Filter

Could Social Security Statement Do More?

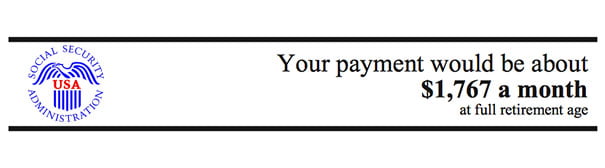

Two out of three working Americans grade their retirement readiness at no better than a “C.” So how about using the Social Security Statement that lands in their mailboxes, grabbing their attention, to spur them to action? The statement is already valued by millions of Americans. A survey funded by the U.S. Social Security Administration (SSA) found that people who received statements were “dramatically” more knowledgeable about their basic pension benefits than people who had already retired when SSA started mailing them out in the mid-1990s. Social Security is the nation’s most important source of retirement income, and the information in the statements is essential to most workers’ retirement planning. Mailed out before every fifth birthday – 25, 30, 35,…

February 9, 2016

Retirees Don’t Touch Home Equity

Remarkably, middle-class Americans have at least as much money tied up in their homes as they have in all their retirement plans, bank accounts, and other financial assets combined. A hefty share of older U.S. homeowners are even better off: 41 percent between ages 65-74, and 63 percent over 74, have paid off their mortgages and own their homes free and clear. But only one in five retirees would be willing to use their home equity to generate income in a new survey by the National Council on Aging (NCOA). This reluctance seems to be on a collision course with financial reality for working baby boomers, when so many are at risk that they won’t be able to maintain their…

April 6, 2017

Webinar to Explain Social Security

In a webinar next Thursday, an official from the Social Security Administration will explain the fundamentals of calculating and claiming benefits. Social Security represents the largest single financial resource for most baby boomers, so deciding when to file for benefits is their single biggest retirement decision. The value today of that future stream of monthly checks – $287,200 for the typical household aged 55-64 – far exceeds the value of home equity or 401(k)s for most people, according to 2010 data from the Federal Reserve Board. And it often exceeds the value of their traditional defined benefit pension plan – if they even have one. The lower one’s income, the more Social Security matters too. The webinar was organized by…

April 4, 2013

62YO Men File Social Security; Wives Pay

My father was never more in love with my mother than on the day he died in 2004, days before their 50th anniversary. But he made one bad financial decision that she lives with today: he started up his Social Security benefits at age 62. He felt he needed the money sooner than later. He had an inadequate pension from his first career, as an Air Force flyboy, and none from his Rust Belt business that went bust. But waiting to claim his Social Security would’ve increased the size of his check – and, after he died at 70, the money that’s still deposited into my mother’s bank account every month. This happens to a significant share of couples, becaus…

June 27, 2013

Few Put Finances First When Retiring

Will you retire when you want to, when you have to, or when you can afford it? This is crucial, because when Americans retire is more important than it’s ever been to our financial well-being in old age. Yet the research indicates this doesn’t carry enough weight in people’s decisions. This doesn’t make any sense. The typical combined 401(k)/IRA balance is a slim $111,000 for working households between 55 and 64 years old that have a 401(k). And fewer and fewer retirees have defined benefit pensions, which provide reliable income. More than half of us are at risk of experiencing a decline in our standard of living after we retire, estimate economists at the Center for Retirement Research, which supports…

January 5, 2016

Unpaid Water Bills Open Door to Advice

Nearly half of the low-income residents in some sections of Louisville are delinquent on their city water bills. In Newark, water customers’ unpaid balances have been known to reach $4,000. The shutoff and reactivation fees that some cities charge when they stop a customer’s water service create another problem in places like Houston: they add to the unpaid balances of customers who are already struggling financially. Cities are also becoming more aggressive about collecting on their debts, hiring third-party collection firms. Researchers and the National League of Cities tried an alternative in the form of an ambitious pilot program involving five city water departments: Houston; Louisville, Kentucky; Newark, New Jersey; Savannah, Georgia; and St. Petersburg, Florida. Driving the program was…

February 14, 2017

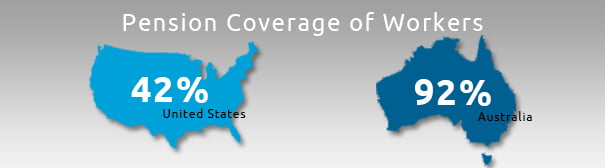

Aussie Employer Mandate Fuels Saving

Consider this: 92 percent of Australian workers have 401(k)-style plans, while less than half of Americans have any kind of pension coverage on their current job. This yawning disparity exists, because the Australian government requires employers to contribute 9 percent of each worker’s earnings to a personal account, which participants invest much like a 401(k). Under reforms to Australia’s system, employer contributions will rise gradually until 2020 – to 12 percent. Even though Aussie employers are mandated to make the contributions, economists argue, the money ultimately comes from workers – through lower wages. But U.S. workers, left on their own, have proved to be poor savers, and the fact remains that putting the onus on employers to ensure that retirees…

May 28, 2013

Will Boomers Delay Social Security?

A 1983 reform to Social Security is now in full swing for baby boomers: they must wait at least until their 66th birthday to claim their full pension benefits. But is the gradual increase in the program’s so-called full retirement age – it was 65 for prior generations – having any effect on when boomers retire? Why people decide to retire when they do is complicated, and economists have tried for years to understand this. Americans are working slightly longer than they did in the mid-1990s, with the average retirement age rising from 62 to 64 for men and from 60 to 62 for women (though this trend may be stalling). Myriad possible explanations for retiring later include the declin…

April 16, 2015

Tapping 401(k)s, IRAs Early Is Costly

It’s fairly easy to withdraw money prematurely from 401(k)s and IRAs – a practice that depletes roughly one-fourth of account balances over a worker’s lifetime. U.S. workers on average withdraw 1.5 percent annually from their retirement account assets. When they do, they forgo years of investment gains they could have earned had they left their money alone. Early withdrawals can pose a problem for many Americans at a time financial security in retirement increasingly hinges on these defined contribution plans. The potential for leakages has also grown in recent years, in part due to the shift away from traditional employer pensions to 401(k)s that place control in employees’ hands. Further, the assets being held in IRAs, which have more libera…

March 31, 2015

TDFs Appeal to the Most Inexperienced

New research finds that the people most likely to benefit from target date funds are also the people inclined to invest their 401(k)s in them – unsophisticated investors. Retirement and financial literacy researchers long ago established the pitfalls of our nation’s do-it-yourself system of retirement saving (i.e., people don’t save at all or don’t save enough, and investing is too complex for most people). Target date funds (TDFs) have become an increasingly popular solution to the investment piece of the problem in the wake of the Pension Protection Act of 2006, which allowed employers to use them as the default investment option in defined contribution savings plans. TDFs place a 401(k) participant’s accumulated savings into a broadly diversified portfolio of…

April 30, 2015

Taxes and Social Security Progressivity

Social Security’s old-age pensions were designed to replace more of the earnings of retired low-wage workers than of higher-wage workers. But how is this progressivity affected by the federal income taxes paid by all workers and retirees? A study by economists at the Center for Retirement Research, which sponsors this blog, analyzed this complex issue and found that income taxes have not had any real impact on the overall progressivity of the Social Security program. To reach this conclusion, the researchers used the actual experiences of older American households contained in survey data linked to their lifetime earnings. There were several different tax effects to consider. First, the payroll tax that funds Social Security is shared by workers and employers,…

November 6, 2014

Marching to Retirement Without a Plan

Only about half of all U.S. workers in the private sector participate in retirement savings plans at their current places of employment, according to a new report by the Center for Retirement Research. Pension coverage in this country “remains a serious problem,” concludes the Center, which also sponsors this blog. The goal of the Center’s report is to make sense of the myriad estimates of how many Americans are covered at work. One prominent source of data is the federal government’s survey of employers, the National Compensation Survey. The NCS shows that 78 percent of full-time workers, ages 25 through 64, have some type of defined benefit or defined contribution plan available to them at work. But that’s the rosiest…