Social Security Benefits Should Not Be Cut

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

And raising the Full Retirement Age from 67 to 70 would be the worst way to cut them.

The American Academy of Actuaries – a group of usually sober and sensible people – recently issued a brief making the case for “Raising the Social Security Retirement Age.”

Their argument is straightforward. Social Security is running a 75-year deficit equal to 3.5 percent of taxable payrolls. The only way to fix the problem is to raise revenues or cut benefits. Life expectancy at 65 has increased, and is projected to continue to increase, which pushes up program costs. Therefore, Congress should make people work longer and postpone claiming their benefits. Raising the full age to 70 could cut the long-run deficit by about a third.

Just to be absolutely clear, increasing Social Security’s Full Retirement Age is not just a question of “postponing” claiming; it is a benefit cut. Those who are able to delay retirement receive one less year of benefits. Those who cannot adjust their retirement behavior get lower benefits due to the increased actuarial adjustment – an adjustment made to keep lifetime benefits constant regardless of claiming age. Currently, those claiming at age 62 receive only 70 percent of the benefit available at 67. If the Full Retirement Age were increased to 70, that amount falls to 55 percent.

I’m against any form of benefit cut, because the rest of the U.S. retirement system seems quite wobbly to me. At any moment, only about half of private sector workers are covered by any type of workplace retirement plan. That means some people never are covered and are totally reliant on Social Security, while others move in and out of coverage and end up with modest balances.

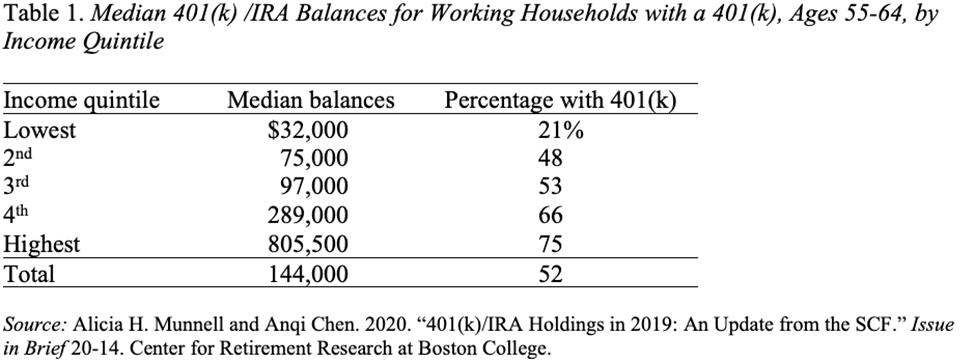

We actually know how much people have in their retirement accounts from the detailed financial data in the Federal Reserve’s Survey of Consumer Finances. As of 2019 – the date of the latest survey – households (with a 401(k)) approaching retirement (ages 55-64) had $144,000 in 401(k)/IRA balances (see Table 1). That may sound like a lot but if they buy a joint-and-survivor annuity, they will receive only about $600 per month. And this amount is likely to be their only source of retirement income beyond Social Security because the typical household holds no other financial assets. Cutting Social Security benefits would be a disaster for most Americans.

Moreover, increasing the Full Retirement Age is the most pernicious form of benefit cut, because it hurts the most vulnerable who are forced to claim early. And it’s clear who these people are.

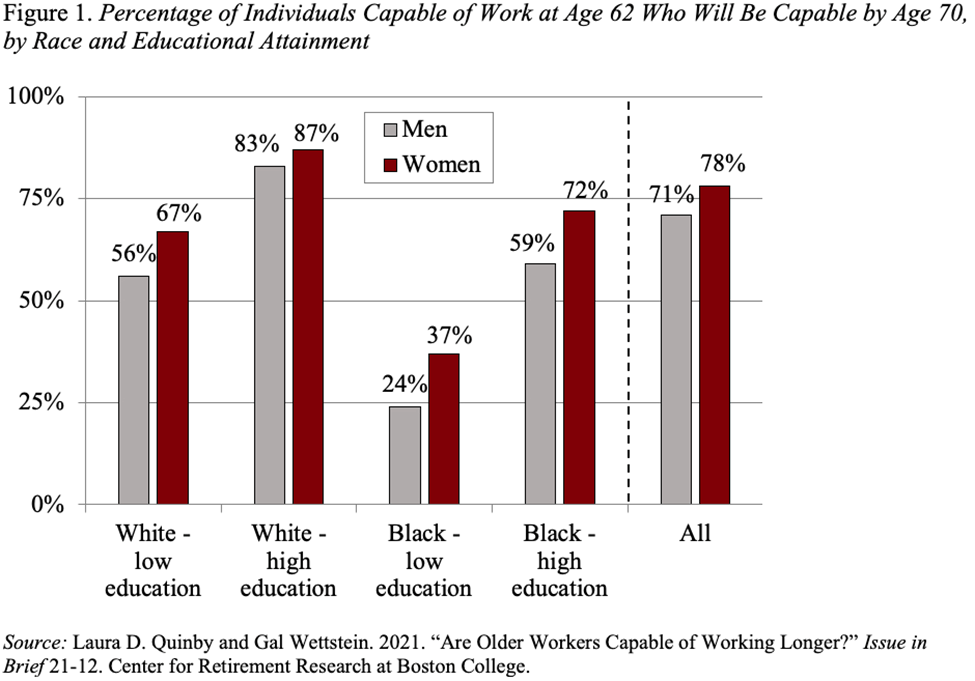

In a recent study, my colleagues examined “working life expectancy” for all individuals and by race and education. They looked at individuals who are expected to be working at 62 and calculated the probability that they will still be capable of work if Social Security’s Full Retirement Age were increased to 70 (see Figure 1). The exercise showed that while age 70 might be possible for a large majority of high-education Whites, it is out of the question for many men and women with low education – particularly Blacks – and even for many high-education Black workers. These individuals would end up with grossly inadequate benefits.

Yes, it is possible, as the actuaries suggest, that some of the pain created by increasing the Full Retirement Age could be offset by expanding Disability Insurance. But I have no confidence this would happen. So, don’t cut Social Security benefits. And, if for some crazy reason we decide to do so, don’t do it by raising the Full Retirement Age.