Older Mortgage Applicants Face Higher Rates

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

But the differences are small.

We have just published a second brief on outcomes in the mortgage market based on the interesting paper by Natee Amornsiripanitch, a senior financial economist at the Federal Reserve Bank of Philadelphia. Again, the analysis is based on Home Mortgage Disclosure Act data, which contain applicant and co-applicant age and a rich set of applicant, property, and loan characteristics.

The first brief concluded that older mortgage applicants were significantly more likely to be turned down for a loan than their younger counterparts. One fairly convincing rationale for the pattern was age-related mortality risk. Having a borrower die can be costly to the lender, because it increases the likelihood of the loan being paid off early (prepayment risk) or entering foreclosure (default and recovery risk). Since mortality risk is higher for older borrowers than for younger borrowers, a rational and risk-averse lender should consider age-related risks when making lending decisions.

This brief focuses on the relationship between age and the cost of mortgages. The analysis compares the rate on the loan with that on the Fannie Mae and Freddie Mac loan-level pricing adjustment grids. The notion is that if the loans were originated to be sold, then for a given lender any deviations by age in coupon rates for loans in the same grid cell must be unrelated to the lender’s cost structure or credit risk. In practice, the analysis is implemented using a regression that relates the rate on the loan to demographic variables, controlling for the grid fees and the lender.

Coupon rate = ƒ(Age, demographics, grid, lender)

[While the grid sounds very complicated, it merely lays out the fees that Fannie Mae and Freddie Mac charge lenders to insure them against default. Specifically, the grid is a matrix with the mortgage’s loan-to-value ratio along one axis and the borrower’s credit score along the other axis. For example, in the case of loans with a loan-to-value ratio of 80.01-85.00 percent and a borrower with a credit score of 680-699, Fannie Mae requires the lender to pay an additional 1.5 percent of the loan amount. Freddie Mac’s grid is very similar.]

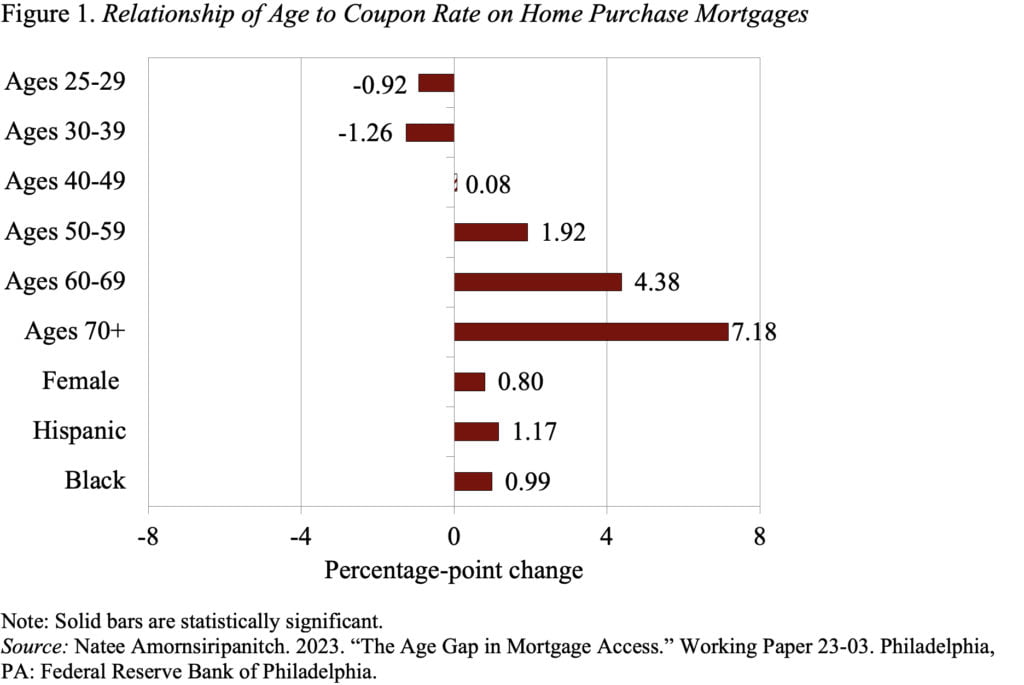

Figure 1 presents the results for home purchase loans that were sold to Fannie Mae. (Separate estimates for Freddie Mac loans produced the same qualitative conclusions.) Several notable patterns emerge. First, starting from the 30-39 age group, the relationship between borrower age and coupon rate increases monotonically. For example, 70+ borrowers pay, on average, 7.2 basis points more than the reference group or 8.4 basis points more than the 30-39 group. The generally positive relationship between borrower age and coupon rate is robust. The economic magnitudes of the coefficients, however, are not very large when compared to the sample’s unconditional average of 391 basis points.

One possible explanation for the positive correlation between borrower age and coupon rate is differences in shopping behavior across age groups. Since search can be costly, it is plausible that, due to a higher likelihood of physical or mental fatigue and technology aversion, older borrowers perform a less comprehensive search of potential lenders than younger borrowers. Therefore, older borrowers end up receiving less favorable coupon rates because they cannot provide competing rates for lenders to match.

The bottom line, however, is that while the difference in application denials by age were large, the differences in coupon rates are small. Pretty interesting!