One in Four Households Unaware They Should Start Worrying About Retirement

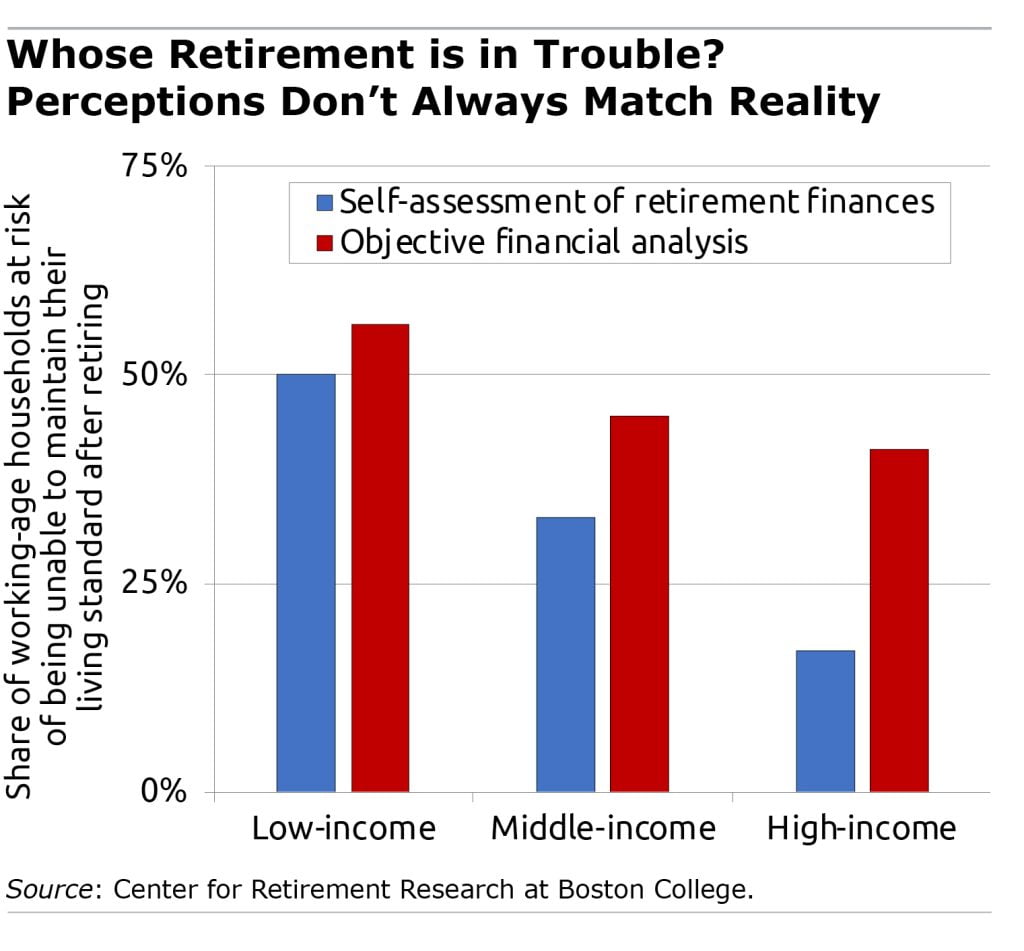

Americans’ retirement outlook doesn’t change all that much: one standard measurement consistently shows that roughly half of working-age households may not be able to afford their current lifestyle after retiring.

But do they even understand what condition their retirement finances are in? This is a critical question because perceptions can affect how much people will save for the future.

The good news is that about 60 percent of working-age couples and single people are getting it right, the Center for Retirement Research finds. In other words, they predict, accurately, that they’re in trouble or that they’re in pretty good shape.

But that leaves significant numbers who are either over- or underestimating how much money they will need to retire.

In this study, the researchers used the Federal Reserve’s Survey of Consumer Finances in 2019 to gauge the accuracy of workers’ perceptions, using their answers to a question about how they feel about their retirement finances. They had five choices, ranging from “totally inadequate” to “very satisfactory.”

Their impressions were paired up with an objective financial analysis, derived from the same survey, of the percentage of U.S. households that are not saving enough to maintain their current standard of living in retirement.

The 40 percent who don’t have a good handle on their finances were split into two groups – “not worried enough” and “too worried.” About 25 percent are in the not-worried-enough camp and arguably worst off because they do not recognize the trouble they’re in.

Workers at every income level make this mistake, but high-income households do this more than others. One reason for their over-optimism is most likely that they own expensive houses and may put too much stock in the strong recent rise in prices on their substantial real estate holdings.

High-income couples also underestimate their retirement risk when both of them are working but only one spouse is saving for retirement. They will need more savings to maintain their relatively high living standard when they retire.

The remaining 15 percent of households who misperceive their finances are too worried. This can be a problem for anyone, and perhaps more so low-income workers, if they’re making unnecessary sacrifices today because they are unaware of all the resources they’ll have in retirement.

When only one spouse is working, for example, the couple may not know the non-working spouse will also receive a Social Security check based on the worker’s earnings. Home equity is an issue for low-income workers too. It is a disproportionately large share of their wealth, but they probably don’t have plans to tap into it when they retire.

Planning for retirement is a complicated and challenging task but about 60 percent of households have a good gut sense of their financial situation. The bigger challenge is the one in four that are not worried enough. They need to get a better handle on what retirement will look like. They can’t come up with a plan unless they do.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.