Has the Time Come to Move to a Single-Payer Health Care Plan?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

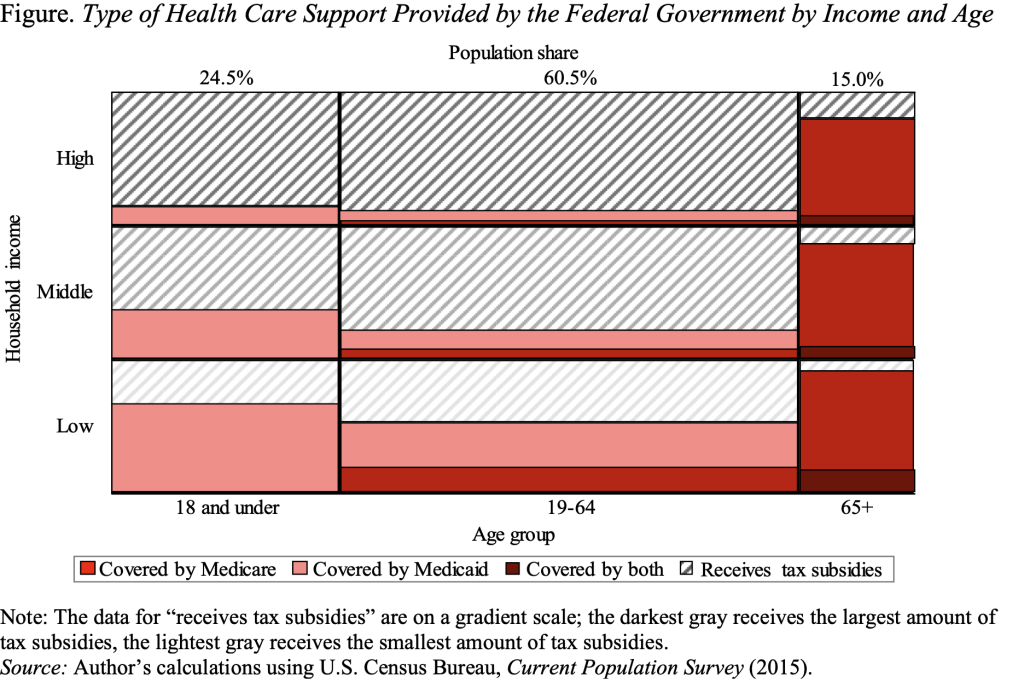

Government already provides either health insurance or tax incentives.

As the health care debate proceeds, the thing that strikes me most is the complexity of our current system. Obamacare is clearly a compromise – suggested originally by the Heritage Foundation – that builds on our existing employer-based system and Medicaid. It can, and does, work in states that support it, but can fall apart otherwise. And the proposals currently in the House and Senate bills will create enormous hardship for millions of people.

Perhaps, the time has come to follow the example of most other developed countries and create a single-payer system. As a prelude to making that argument, I wanted to see how many people are already receiving government health care. Please take a minute and look at the Figure. It divides the U.S. population by age – 18 and under, 19-64, and 65+ – and by income thirds – low middle, and high. Then, I colored in the boxes based on the number of people in each age and income group that are covered by Medicare and Medicaid (including the Children’s Health Insurance Program). For example, most low-income children (18 and under) are covered by Medicaid, while virtually all those 65 and over are covered by Medicare. Some Medicare recipients also receive Medicaid benefits either because they are low income and Medicaid pays their Medicare premiums or because they have spent down their assets and Medicaid pays for their nursing home care.

In total, 45 percent of today’s population is covered directly by a government health care program. Together these programs exceed $1 trillion in expenditures. (This figure is an underestimate because it excludes the military and veterans programs and subsidies that the government provides through the Obamacare exchanges.)

But the government also provides indirect support for health insurance through its favorable tax treatment of employer-provided health insurance. That is, the amount that the employer contributes for health insurance is not included in the employee’s income for tax purposes, so the government foregoes about $150 billion in tax revenues. This “tax expenditure” is shown in Figure 1 by hatched lines, darker at the top where higher-income people – facing high marginal tax rates – benefit more from the exclusion than their lower-income counterparts.

Since the government is already so deeply involved in the health care system, it may make sense to consider a government-run system like other countries. We already spend more than other countries do as a percentage of GDP, so we could reduce that percentage and still have a more generous system. And we could learn from their mistakes. It would involve higher taxes and serious implications for private health insurance companies, but everyone would be covered, administrative expenses could be significantly reduced, and we would no longer have to pay health insurance premiums. So, what do you think about Medicare for all??