Filter

Pension Cuts Could Hurt Worker Quality

Cuts in public pensions taking place around the country could reduce the ability of state and local governments to recruit and retain top-quality workers, according to new findings by the Center for Retirement Research, which sponsors this blog. Economists have long argued that pensions and worker quality are related. Pensions, like paychecks, are a form of compensation, one that particularly appeals to workers with the foresight to value financial security in a retirement still decades away. And these are often better, more productive workers. To examine the effect of pension generosity on worker quality, the Center’s researchers first had to find good measures of each. For worker quality, they used U.S. Census Bureau survey data on workers who have moved…

November 18, 2014

Pandemic Puts More Retirements at Risk

Americans’ retirement outlook has gone from bleak to bleaker. The unemployment caused by COVID-19 has pushed up the share of working-age households not able to afford their current standard of living in retirement from 50 percent to 55 percent, according to a new analysis by the Center for Retirement Research, which sponsors this blog. The analysis updates a previous estimate, based on 2016 data, to include the harmful effects of surging unemployment. The researchers estimate that perhaps 30 percent of workers – far more than is reflected in the monthly jobless rate – could be affected by layoffs now and in the future. They did not factor in the recession’s impact on the housing and financial markets, which could mak…

July 21, 2020

Lift SNAP’s Asset Test and People Save

When a low-wage worker has a dental emergency or the car breaks down, it can set off a chain reaction of financial problems. Losing a job due to that car problem is a catastrophe. It’s not an exaggeration to say that having just a little money in a bank account is a lifesaver. But low-income Americans are discouraged from saving due to the asset limits in joint federal-state assistance programs such as food stamps, Medicaid, and Temporary Assistance to Needy Families. These asset limits create a Catch-22: if the recipient builds up the savings crucial to their financial well-being, they lose their assistance, which is also critical to their well-being. This illustrates just how difficult it is to design programs…

September 20, 2016

Can’t Afford to Retire? Not All Your Fault

Three out of four members of Generation X wish they could turn back the clock and get another shot at planning for retirement. One in three baby boomers say don’t think they’ll ever be able to retire. “Overwhelmingly, Americans are stressed about their current – and future – financial situation,” the National Association of Personal Financial Advisors said about these new survey results. Regrets about not planning and saving enough are enmeshed in our thinking about retirement. But it is really all your fault that you’re not getting it done? The honest answer to that question is “no.” There are big gaps in the U.S. retirement system that make it very difficult for many to carry the responsibility it places…

February 6, 2020

Does Increased Debt Offset 401k Savings?

Roughly half of U.S. employers with a 401(k) plan enroll their workers automatically, deducting money from their paychecks for retirement unless they explicitly opt out of this arrangement. This strategy is widely viewed as a good way to get people to save. But auto-enrollment might not be as effective as it seems, if individuals are compensating for a smaller paycheck by borrowing more. A new study of civilian employees of the U.S. Army used credit and payroll data to gauge whether debt increased for employees who were automatically enrolled in the federal government’s retirement savings plan. The researchers compared changes in debt levels for people hired after the government’s 2010 adoption of auto-enrollment with hires prior to 2010. The good…

October 15, 2019

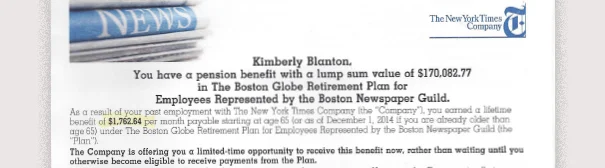

Evaluating a Pension Buyout Offer

Like many baby boomers, I’ve received an offer from a former employer that’s meant to entice: “The Company is offering you a limited-time opportunity to receive this benefit now, rather than waiting until you otherwise become eligible to receive payments from the Plan.” My 17-year employment as a Boston Globe reporter entitles me to a $1,762 monthly pension for life, starting at age 65. I’m 57 now. But a few weeks ago, the company put two alternatives on the table: take a smaller pension that starts now or trade my pension for a lump sum of $170,000 in cash. The deadline for accepting the new offer: the day after Christmas. The New York Times Co., which used to own t…

December 16, 2014

Wisconsin Finds Owners of Lost Pensions

Some people lose old retirement accounts because they forget about them. Others don’t want the hassle required to retrieve small amounts. And workers who change jobs fairly often can leave a lot of small accounts in their wake. As a result, millions of dollars of retirement wealth – in pensions, 401(k)s, IRAs, profit-sharing plans, and annuities – sit in state repositories of unclaimed property. So how can workers and retirees be united with their long-lost money? To answer this question, a new study contrasts what has happened to unclaimed retirement accounts in two states with vastly different approaches to handling them: Wisconsin and Massachusetts. Wisconsin in 2015 began to use Social Security numbers to automatically match up and return misplaced…

February 2, 2021

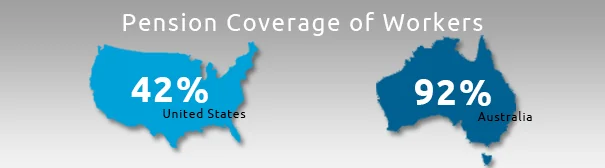

Aussie Employer Mandate Fuels Saving

Consider this: 92 percent of Australian workers have 401(k)-style plans, while less than half of Americans have any kind of pension coverage on their current job. This yawning disparity exists, because the Australian government requires employers to contribute 9 percent of each worker’s earnings to a personal account, which participants invest much like a 401(k). Under reforms to Australia’s system, employer contributions will rise gradually until 2020 – to 12 percent. Even though Aussie employers are mandated to make the contributions, economists argue, the money ultimately comes from workers – through lower wages. But U.S. workers, left on their own, have proved to be poor savers, and the fact remains that putting the onus on employers to ensure that retirees…

May 28, 2013

Boomers Find Reasons to Retire Later

It is one of “the most significant labor market trends” in the United States, says Wellesley College researcher Courtney Coile. She’s referring to big increases since the 1980s and 1990s in the share of older Americans in the labor force, including one in three men in their late 60s. As for women, the baby boomers were really the first generation to thoroughly embrace full-time employment. Older women’s participation in the labor force hasn’t quite caught up with their male coworkers, but they’ve made impressive strides since the 1980s and have rapidly closed the retirement-age gap. Given the implications of this trend for retirement security – the longer people work, the better off they’ll be – Coile and many other researchers hav…

November 29, 2018

Pre-Retirement Financial Review is a Must

My husband has taught high school biology for 30 years in Boston and works hard for his students. But he’s nearly 64 and it’s time to think about retiring. Can we afford it? When we retire, will we eventually run through our savings? Is retirement scary – or what? Questions like these are also probably haunting millions of baby boomers in the middle of the night. One out of three boomers in a recent Transamerica survey said they are not confident they will have enough income to retire “comfortably” and another third concede that they are only “somewhat confident.” To find the answer for ourselves, my husband and I hired a financial adviser. It was the best thing we could’ve done. T…

June 15, 2017

Social Security Eases Racial Disparities

Social Security is a major source of income for most retirees. It is even more important to blacks and Hispanics in a nation that is becoming increasingly diverse. Social Security is helping to even out the racial and ethnic inequities in income and wealth that exist in the working population and continue in old age, according to a study by the Center for Retirement Research for the Retirement and Disability Research Consortium. The researchers estimate how much Social Security reduces this inequality by comparing retirement wealth for white, black, and Hispanic-Americans. Wealth is defined broadly to include obvious things like home equity and financial assets such as 401(k) retirement accounts, certificates of deposit, and money market accounts. In addition, t…

November 19, 2019

Government Workers See COLA Cuts

State and local government workers have long felt their pensions were more secure than the vanishing pension coverage in the private sector. But a spate of changes to cost-of-living protections should give them pause. In the wake of the Great Recession, 17 states reduced, suspended, or eliminated cost-of-living increases (COLAs) in their defined benefit pensions for state and local workers, according to a recent summary of legislative actions around the country by the Center for Retirement Research, which sponsors this blog. And the courts are backing them up, deciding that the inflation protections – a fixture of the majority of public pensions – do not have the same constitutional or other legal protections that apply to core benefits. The COLA…