Half of Households Still Face a Retirement Shortfall – Even with Rising Assets

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Workers should plan to work longer and save more.

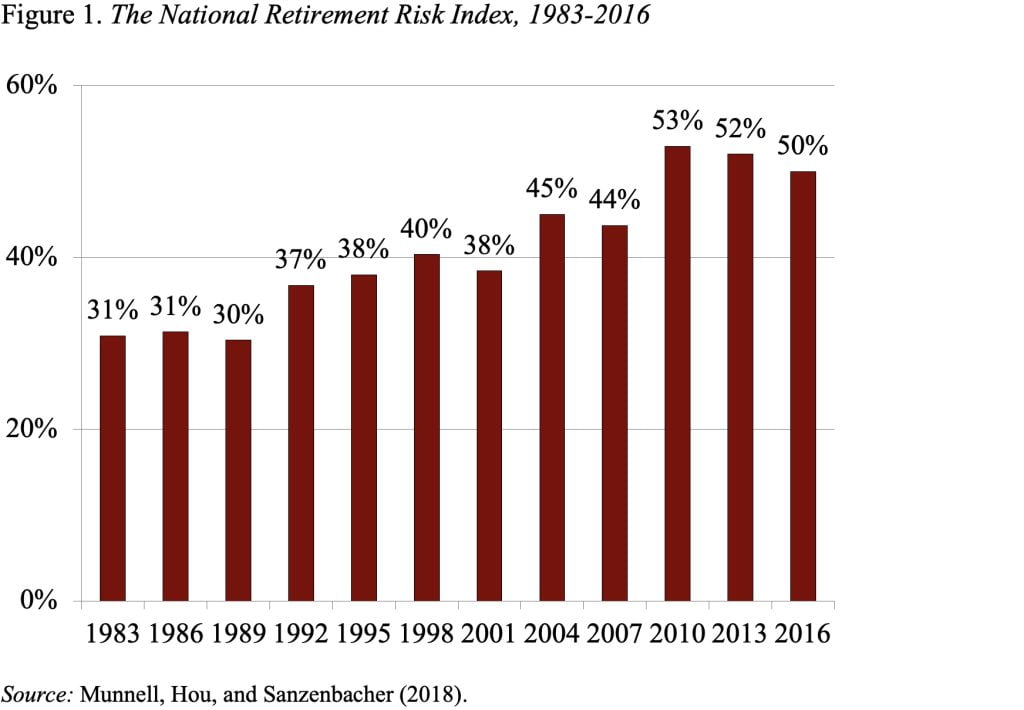

The release of the Federal Reserve’s 2016 Survey of Consumer Finances (SCF) is a great opportunity to reassess Americans’ retirement preparedness as measured by the National Retirement Risk Index (NRRI). The NRRI shows the share of working-age households who are “at risk” of being unable to maintain their pre-retirement standard of living in retirement. This Index is constructed using the SCF, a triennial nationally representative survey of household finances.

Constructing the NRRI involves three steps: 1) projecting a replacement rate – retirement income as a share of pre-retirement income – for each of the households in the sample; 2) constructing a target replacement rate that would allow each household to maintain its pre-retirement standard of living in retirement; and 3) comparing the projected and target replacement rates to find the percentage of households “at risk.”

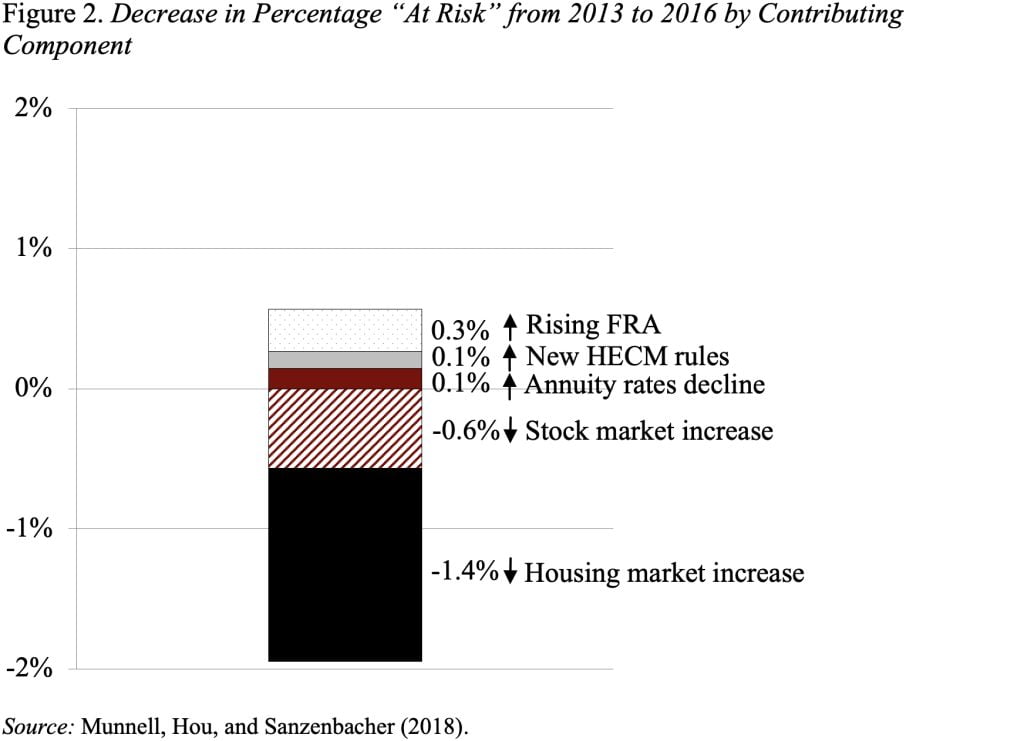

Since the last SCF was conducted in 2013, the U.S. economy has enjoyed a period of low unemployment, rising wages, strong stock market growth, and rising house prices. These factors should help improve households’ preparedness for retirement. At the same time, though, longer-term trends – such as the gradual rise in Social Security’s Full Retirement Age (FRA), low interest rates, and increasing restrictions on reverse mortgages – serve as headwinds that make it more difficult to achieve retirement readiness.

The net effect of these positive and negative developments was a decline in the percentage of working-age households at risk from 52 percent in 2013 to 50 percent in 2016 (see Figure 1).

Figure 2 shows that the increase in housing prices had the largest effect on the NRRI; it reduced the Index by 1.4 percentage points, reflecting the fact that housing is most households’ largest asset. The effect of the rise in stock prices was essentially offset by the rising Social Security FRA, the decline in annuity rates due to low interest rates, and the new rules for reverse mortgages (under the Home Equity Conversion Mortgage program (HECM)).

The bottom line is that – despite the improvement – half of today’s households will not have enough retirement income to maintain their pre-retirement standard of living, even if they work to age 65 and annuitize all their financial assets, including the receipts from a reverse mortgage on their homes. The update confirms that many of today’s workers need to save more and/or work longer to achieve a secure retirement.