The Medicaid Requirements in Trump’s Spending Bill Will Hurt the People Who Need It Most. Here’s How.

Geoffrey T. Sanzenbacher is a columnist for MarketWatch and a professor of the practice of economics at Boston College. He is also a research fellow at the Center for Retirement Research at Boston College.

Getting people to work probably isn’t the point.

As a rule, I don’t trust any piece of major legislation whose title contains literally no information on its contents. So, when I saw that Republicans in the House of Representatives had passed something called the “One Big Beautiful Bill Act,” I was suspicious. I mean, give me something. Like many people, when I started to examine what the bill actually contained, one of the things that caught my eye involved Medicaid and the strict work requirement that the act imposed on many recipients.

Starting in 2026, the bill would require states to refuse coverage for most individuals ages 19 to 64 who cannot document that they were working or engaged in another qualified activity (e.g., volunteering) 80 hours per month. I certainly recognize the impetus for work requirements. Most needs-based programs have built-in disincentives for work. After all, if you make too much money, you lose coverage. Well-designed work requirements could get around this by pairing program receipt with employment. So, as I read the act, I wondered: will this work requirement work (pun intended)? I was especially curious because a group that I care about as a retirement researcher – those ages 50 and over – seem especially likely to be affected. After all, they rely disproportionately on the ACA Medicaid Expansion that seems to be targeted by the bill.

In an ideal world, a Medicaid work requirement would encourage people on the program to accumulate work experience, see increased wages, and ultimately move to jobs offering pay and benefits that eliminate the need for Medicaid. Such success relies on two assumptions. First, that people on Medicaid who aren’t working now can work in the future. Second, if these individuals did work, the jobs that they get would actually lead them out of the need for Medicaid.

On the first point, the truth is that most people on Medicaid who can work do work. According to the Kaiser Family Foundation, nearly 60 percent of adult Medicaid recipients already work. Among those that do not, their data show that health limitations are a major limiting factor. Data from a team lead by Rodlescia Sneed makes this point for the group of workers that so interested me, those ages 50 to 64. Their research shows that individuals in this age range working fewer than 20 hours per week have 2.9 chronic health conditions on average, versus 1.5 for those working 20 hours or more. Nearly a third of these older individuals working less than 20 hours have a limitation in activities of daily living like eating and grooming.

So, for many of these folks, working may not be an option. Now, the act supposedly exempts those with a disability from the work requirement. But, due to their low-income and health problems, many of these individuals do not use computers, the internet, or e-mail. So, obtaining the exemption will be very challenging, and the risk is that many people eligible for an exemption do not get one.

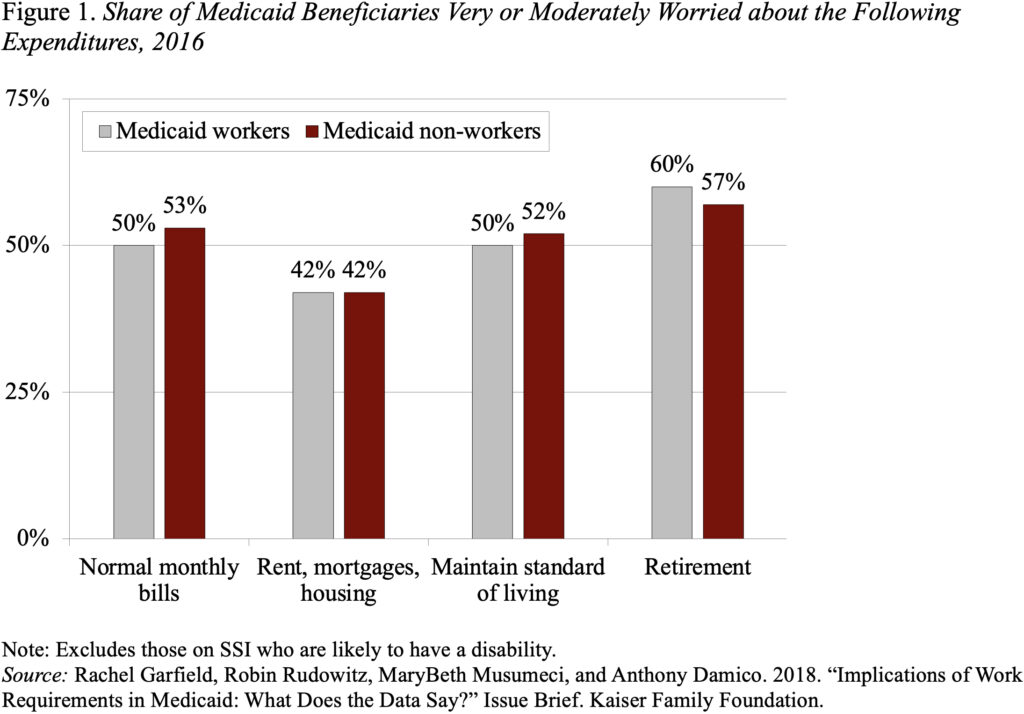

OK, but what about those on Medicaid who can work but do not? Will a work requirement lead them to higher wages at a good job with benefits? Probably not. The issue is one of simple selection. People who are on Medicaid and not working aren’t working for a reason – their job prospects may not be great. To see this fact, one need only look at the folks on Medicaid who are working. Figure 1 shows that they have very similar rates of financial distress as their counterparts who aren’t holding down jobs. The reason: they work in low-wage jobs at small firms that rarely offer benefits.

OK, so most Medicaid recipients already work. Those who don’t work often have limiting health issues, especially as they approach retirement. And, even if these folks do find work, they are likely to find it in a job that provides little financial security. Not looking good for these work requirements. So, it shouldn’t be surprising that the research into the few states that have tried these sorts of requirements is discouraging. The most prominent example is Arkansas, which only applied its work requirement to workers ages 30-49. Before the requirement was struck down in court, a team of researchers led by Benjamin Sommers found that it had no impact on employment. But, 18,000 individuals did lose Medicaid coverage. Of those, the majority delayed medical care or prescriptions because of the loss of their insurance. Maybe that’s the point – cut the Medicaid program under the guise of a work requirement. How else could you explain a bill passed by Congress whose own Congressional Budget Office has previously found that Medicaid work requirements don’t increase employment but do save money by limiting benefit receipt.

Now, I can see why they went with the “One Big Beautiful Bill Act.” It has a better ring than the “Hurt People Who Might Have Trouble Finding a Job Act.”