People Lack Emergency Funds, Tap 401ks

When between 45 percent and 60 percent of Americans don’t have enough money for retirement, encouraging saving is a national priority.

When between 45 percent and 60 percent of Americans don’t have enough money for retirement, encouraging saving is a national priority.

A related issue is preserving the funds once they’re set aside.

A survey released last month by Transamerica indicates that workers frequently resort to hardship withdrawals and loans from their 401(k)s, because they lack the cash required in emergencies. The survey bolsters the argument made by some retirement experts and employers that until workers’ cash-flow problems are addressed, many will continue to view retirement funds as their best option in an emergency.

More than one in four U.S. workers in the survey said they have taken premature withdrawals from their 401(k) or IRA retirement funds. Catherine Collinson, president of the Transamerica Center for Retirement Studies, connected this “alarmingly high share” to a shortage of cash: 21 percent of workers reported having less than $1,000 saved for emergencies and another 14 percent have saved just $1,000 to $5,000.

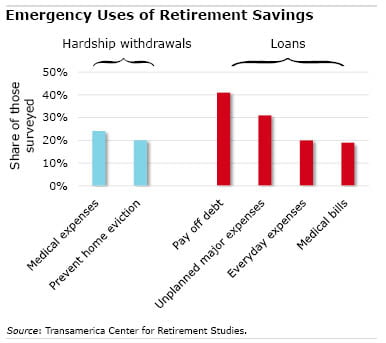

So it shouldn’t be surprising that the top two reasons for hardship withdrawals were for medical expenses (24 percent of those surveyed) and to prevent home evictions (20 percent). Hardship withdrawals are subject to a 10-percent penalty tax on the amount withdrawn.

Loans from 401(k)s, which are permitted under federal law and typically are repaid, are also being used in emergencies: nearly three out of four people put their loan proceeds toward “unplanned major expenses” or to pay off credit card and other debts.

If workers “don’t have cash on hand, the credit card is the natural go-to source of funds,” Collinson said. When the debt pile gets too high or other emergencies arise, 401(k)s are one way Americans are solving the problem.

But this solution to short-term crises can create big problems in the long-run.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our Squared Away blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.

Comments are closed.

This situation of borrowing from retirement accounts in not new.

It had been reported during the financial crisis and other hard times. I took advantage of 401(k) loans several times over my career. They were always paid back. Once I was 59 1/2, I used my 401(k) like a savings account since there were no penalties just taxes.

Can you imagine the hardship if people were not participating in 401(k) plans or did not have deductions taken automatically from from their paychecks? There would be no savings to fall back on.

Making matters worse, our collective 401K, Social Security, is in the same boat.

For a few decades Americans duly made their contributions in excess of what the program paid out, running up a large “Trust Fund.”

But because of emergencies — such as the Reagan and Bush II tax cuts, the Medicare prescription drug plan, a couple of wars, the financial bailouts, the decennial census — elected officials borrowed against that money. Spent it and deposited IOUs in the trust fund, to go along with all the other IOUs.

Back in the Reagan Administration, I thought people were being conned. But the evidence suggests they voted for what they wanted after all.

Back in 2009 my husband lost his job and took 9 months to find another job, which paid significantly less than he had been earning. During that time I was forced to tap my 401(k) to keep up with our expenses. The only thing that made me whole again was receiving a severance package in 2010 from my employer. Many seniors have still not recovered from the Great Recession and time is their enemy.

I’m really not surprised. Year after year, this problem persists. I really afraid myself, what I’d do in emergency situation, especially in retirement. What will happen and where will I find help?