The First State Auto-IRA Program Is Up and Running

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Early data show how employers and workers are responding to OregonSaves.

About half of private sector workers are not covered by an employer-sponsored retirement savings plan at any given time, and few workers save without one. In the absence of federal action to close this coverage gap, some states have passed legislation to implement “Auto-IRA” programs. Oregon’s plan – OregonSaves – is up and running, and data are available to determine how workers who gain access to an auto-IRA initially interact with the program.

Employers without a plan are required to automatically enroll their employees in an IRA; the employees have a right to opt out if they do not want to participate. OregonSaves has a default deferral rate of 5 percent of pay, which automatically increases by 1 percent per year until reaching 10 percent; participants have the right to move their contribution rate from the default. Deferrals are invested in an age-based target date fund (except for the first $1,000, which goes to a capital preservation fund).

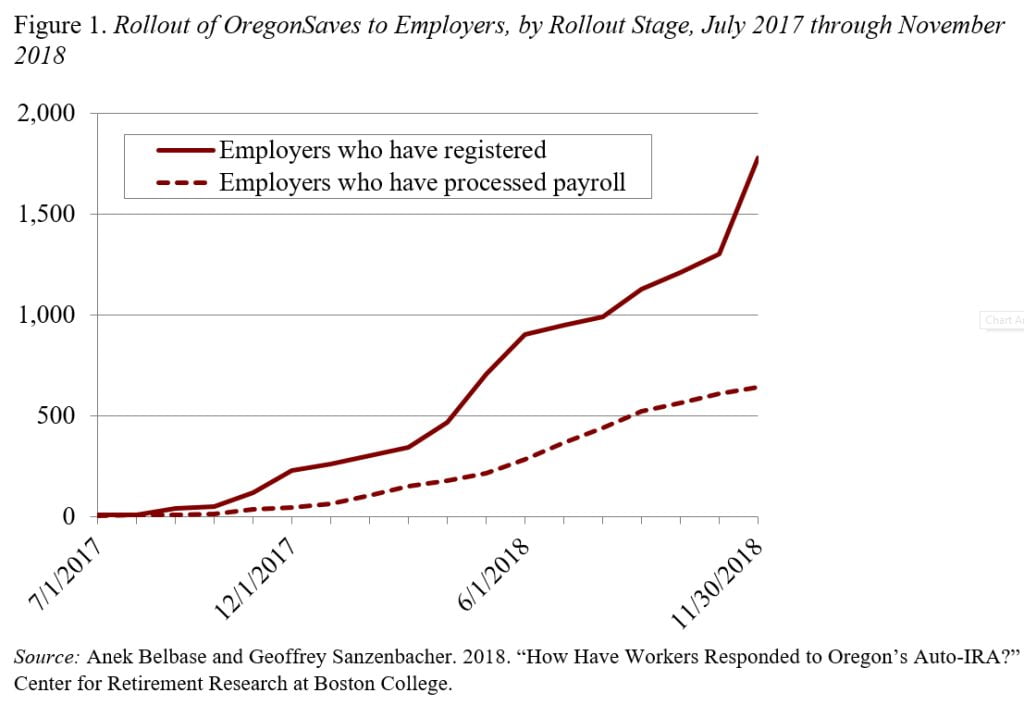

Figure 1 shows that registrations have grown rapidly, with a sharp uptick as the mid–December deadline approaches for firms with 20-49 workers. The figure also shows that only about a third of the employers that have registered have actually begun submitting their employees’ contributions.

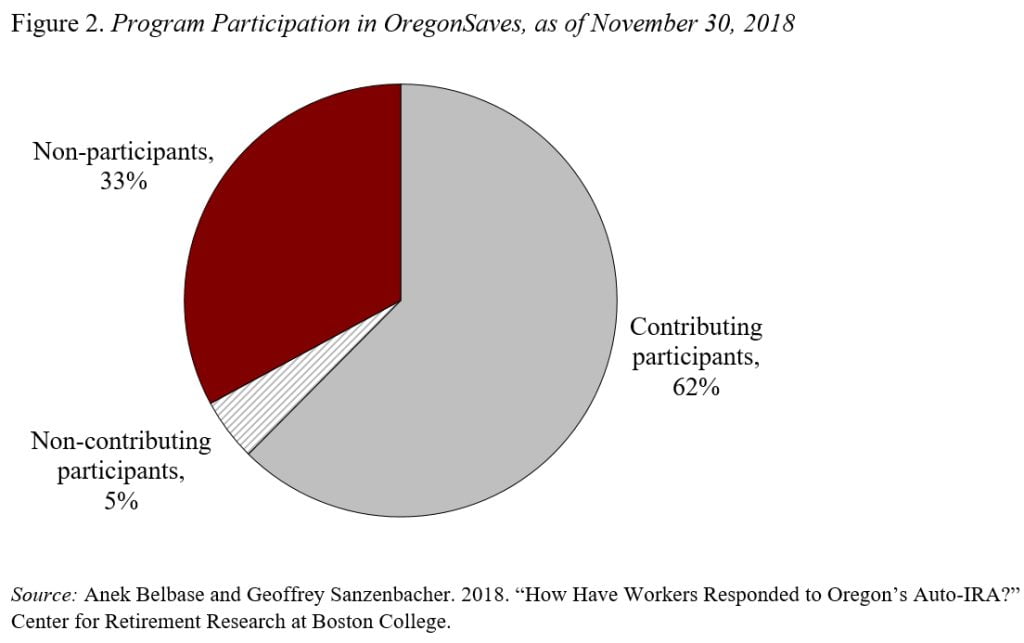

One key question is how many of the 39,524 potential participants stay in the program. Figure 2 shows that 62 percent of those eligible were participating.

Workers who chose not to participate offered three main reasons: 1) 30 percent said they could not afford to save; 2) 19 percent said they had their own or another retirement plan (e.g., through a spouse); and 3) 12 percent said they did not want to save through this particular employer, perhaps because they did not expect the relationship to last long or because they have another job where the employer is not yet registered.

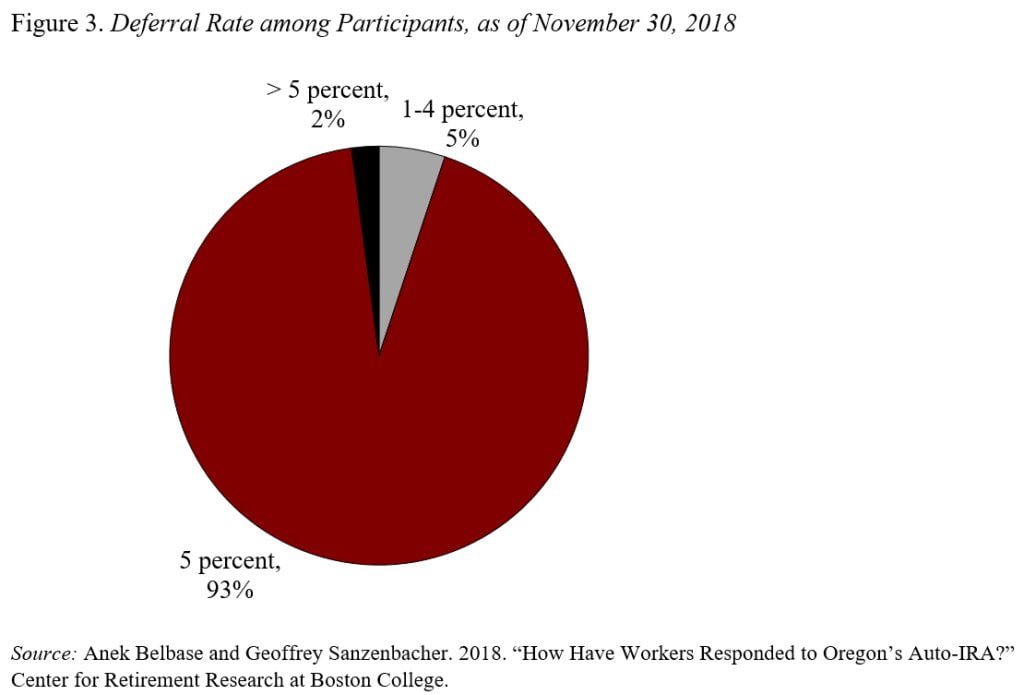

A second question is how many of those participating stuck with the default contribution rate. Figure 3 shows that 93 percent of contributing participants had not changed their default deferral rate of 5 percent. The stickiness of the default mirrors participant behavior in 401(k) plans and means that the average contribution rate is right around 5 percent. It is worth noting that workers’ response to auto-escalation is still an open question, as that process does not begin until 2019.

In short, the early results from OregonSaves show that the program works. Nearly 22,000 previously uncovered workers – 62 percent of those eligible to participate – have begun to accumulate assets and almost all have stuck with the default contribution rate. At the same time, the early data highlight the challenge of getting employers to provide timely and accurate data and process payroll deductions. Speeding up this process will result in a larger participant pool.