Recognizing ‘Legacy Debt’ Is Key to Better Funding of Public Pensions

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Shortfalls accumulated over decades should not all rest on today’s workers.

Legacy debt — leftover costs from the startup of retirement programs — is important not only when considering policy changes for Social Security but also for state and local pension plans. In the case of Social Security, the required payroll tax rate to fund promised benefits is high because we gave away the trust fund to provide benefits to early generations of retirees. Should today’s workers bear the full burden of that decision or should it be spread more broadly through an infusion of general revenues?

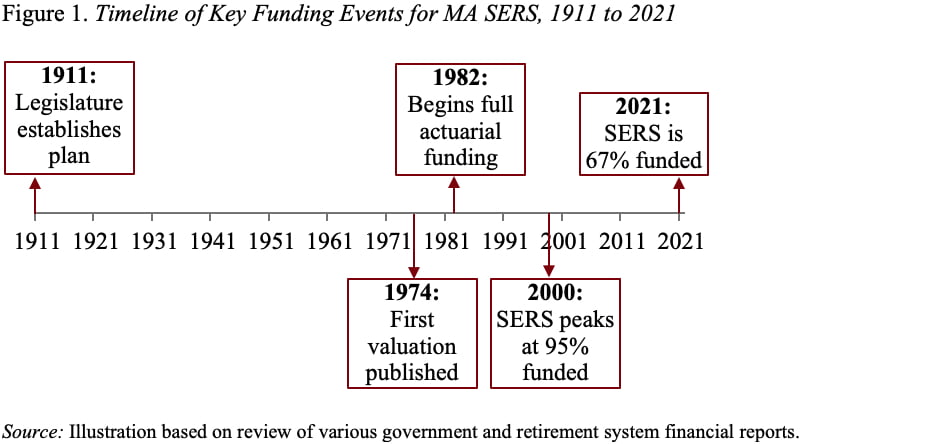

In the case of state and local plans, the legacy debt arises because plans have been providing benefits since the early 1900s, but did not adopt modern actuarial practices until the 1970s or 1980s. The timeline for Massachusetts’ State Employees Retirement System (MA SERS) is typical (see Figure 1). The impact of these unfunded liabilities from a bygone era is still felt today, because the shortfall keeps getting passed forward.

Moreover, public plan unfunded liabilities grew significantly even after plans shifted to modern actuarial funding. The primary reasons for this increase were: insufficient contributions; poor investment returns relative to expectations; changes to actuarial assumptions, such as the expected mortality of retirees; the actual experience of plan members relative to those expectations; and – to a lesser extent – benefit increases in the 1980s and 1990s.

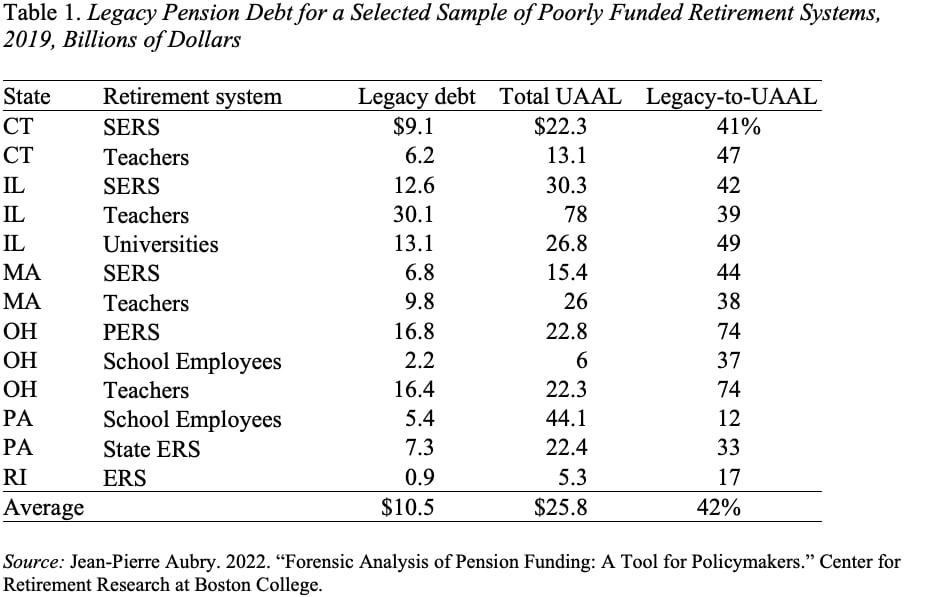

As a result, legacy debt accounts for a significant share of unfunded liabilities in several states with seriously underfunded plans. According to a recent study by my colleague J.P. Aubry, who calculated the legacy debt for 13 plans in six states, legacy debt averaged more than 40 percent of unfunded actuarial accrued liability (UAAL) (see Table 1).

Ignoring the unique aspects of legacy debt and managing them within the modern actuarial framework can lead policymakers astray in many ways:

- It makes currently promised benefits look more expensive than they are – a misperception that encourages policymakers to focus on benefits cuts as a primary solution.

- It places most of the burden on the current generation – which, at this point, is no more responsible for the legacy debt than any other.

- It makes the unfunded liability look overwhelming, encouraging long open amortization periods and assumed investment returns to value liabilities.

Legacy costs that arise from the transition to funded plans need to be taken off the books and managed separately. They still need to be paid off, but not solely by today’s public sector workers and today’s taxpayers.