab the benefits as soon as possible and enjoy their retirement years.

“I’ve seen enough of my peers/family pass away in their 60s and 70s,” said Deanna, another reader.

The way Social Security’s formula works is that the larger checks a retiree receives by delaying will, if they live long enough, eventually make up for the “lost” years of benefits caused by waiting. Every year of delay will increase the size of that monthly benefit check by 7 percent to 8 percent, which is substantial. Claiming at age 62 or 64 to enjoy retirement has a steep financial cost for people with average or above-average life expectancy.

Brian Krech and his wife plan to split the difference. Krech, who said he has serious health issues, plans to start his benefits early. His wife will wait until 70.

“If you are relatively healthy and longevity runs in your family, it’s a no-brainer to hold off and claim at 70 to maximize your benefits,” he said.

But this is an option that wouldn’t work for other couples. First, the Kreches both have similar earnings, eliminating the issue of needing to maximize the spousal benefit – in contrast to the reader who earns more than his wife. And Krech’s wife apparently has the kind of job that allows her to delay Social Security – in contrast to aging blue-collar workers who struggle to keep up with the physical demands of their jobs.

“Each personal and family situation is so different that it’s critical to look at all options and rationale before claiming your Social Security benefits,” Krech said.

Every worker’s situation is different. But the ability to work longer is also a big part of the equation.

To read the study by Suzanne Shu and John Payne, see “Social Security Claiming Intentions: Psychological Ownership, Loss Aversion, and Information Displays.”

The research reported herein was derived in whole or in part from research activities performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, make any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

A worker with any kind of 401(k) balance, regardless if they need to retire early, should always run the numbers on delaying. It may be that they can do better by spending down the 401(k) balance in order to delay claiming Social Security than by claiming Social Security early and taking distributions from the 401(k), particularly if they’re going to be conservative with those distributions.

Excellent advice. Delaying taking your SS benefit until age 70 maximizes your inflation-indexed SS benefit for the remainder on your and your (lower earning) spouse’s lives. The Federal income tax on SS income is, at most, 85% of the total SS income, and many States do not tax SS income at all (CA is one of them). 401(k) and regular (non-Roth) IRA withdrawals, on the other hand, are taxed by both Federal and State.

If possible, the higher wage earner of a married couple should definitely delay taking their SS benefit until age 70!

This article, like virtually every other on this topic, leaves out the two biggest reasons many (if not most) start collecting at 62: They have lost their jobs due to age discrimination, or they get scared listening to conservative politicians talking about eliminating Social Security altogether.

Regarding age discrimination, it seems no one wants to discuss it, but when I lost my job at 61 (even though I was the best performer in my department) and went to the unemployment office, all but one of the others laid off people filling the waiting room were my age. Virtually every person I know who ‘retired’ early did so because they had been pushed out of their long-time job and couldn’t find another. You work and produce for a company for years, and get raises along the way, only to be fired and replace by a twenty-something they can pay less. Then you can’t find another job because every other company is hiring twenty-somethings as well. And age discrimination is the hardest discrimination to prove.

For me, by the time I started collecting Social Security at 62 and a half, I’d been unemployed for well over a year, and I had only gotten 6 months of unemployment benefits. It was during Covid lockdown and all those GOP politicians were not only talking about how seniors should be willing to sacrifice their lives for the economy (remember that?), but they were also (yet again) talking about eliminating Social Security. I felt I had no choice. I thought that if I was already collecting it when they eliminated at least I might be grandfathered in.

Four years after I started collecting, I’ll hit full retirement age later this year and had I been able to wait, as I had always planned to do, I’d be getting over $700 a month more than I am now.

As for work, I’ve been looking for another full-time job for 5 years with no results. All I’ve been able to find is a part-time job. I’m glad I have it, but it doesn’t pay my bills without Social Security.

I am in the same place. An educated nurse and administrator with many skills, I was laid off at 63.5 years of age. I was working with a Church at the time and the new Rector (from England) decided he wanted a younger team. He made it clear that he was going to lay off anyone over 60 of which there were several of us. I ended up attempting to train a younger person who was to do my job and she quit after ONE week. She said she could not do all that I had done, because I worked for a Church, and no unemployment benefits were available to me, I was out of luck there. They paid me severance of three months salary and health insurance. While I could cash out unused vacation, they would not let me do so for the sick leave that I had accumulated and since I was never sick, I never took off time, and I had many hours that I could not access. I could not find a full-time job with the benefits and money I needed. I planned to work until 70 and maximize my Social Security benefits. I realized that I would be forced to take it early, it was hard until I turned 65, as I had NO health insurance, so I joined Christian Healthshare Ministries until I qualified for Medicare. Six weeks after I qualified for Medicare, I also got sick with Covid-19 and I also was afflicted with Atrial Fibrillation (AFib). I now walk dogs Monday to Friday to keep fit and make a bit of money and I will be 70 in September. I still have my savings, which I do not want to touch.

“Scared by listening to conservative…” I watch what they do, not what they say. “Fear is no way to go thru life, son.”

Thanks for sharing your story. Job hunting over 60 really is tough – even though we’re good at our jobs! – and I am sure other readers can relate.

Being Hispanic, reading this hurts me because it describes most of my family. Growing up poor and now wealthy, I have enough to leave my job early next year during my full retirement age, yet not touch my Social Security until age 70, living off my IRA.

I firmly believe that we need to aggressively educate young Black and Brown people to delay instant gratification [high-end new car] while in their low-paying jobs and start their 401(k) as young as possible. Teach them the long-term benefits through visual effects. I’ve done that within my multigenerational family, 100% Hispanic. I have had some positive impact and consistently show my college-age grandchildren the power of compound interest, while constantly reminding them how I was able to spoil them and how I made money through the S&P 500, and why I can wait to take Social Security at 70 in comparison to their other grandparents that took it very young and can’t afford to take them out.

Bravo, good for you for mentoring young people about money and showing them how important it is to save for retirement.

There are so many “best time to take Social Securtiy” calculators. Run a few and see what happens.

Fair to moderate and good health usually pegs out at 67/68. For me, in fair health, I can wait till

70, because I don’t need the money.

Just because someone works in an office or in an occupation that is not physically demanding does not necessarily make it a “cushy” job. Stress to produce and retain a job has health consequences too. People make choices in life and sometimes they work out and sometimes they do not. My advice is to make better informed decisions about work and money early in life. Perhaps we should be educating our youth about decision making and financial acumen?

Could not agree more. I’ve know many people in “cushy office jobs” where the stress levels are killing mentally AND physically.

Or how about someone who served in the infantry 20 years and then at the age of 42 gets an office job? Which side of the equation does he fall into, the “cushy” job or the physically demanding job?

I got lucky, or to some, maybe not. My physical self was destroyed by the age of 45. I kept trying to do what I was good at (woodworking/design/construction), but the speed of my output was slowing down along with too much pain and pain meds to operate safely. I ended up rehabbing myself and got off meds.

At age 57 I began a new career as an Independent Living Specialist working with disabilities and aging. Now at age 62 I’m still working and have the credibility to give advice to persons that wish to age in place.

It’s wonderful to hear all of these perspectives on deciding about a retirement age. So thank you to all of you for telling your personal stories!