The Money in Your 401(k) and IRA Accounts Doesn’t Belong Entirely to You

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

People with higher incomes might be less prepared for retirement than they think.

I keep worrying that people approaching retirement with 401(k)/IRA balances don’t realize that they owe taxes on their accumulations. I’m sympathetic. It’s hard to accept that the pile that we’ve contributed to and nursed over our working life is not all ours.

Of course, we have all benefited throughout the years by not having to pay taxes on contributions paid into our traditional 401(k) plans and IRAs and on the investment returns on those contributions. Deferring taxes for decades has real value. A little algebra reveals that the benefit is equal to exempting investment returns on plan assets from taxation. So we come out ahead, even after we pay taxes on the withdrawals. Therefore, the issue is not whether the tax treatment accorded 401(k)s is a good deal. It is, and higher income people benefit the most. Rather, my concern is that people with moderate and higher incomes haven’t taken taxes into account in assessing how well prepared they are for retirement.

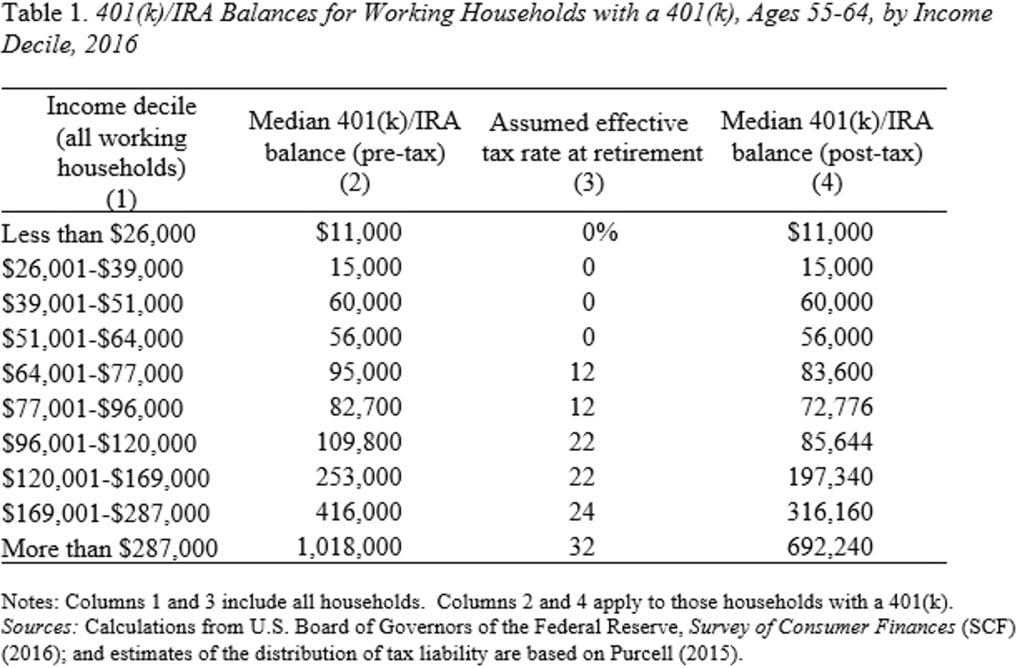

For some, the tax bill will be quite high, as shown in Table 1. These estimates are far from perfect, but let me tell you what’s being shown. The group under consideration is working households ages 55-64 with assets in a 401(k) plan in 2016 – the most recent year for the Federal Reserve’s Survey of Consumer Finances. The income levels that define the deciles in the first column are for all working households. The second column reports the median combined 401(k) and IRA balances for those households in each decile that have a 401(k). The third column, which is based on an earlier study, shows the estimated tax rate in retirement that will be faced by households in each decile. The final column shows the after-tax 401(k)/IRA amounts that households in each decile will have to support themselves.

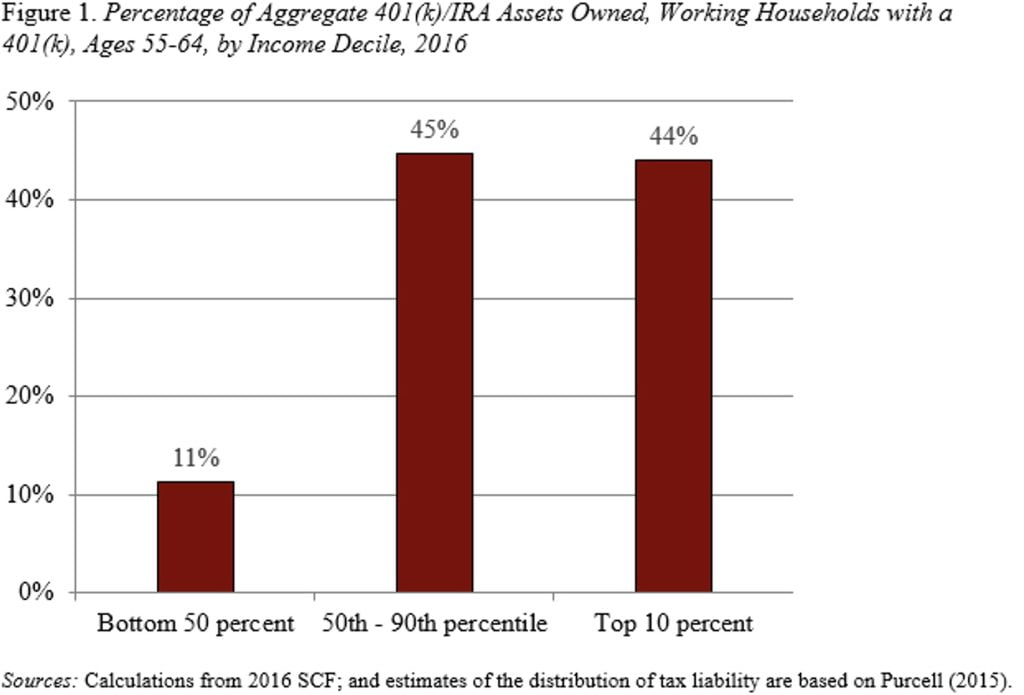

For those in the bottom half of the income distribution, taxes are not an issue. These households, however, hold only 11 percent of 401(k)/IRA assets (see Figure 1). The next four deciles, which hold about 45 percent of the assets, will pay about 22 percent to the federal government. The top decile holds the remaining 44 percent and will pay about a third of their assets in taxes.

The point of this discussion is not to suggest that we need to reduce the progressivity in our personal income tax structure, but merely to remind all of us who think about the adequacy of retirement savings that we need to pay the piper when we start drawing on our sources of retirement income.