These 4 Factors Explain Why 401(k) Balances Are So Far Below Their Potential

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

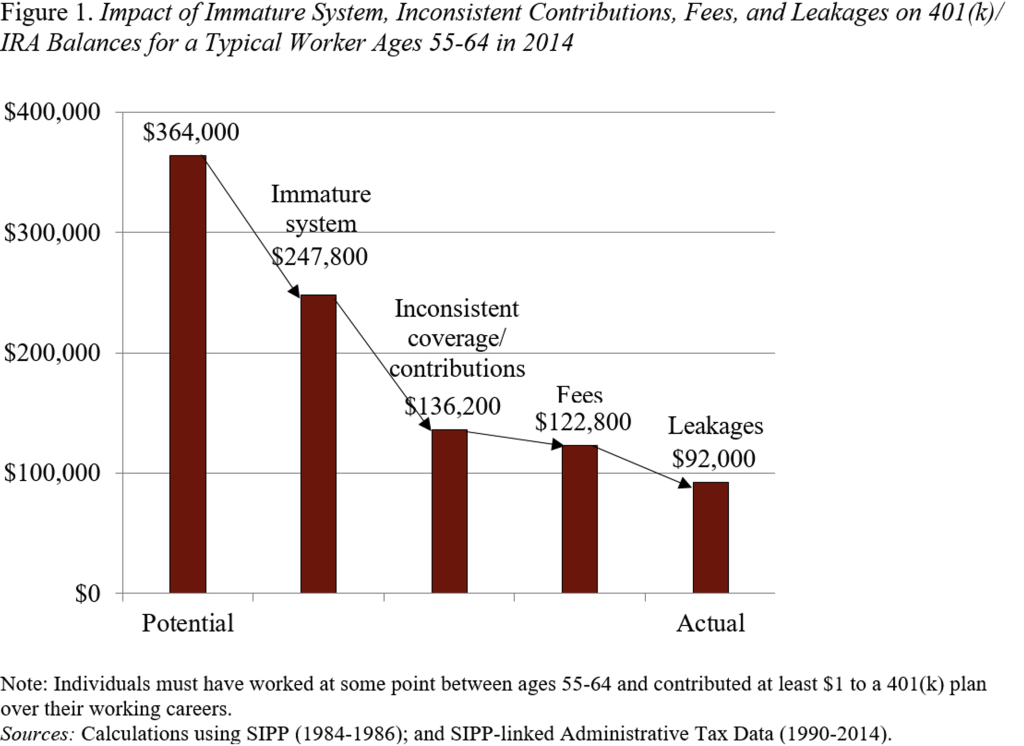

Why are average 401(k) balances at age 60 only $100,000 rather than $360,000?

We recently completed a new study that explains a discrepancy that has bothered me for years – namely, the difference between what people could have in their 401(k) plan and the amount that they actually hold. More specifically, a 25-year-old median earner in 1981 who contributed regularly would have accumulated about $364,000 in combined 401(k)/IRA assets by age 60, but the typical 60-year-old in 2016 had less than $100,000.

Four aspects of the U.S. retirement system could explain the discrepancy between potential and actual accumulations at age 60. First, the immaturity of the 401(k) system means that many 60-year-olds did not have access to a 401(k) plan early on in their careers, so they would have accumulated less than workers covered throughout their worklives. Second, the lack of universal coverage means that workers are not always in jobs that offer retirement plans and, therefore, are not always able to contribute. Third, participants’ ability to tap their account before retirement means that accumulations leak out. Fourth, fees can significantly erode net returns on investments.

This study used the Survey of Income and Program Participation (SIPP), linked with administrative tax records, to explore the relative importance of each factor. The analysis proceeded in five steps. Step 1: Estimate potential balances based on universal coverage and consistent contributions of 9 percent of earnings (6 percent employee plus 3 percent employer). Step 2: Document actual balances, as reported in the SIPP. Step 3: Calculate actual lifetime contributions and accumulated balances for each individual in the SIPP sample, assuming no leakages or fees. Step 4: Use the contributions of a younger cohort to separate the lack of contributions from the immaturity of the system. Step 5: Divide the remaining difference between fees and leakages using fees data from the Investment Company Institute.

The findings show that the immaturity of the system and inconsistent contributions are the main culprits, followed by leakages and fees (see Figure 1). The lack of universal coverage means that – even once the system matures – 401(k)/IRA plans will continue to fall below their potential.

The good news from this analysis is that as the 401(k) system has matured, more workers will have had a chance to spend their entire worklife in a 401(k) environment and balances at age 60 should be higher. The bad news is that the coverage gap, whereby about half of private sector employees do not have an employer plan at any given time, means that people will move in and out of coverage and end up with balances well below potential.