Dismal Fed Data on Retirement Saving

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

2013 Survey of Consumer Finances shows drop in balances and in participation.

The Federal Reserve has just released the 2013 Survey of Consumer Finances (SCF), a triennial survey of a nationally representative sample of U.S. households, which collects detailed data on their assets, liabilities, and demographic characteristics. It is considered the gold standard of information on income and wealth. Overall, this year’s report is very discouraging. For American households, both median income and median wealth have declined since 2010.

But retirement is our game, so we turned immediately to combined 401(k)/IRA balances – particularly for those approaching retirement. The great advantage of the SCF is that it provides information not only on 401(k) balances, much of which is available from financial services firms, but also on household holdings in IRAs. While 401(k) plans serve as the gateway for retirement saving, more than half of the money collected now resides in IRAs. The relevant question is how much do households hold in these two sources combined.

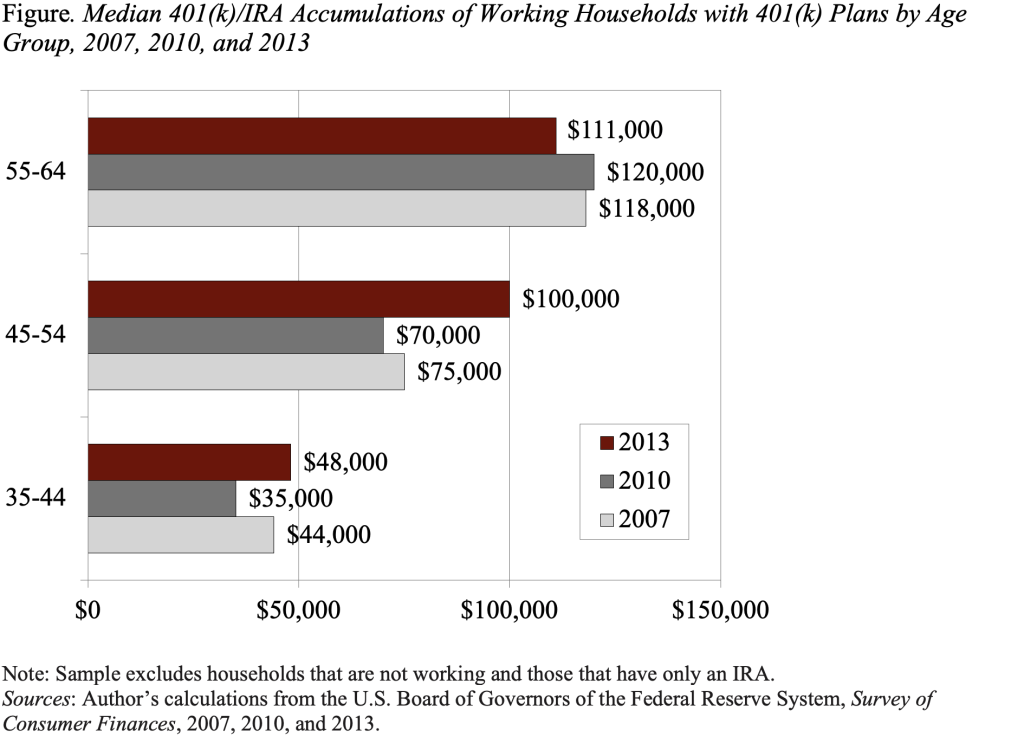

Candidly, I had already drafted an Issue Brief on the assumption that the positive developments of the last few years – a recovering economy, strong stock performance, and the continuing maturation of the 401(k) system – would have pushed combined 401(k)/IRA holdings considerably higher than the $120,000 reported for 2010. (This figure differs from the value of “retirement accounts” presented by the Fed because it pertains only to those households that are working and have a 401(k) plan; those that are not working or only have an IRA are excluded.)

The new numbers are both surprising and discouraging – particularly for those approaching retirement. The SCF shows for households age 55-64 a surprising decline in 401(k)/IRA balances from $120,000 in 2010 to $111,000 in 2013. $111,000 will only provide roughly $500 per month; and since that amount is not indexed for inflation, its purchasing power will decline over time. The only bright spot in the numbers is a significant increase in holdings for households age 45-54 (see Figure).

As indicated above, the decline in balances for those approaching retirement was totally unexpected. One way to try to figure out what is going on is to compare the aggegate retirement wealth with 401(k)/IRA balances reported by the Investment Company Institute. This check shows that the aggregate 2010 SCF number exceeded the ICI total by 13 percent, while the two totals virtually matched in 2013. One hypothesis is that 2010 SCF respondents were in denial about the impact of the financial crisis on their balances. Thus, it appears that the 2013 values may well be correct.

Not to pile on, but the SCF also reports on participation in any type of retirement plan, including defined benefit plans. The data show a steady decline from 2007 to 2010 to 2013 in the percent of households in the bottom half of the income distribution; participation among those between the 50th and 90th percentiles has not yet rebounded to 2007 levels; participation among the top ten percent has held steady. In terms of retirement accounts – that is, excluding defined benefit plans – participation is sharply lower than 2007 levels in all but the top 10 percent of households.

The decline in both 401(k)/IRA balances and the decline in participation underline the need for us to fix our retirement system. We have the tools; we just need to get to work.