Four Reasons Baby Boomers Need More Wealth than Their Parents for Retirement

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

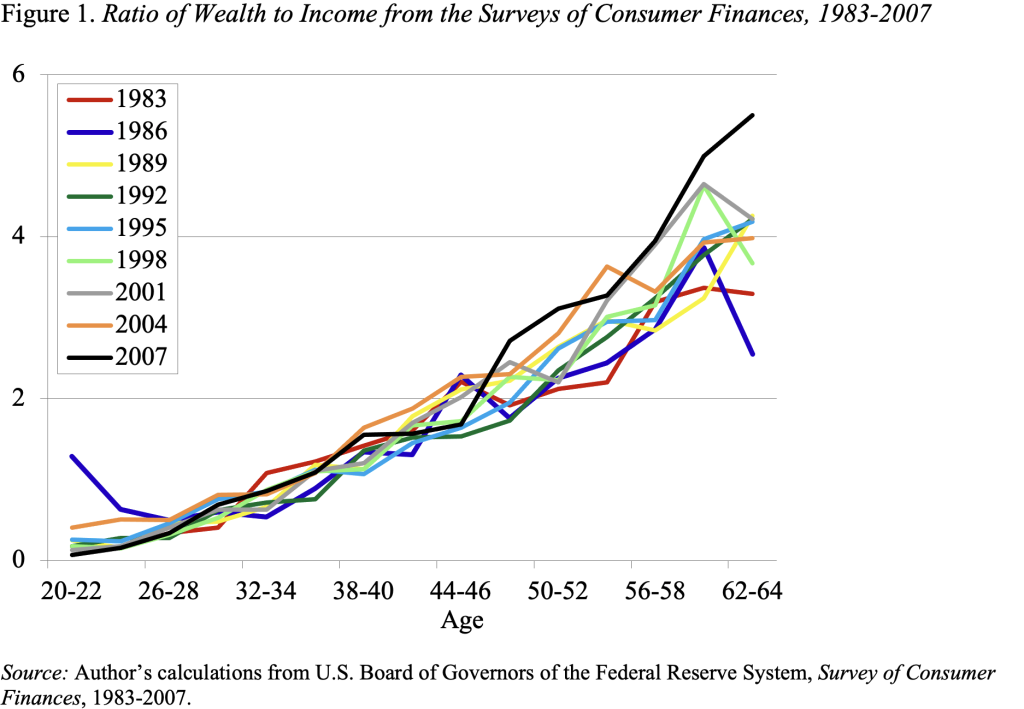

People often ask how baby boomers compare with their parents in terms of being prepared for retirement. The easiest way to answer that question is to look at the ratio of wealth to income from the Survey of Consumer Finances (SCF), the Federal Reserve’s comprehensive survey of household wealth in the United States. The notion is that the wealth-to-income ratio is a good proxy for the extent to which people can replace their pre-retirement earnings in retirement. From 1983 through 2007, the period during which the surveys were conducted, the ratio of wealth to income has remained virtually unchanged at any given age. That is, the lines are roughly on top of one another.

At first glance, this regularity seems comforting, suggesting that the boomers and the cohorts that follow are as well prepared for retirement as their parents. But that conclusion is wrong. For while the boomers have been accumulating wealth at much the same pace as their parents, the world has changed in four important ways.

- The prevalence of defined benefit pension plans has declined dramatically over the last 25 years. Defined benefit plans and 401(k) plans are treated very differently in the Survey of Consumer Finances. Accruals of future benefits under defined benefit plans are not included, because they are very difficult to value on an annual basis. On the other hand, the buildup of assets in 401(k) plans is included. Thus, the wealth reported in the 1983 SCF significantly understated the well-being of the participants because they had a lot of defined benefit “wealth” that was not reported. The shift from unreported to reported pension accruals would have been expected to increase the wealth-to-income ratio, but instead the ratio remained stable.

- Real interest rates have fallen significantly, so a given amount of wealth will now produce less retirement income. If people were interested in generating a given stream of income, the significant decline in interest rates since 1983 would have been expected to boost wealth accumulations. But it did not.

- Life expectancy has increased, so accumulated assets must support a longer period of retirement. Since 1983, life expectancy at age 65 has increased by 3.5 years for men and 1.8 years for women. As a result, for any given level of income one would have expected workers to accumulate more wealth in order to support themselves over their longer period in retirement. But, the pattern of wealth to income by age has been remarkably stable.

- Health care costs have risen substantially and show signs of further increase, indicating a need for greater accumulation of retirement assets. Even older Americans, who have Medicare to cover a large share of their medical bills, have seen out-of-pocket expenditures increase significantly. The rising cost of health care relative to Social Security is one more reason why people should have higher wealth-to-income ratios today than in the past to maintain their standard of living in retirement.

In short, the world has changed in four important ways since the 1983 Survey of Consumer Finances. Each of these changes would have been expected to lead to higher wealth-to-income ratios if people were aiming to preserve their standard of living in retirement. Instead, the pattern of wealth accumulation has remained virtually unchanged. The phenomenon suggests that people are increasingly less prepared for retirement.