Filter

401(k)s Stall, Post-Auto Enrollment

Seven years after Congress encouraged employers to automatically enroll their workers in the company 401(k), the retirement fix has run out of steam. Corporate America rushed in to adopt the feature in their 401(k) plans after the Pension Protection Act (PPA) made auto enrollment more attractive by giving employers that used it a safe harbor from non-discrimination rules governing their benefits. Immediately after the PPA provision became effective in December 2007, employee participation in 401(k)s increased. But since that initial bump, it’s been virtually flat for years. In 2008, participation increased to 73 percent of all employees in workplaces that offered 401(k)s, up from 68 percent in 2007, according to Vanguard Group Inc.’s new “America Saves 2013” report, which provides…

June 25, 2013

Older Patients Tell Doctors, “Charge It!”

New research has uncovered one reason for the alarming rise in credit card use among older Americans: medical bills. When people age 50 or older experience “health shocks” – newly diagnosed medical conditions – their credit card balances rise, according to research published in the Journal of Consumer Affairs. The worse the medical condition, the more they charge. A mild, new medical problem, for example, adds $230 to credit card bills – that’s a 6.3 percent increase on a starting balance of $3,654. If the new condition is severe, balances increase by $339, or 9.3 percent. Separately, the researchers looked at the effect of out-of-pocket medical costs, such as copayments for doctor visits and prescriptions not covered by private insuranc…

June 20, 2013

Are You An Ostrich About Investing?

As the stock market approached and then broke through the 15,000 mark, did you get a little obsessed with your 401(k) balance? You would not be alone. A novel research project recently analyzed how often investors went online to check their 401(k) accounts and found that they did so more often when the Dow was rising. What could be more pleasant than watching your wealth grow? The researchers quantified the emotional roller coaster that our investments can take us on by looking at log-on activity during 2007 and 2008 for 100,000 401(k)-style accounts at Vanguard Group Inc. To make sure they were properly measuring investor interest, the sample included only online customers who did not receive paper statements in t…

June 18, 2013

Retirement Tougher for Boomer Children

The financial media (including this blog) inundate baby boomers with articles cajoling, coddling, and counseling them about their every retirement concern. But members of the Me Generation might want to focus on their children: retirement is likely to be an even greater financial challenge for Generation X, now in their 30s and 40s. Economists at the Center for Retirement Research, which supports this blog, recently produced this striking prediction: three out of five Americans in their 30s and well over half of those in their 40s are at risk of experiencing a decline in their standard of living after they retire. This compares with 44 percent of baby boomers. The reasons for Generation X’s poorer prospects are due to long-term…

June 13, 2013

Too Many Homeowners Still Underwater

With house prices rising smartly, homeowners should be celebrating. Right? Wrong. To be sure, a 10 percent jump in house prices in the first quarter, compared with a year earlier, pushed more people out of the red and into the black. But one in four U.S. homeowners with a mortgage still has “negative equity:” the mortgage exceeds the value of the home, according to new data from Zillow. These 13 million U.S. homeowners will need more price appreciation before they can feel that the housing-market downturn of the previous decade is truly over. Negative equity is prevalent not just in obvious places like Las Vegas, once the poster child for the go-go real estate market that went bust. The painfu…

June 11, 2013

Nobel Winners Are Unsure Investors

Medal for the Sveriges Riksbank Prize in Economic Sciences. © ® the Nobel Foundation A Los Angeles Times reporter once called up several Nobel laureates in economics to ask how they invest their retirement savings. One of the economists was Daniel Kahneman, a 2002 Nobel Prize winner who would become more famous after writing “Thinking, Fast and Slow” about the difference between fast, intuitive decision-making and slow, deliberative thinking. Kahneman admitted to the reporter that he does not think fast or slow about his retirement savings – he just doesn’t think about it. Kahneman’s confession in the 2005 article seems even more relevant in today’s 401(k) world. Americans are realizing the investment decisions imposed on them by their employers may…

June 6, 2013

Earnings Growth: Better at the Top

U.S. inequality can be measured two ways – by wealth or by earnings. Either way, most working Americans are losing out. It’s the 1920s again for the richest 1 percent of Americans, and a recent analysis of the wealth gap illustrates why they’re able to live like the fictional Jay Gatsby, portrayed by Leonardo DiCaprio in the new movie, “The Great Gatsby.” The value of their wealth rises and falls with the stock market. But since the 1960s, they have consistently held 33 percent to 39 percent of the wealth owned by all Americans, including their stock, mansions, commercial real estate, and businesses, according to economist Edward Wolff at New York University. In 2010, the last year examined by Wolff,…

June 4, 2013

Layoffs After 50 Cause Severe Losses

For the average older worker who loses his job, his income a decade later is 15 percent lower than if he had escaped the layoff. It gets worse: His pension wealth is worth 20 percent less, and his financial assets are 30 percent smaller. The enormous financial hit delivered to older workers who experienced a layoff sometime during the 1990s was reported recently by researchers at the Center for Retirement Research, which supports this blog. First, the researchers pinpointed all workers in the data set who were over age 50 and lost a job between 1992 and 2000. They then examined their financial outcomes – earnings and assets – a decade later and compared them with outcomes for those who…

May 30, 2013

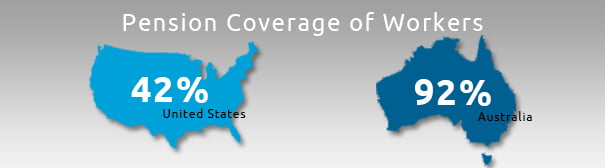

Aussie Employer Mandate Fuels Saving

Consider this: 92 percent of Australian workers have 401(k)-style plans, while less than half of Americans have any kind of pension coverage on their current job. This yawning disparity exists, because the Australian government requires employers to contribute 9 percent of each worker’s earnings to a personal account, which participants invest much like a 401(k). Under reforms to Australia’s system, employer contributions will rise gradually until 2020 – to 12 percent. Even though Aussie employers are mandated to make the contributions, economists argue, the money ultimately comes from workers – through lower wages. But U.S. workers, left on their own, have proved to be poor savers, and the fact remains that putting the onus on employers to ensure that retirees…

May 28, 2013

Student Loans = No House, No New Car

Here’s what Will Flannigan, 26, would rather do with the $401.58 he pays on his student loans every month. • Save. • Buy a house: the mortgage payment on a house he looked at was the same as his rent, but renovating or fixing anything would be unaffordable. • Replace his 2006 Ford Focus – it’s red but he calls it a “lemon.” • Buy new clothes – thrift shops are standard. • Eat dinner out at someplace other than a fast food restaurant. Flannigan is getting married in August – to a woman who pays about $250 per month for her college loans. Three out of four people now paying off student debt – whether graduates or their parents…

May 23, 2013

Few Boomers Catch Up on 401(k) Saving

Only 13 percent of older workers take advantage of the “catch-up” contributions to their retirement accounts permitted by the IRS for anyone over 50, according to new data provided by Fidelity Investments. This is hardly surprising, since prior research has estimated that only about 10 percent of all workers are contributing the maximum $17,500 per year that everyone, regardless of age, is allowed to contribute under IRS guidelines for 2013. Since the vast majority never reach that cap, the “catch-up” 401(k) contribution enacted to encourage people to save more when they hit their 50th birthday – an additional $5,500 per year – is largely irrelevant to them. But the catch-up contribution data, which Fidelity culled from its 401(k) client databas…

May 21, 2013

Our Mission at Year 2

The best place to invest, the coolest cash back rewards, the smartest or cheapest or lowest-rate mortgage – infinite spin ushers out of the financial world every day, and it’s all aimed at you. That’s among the reasons the Center for Retirement Research at Boston College started this blog in May 2011. The blog’s focus is not financial products but financial behavior: what people do, why we do it, and how we can do it better. At its two-year anniversary, the Squared Away Blog hopes that it has become a reliable source of information for a growing number of readers of all ages who struggle every day to save and invest for their own or their children’s futures. It’s important…