How Much Can Online Tools Ease Social Security’s Workload?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

It’s possible to raise electronic filing somewhat, but many will still contact the agency directly.

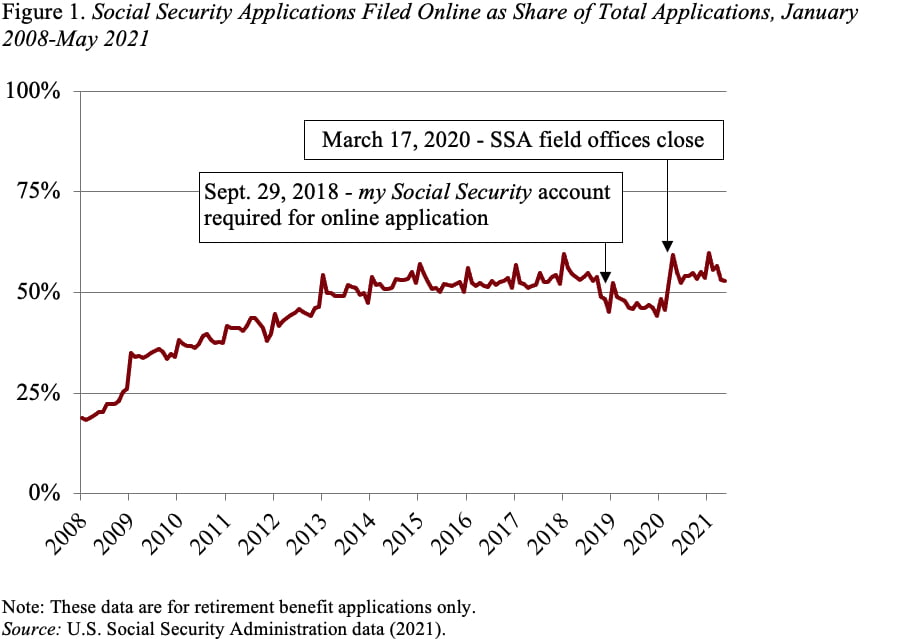

The Social Security Administration faces an enormous challenge to maintain its services as retiring baby boomers increase the demand and budget constraints and retiring staff limit the agency’s capacity to deliver. (The number of SSA employees has been cut sharply over time, from 81,000 FTEs in 1985 to less than 60,000 today.) In theory, web-based tools could help, but the share of retirees applying for benefits online has hovered around 50 percent since 2013 (see Figure 1).

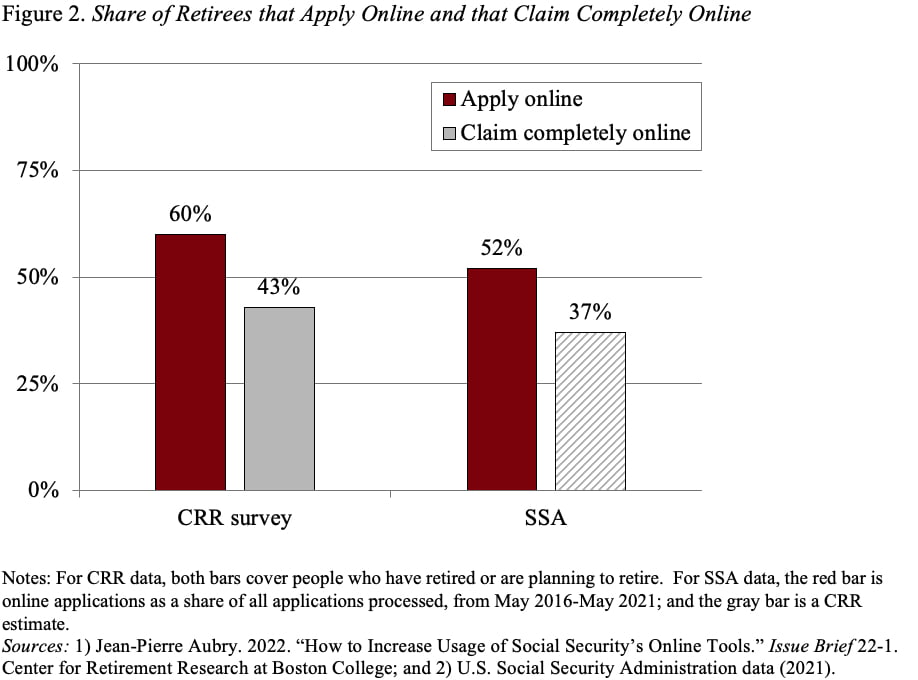

To investigate how individuals claimed or intend to claim their retirement benefits, my colleague JP Aubry surveyed 2,600 people ages 57-70. The responses showed that, while 60 percent of respondents applied or intend to apply online (a somewhat higher share than the SSA data show), only 43 percent of respondents claim completely online – that is, without contacting SSA in-person or by phone. Scaling the survey results to the SSA data for online applications suggests that 37 percent of retirees claim completely online (see Figure 2).

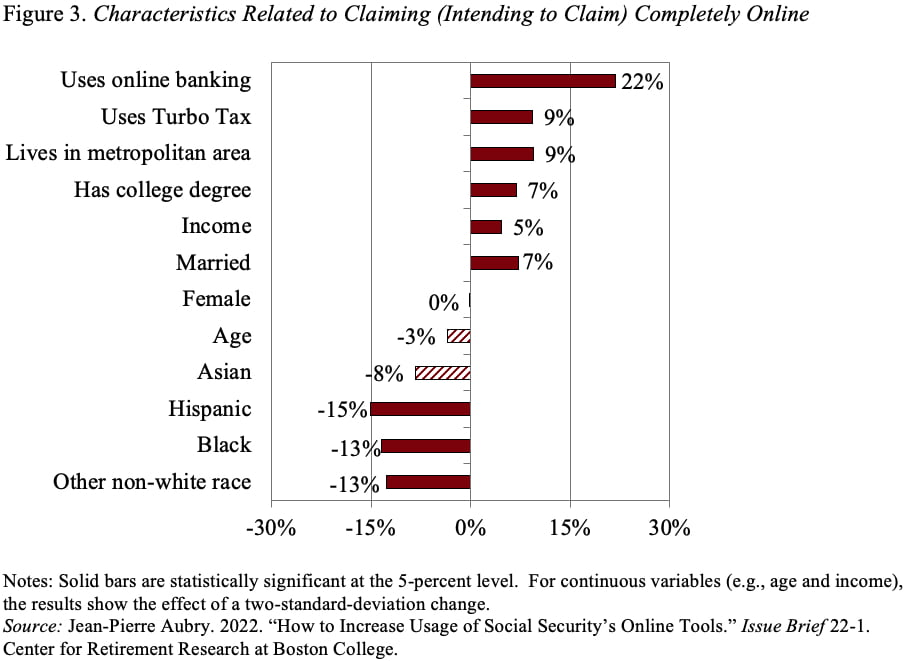

To better understand the factors associated with online claiming patterns, JP estimated a regression that relates respondents’ demographic characteristics to full online claiming (see Figure 3). Two of the characteristics most associated with claiming completely online are the use of online banking and Turbo Tax – both of which are proxies for a high level of comfort with online financial tools. Additionally, claiming completely online is associated with living in a metropolitan area, being college educated, and being married. On the other hand, the characteristics most associated with not claiming completely online are – essentially – being non-white.

In response to in-depth questioning, respondents identified four reasons for contacting an SSA representative: 1) complex issues that clearly require an SSA representative, such as discussing the specifics of spousal and survivor benefits; 2) general aversions to online services, like a concern about data privacy; 3) straightforward inquiries that could be addressed without contacting a representative, like checking the benefit amount and eligibility; and 4) obstacles to online claiming that could be remedied by SSA service improvements, such as fixing data errors.

The survey suggests that implementing policy changes to eliminate the obstacles and make routine information more accessible (along with incremental gains from greater online comfort among younger cohorts) could increase the share that claim completely online by roughly 20 percentage points – to around 60 percent. While these gains would be substantial, the survey suggests that a meaningful share of retirees will likely always choose to contact SSA in-person or by phone when claiming their benefits.