Future Retirees: Brace Yourself for Three Major Financial Risks

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Risks appear manageable to most today, but adverse impacts will increase in the future.

My colleagues just published a review of recent research on the impact of three risks that households face at older ages. These late-life risks include: 1) high out-of-pocket medical costs; 2) cognitive decline; and 3) widowhood. The takeaway from the research is that, so far, these risks have affected only a few households severely.

In the future, however, the adverse effects of these risks are likely to become more significant, because the age 75 + population is projected to more than double between now and 2040; the likelihood of physical and cognitive problems rises sharply after 75; health care costs will grow more rapidly than income, and the older population will increasingly rely on modest 401(k) balances that are difficult to manage.

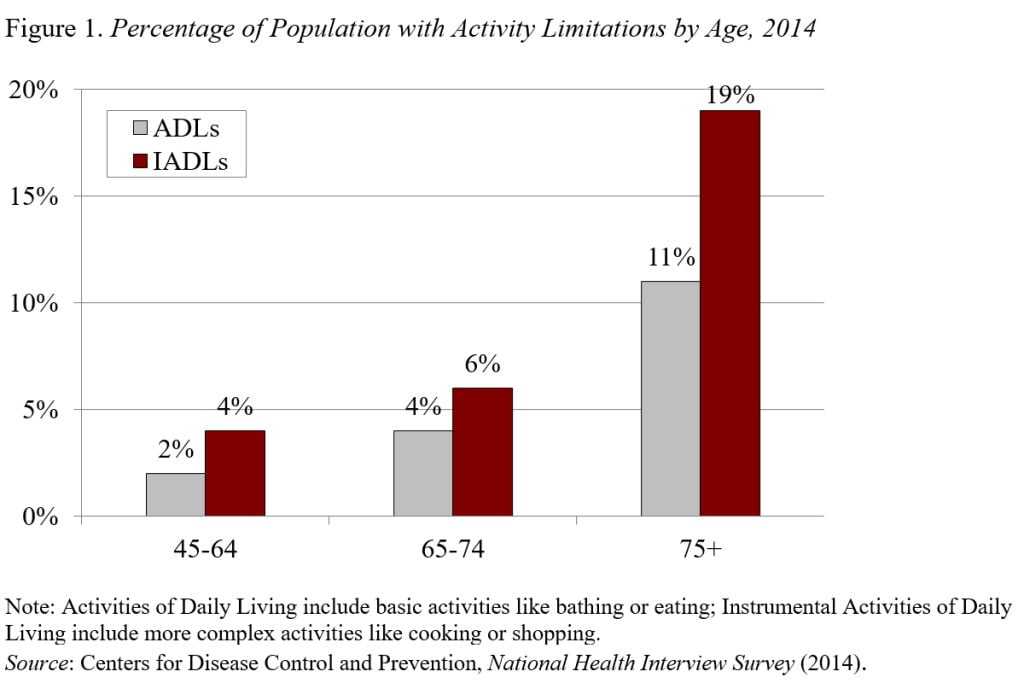

Out-of-Pocket Medical Costs. The percentage of people with health limitations increases dramatically at ages 75+ (see Figure 1).

Even though Medicare provides universal health coverage to retirees, Medicare enrollees pay premiums for Medicare Parts B and D and any supplemental coverage; contribute a portion of the cost of Medicare-covered services they receive through copayments and deductibles; and face the full cost of the many services not covered by Medicare (e.g., dental and vision). Research shows that the typical household devotes about 20 percent of income to these health related expenditures – a noticeable, but manageable burden. For about 5 percent of households, however, these standard out-of-pocket expenses eat up over half their total incomes. Moreover, long-term care costs are very expensive today and will become a major problem for an increasing number of households.

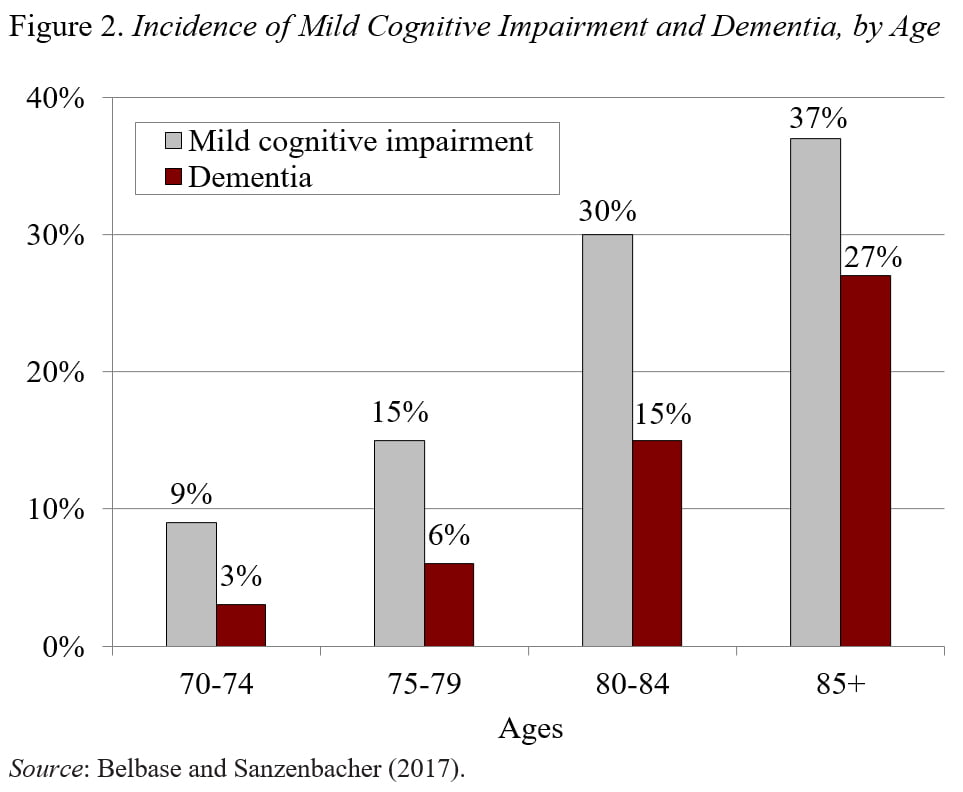

Declining Cognition and Finances. In addition to physical limitations, the likelihood of declining cognition and dementia increases with age (see Figure 2). These impairments can lead not only to high out-of-pocket medical costs, but also to a decline in the ability to manage household finances, leading to the risk of financial mistakes and fraud. So far, a mitigating factor seems to be that most people have help. However, the need for help will be more important in the future, as reliance on 401(k) balances increases.

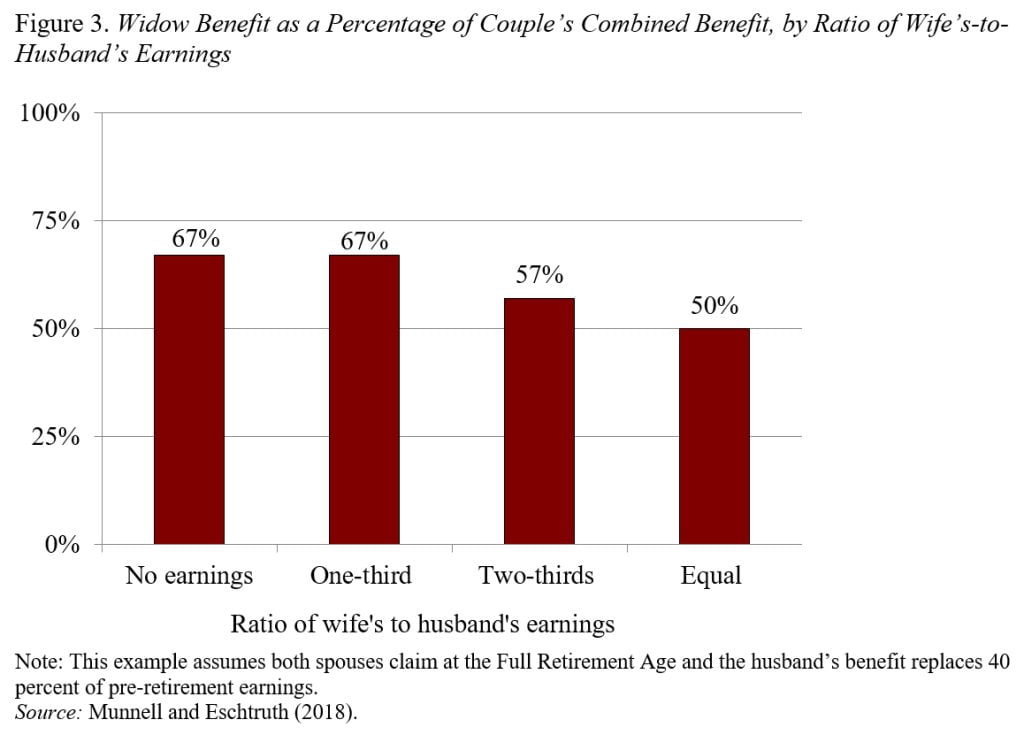

The Risk of Widowhood. In the past, widowhood resulted in poverty for many women – but recently that risk has declined. Furthermore, the poverty rate will continue to drop even in the future, partially because marriage has become more “selective” – higher socioeconomic status (SES) individuals are more likely to be married today than those with lower SES.

Poverty, however, is an extreme measure of financial stress. A broader concern is how widowhood will affect the ability of women to maintain their standard of living in retirement. One counterintuitive reason that widowhood might cause increasing hardship is that women are working more and earning more relative to their husband. Because a widow is entitled to the larger of her own Social Security benefit or her husband’s, a widow’s income drops more than it used to – relative to the combined household benefit – when her husband dies (see Figure 3).

The bottom line is that most households can navigate late-life risks today, but the challenges will increase going forward.