Rising Stocks, House Prices Boost US Retirement Outlook

While COVID was raging, the jump in house prices and a rising stock market were dramatically improving U.S. workers’ retirement finances.

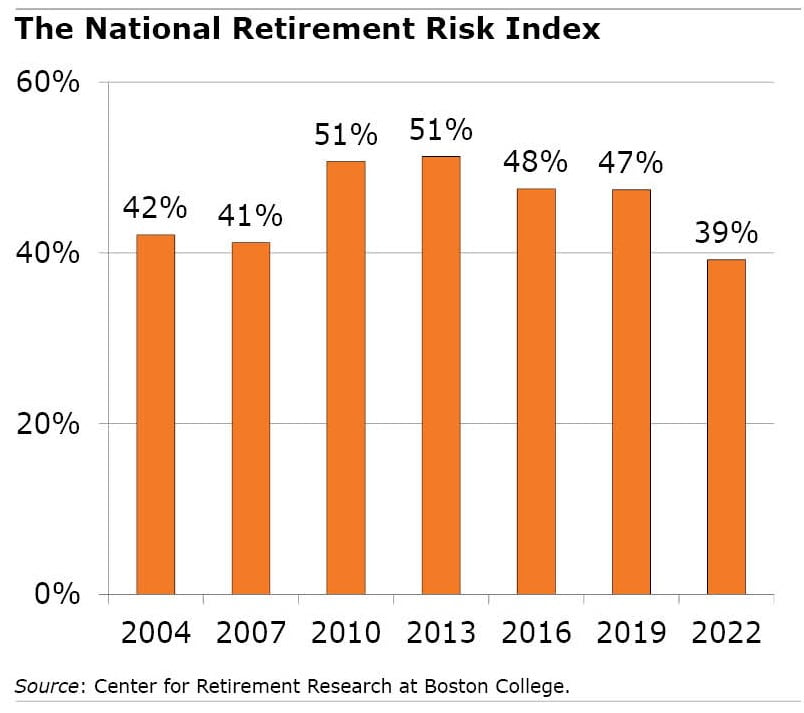

In 2022, the share of households that were not saving enough to maintain their standard of living after they retire dropped to 39 percent, from 47 percent in 2019, according to the Center for Retirement Research, which sponsors this blog.

That 39 percent is the lowest level in the nearly two decades the center has been analyzing the data in the Federal Reserve Board’s Survey of Consumer Finances, which is conducted every three years.

But the news is not quite as good as it appears, because the increase in house prices in 2020 through 2022, which continues today, was the largest single reason for the improvement.

Yes, Americans are wealthier on paper, thanks to a combination of old mortgages with low interest rates and increasing house prices fueled by strong housing demand during COVID in suburban and rural markets. Among the narrower group of people who own their homes, the share of households at risk dropped sharply, from 34 percent to 24 percent.

But it is also fairly unusual for retirees to capitalize on their housing wealth by converting it into income by downsizing to a less expensive home or taking out a reverse mortgage. A conversion through a reverse mortgage is a core assumption in the center’s analysis. In 2022, only 64,437 homeowners took out the federally insured reverse mortgage that becomes an option at age 62.

The increase in home prices wasn’t the only thing boosting retirement wealth, however. A rising stock market was the second most important reason for the improved outlook.

The Standard & Poor’s 500 stock index – despite the 2022 market slump – gained more than 20 percent after inflation during the three-year period. These gains mainly benefited the wealthy, where stock ownership is concentrated – they also tend to own their homes.

But investment portfolios also grew for lower- and middle-income workers who are saving in an employer’s 401(k)-style retirement plan. Among households with a 401(k), the share at-risk fell from 42 percent to 35 percent.

Lower- and middle-income workers also padded their savings accounts when Congress provided a generous package of financial assistance to help them cope with the economic slowdown in the first year of the pandemic.

The improvement in Americans’ retirement finances is encouraging. But even this conservative estimate that counts little-used home equity as retirement wealth leaves four out of ten households with the possibility of a drop in their standard of living once they retire.

This, the researchers conclude, “confirm[s] that we need to fix our retirement system so that Social Security is financially sound and employer plan coverage is universal.”

Squared Away writer Kim Blanton invites you to follow us @SquaredAwayBC on X, formerly known as Twitter. To stay current on our blog, join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

Timing is of ultra importance! Find a financial planner, with whom you feel comfortable, 5 to 10 years before a planned retirement to learn the options you have on how to protect part or all of your 401k.