Plans to Cut Social Security Already?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

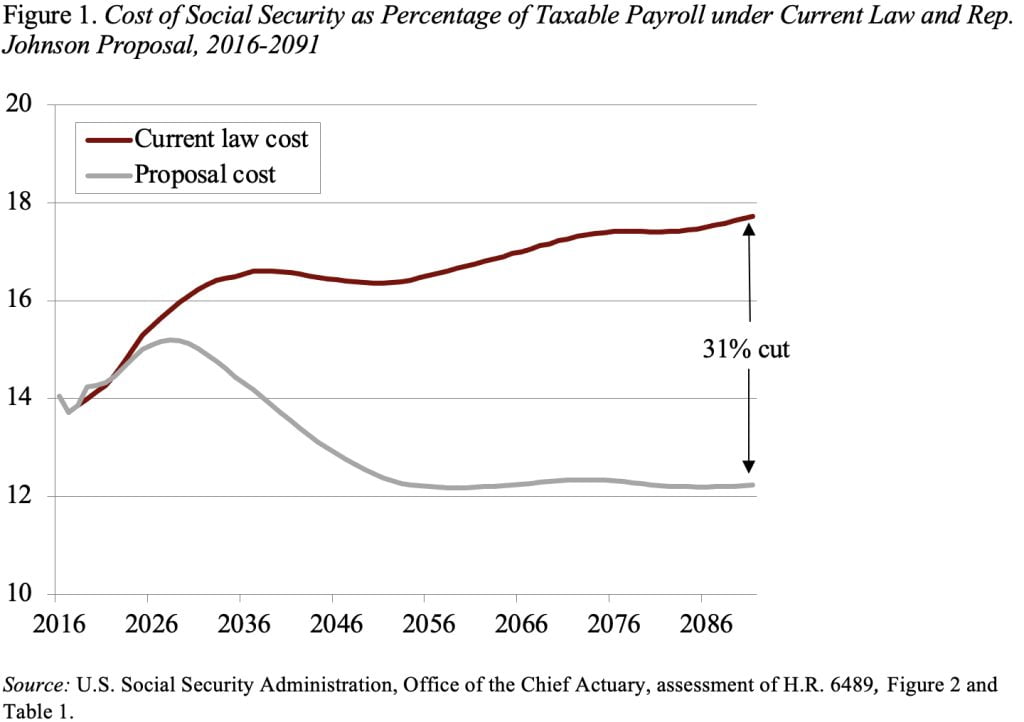

House Ways and Means Subcommittee Chair proposes 31-percent cut in benefits.

In December, House Ways and Means Social Security Subcommittee Chairman Sam Johnson introduced a bill to “save” Social Security. The problem is that he accomplishes this goal through a dramatic cut in benefits. As shown in Figure 1, Social Security costs at the end of the 75-year projection period would be 31 percent lower than under current law.

This 31-percent cut is the result of three major changes:

- raising the Full Retirement Age – currently rising from 66 to 67 – to 69;

- dramatically reducing benefits for above-average earners; and

- eliminating the cost-of-living adjustment (COLA) for individuals with income in excess of $85,000 ($170,000 for married couples) and using a chain-weighted index for those below.

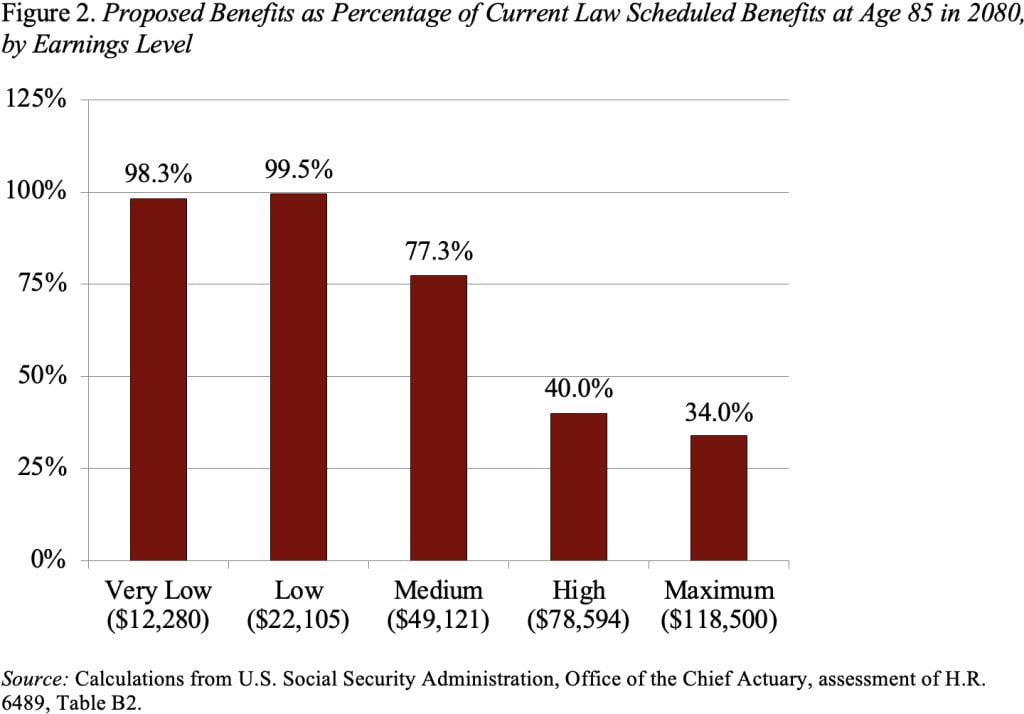

The best way to gauge the impact of these three changes is to examine the ratio of proposed to current benefits at different points in the earnings scale. Because the impact of eliminating the COLA increases over the retirement span, it is helpful to look at individuals at age 85. As Figure 2 below indicates, low earners are basically held harmless, while medium-earner benefits are cut to 77 percent of those provided under current law, higher earners to 40 percent, and maximum earners to 34 percent.

At first glance, one might conclude that’s a fine outcome – cut the benefits of the well paid and preserve the benefits of the low paid. But look closely at the earnings associated with the categories of well paid. The medium worker, who sees benefits drop to 77 percent of current law, earned $49,121 in 2016 and the “high” earner, who sees benefits drop to 40 percent of current law, earned $78,594. These are not rich people.

Moreover, changes to Social Security need to be made in the context of the entire retirement income system. Many households are likely to retire with little other than Social Security benefits, since at any moment in time less than half the private sector workforce participates in an employer-sponsored retirement plan. And among those lucky enough to have a 401(k) plan, balances are modest. The 2013 Survey of Consumer Finances, the latest comprehensive data available, shows that median 401(k)/IRA holdings of working households with a 401(k) approaching retirement (age 55-64) was $111,000.

Policymakers do need to address Social Security’s long-run deficit, but a proposal that consists only of benefit cuts does not merit serious consideration.