Wills, Wealth, and Race

The brief’s key findings are:

- The analysis explores how receiving an inheritance, having a will, and planning and realizing a bequest are interrelated and vary by race.

- Black and Hispanic individuals are less likely to get an inheritance, have a will, and plan to leave a bequest.

- Among those who do plan to leave a bequest, Black and Hispanic individuals are less likely to realize their bequest target.

- However, having a will increases the chances of achieving one’s bequest target, offering a potential way to improve the situation.

Introduction

Inheritances make up a substantial share of national wealth, but are often overlooked in discussions of retirement security. Racial gaps in inheritances are likely to exacerbate racial disparities in wealth. One reason that Black and Hispanic decedents are less likely to pass down meaningful estates is that they are far less likely to have a will than Whites.

This brief, which is based on a recent paper, uses the Health and Retirement Study (HRS) to document how the likelihood of receiving an inheritance, the plan to leave a bequest, having a will, and actual bequests vary by race and how the four are interrelated.1Aubry, Munnell, and Wettstein (2023). That is, to what extent does receiving an inheritance increase the likelihood of planning to leave a bequest and having a will, and to what extent does having a will relate to the realization of bequest expectations? Specifically, the analysis uses the HRS exit interviews of proxy informants for HRS participants who have died to explore whether the existence of a will affects the extent to which bequest intentions are actually realized.

The discussion proceeds as follows. The first section discusses why wills are important. The second describes the data and methods of the analysis. The third section summarizes the factors affecting the likelihood of receiving an inheritance, the plan to leave a bequest of at least $10,000, $100,000, and $500,000, and the presence of a will. The fourth section turns to the results that relate bequest expectations to realized bequests to see whether expectations are a good predictor of real outcomes and how that relationship is affected by the presence of a will and the race of the individual. The final section concludes that race is strongly correlated with the likelihood of having received an inheritance, of having a will, and of leaving a bequest, while wills are positively related to the likelihood that bequest expectations become reality.

Why Are Wills Important?

The Courts have determined that the U.S. Constitution protects the right of people to leave their assets to whomever they want. However, without a will, assets can get dispersed to unintended recipients. This outcome can be a particular problem for people with modest estates, where the major asset is the home and multiple heirs can lead to the fractionalization of the property.

In the absence of a will, the distribution of a decedent’s assets is determined by state intestacy law, which varies from one state to another. The procedure is designed to capture the probable intent of most people; and asset distribution generally proceeds in the following order: 1) surviving spouse; 2) descendants; 3) parents; 4) siblings; and 5) other relatives such as grandparents, cousins, and nephews.

While the objective of the default rules is to distribute a decedent’s assets according to their probable intent, the law’s preference for “traditional” family structures is at odds with the growing prevalence of nontraditional families. Shares of cohabiting and single-headed households have increased; the share of nonmarital child birth has risen; and grandparents are increasingly caring for grandchildren.2See Smock and Schwartz (2020); Manning, Brown, and Stykes (2015); and Pilkauskas, Amorim, and Dunifon (2020).

Estimates show that the default provisions are not appropriate for 22 percent of families, and that the probability of being marginalized by the defaults is positively related to being Black or Hispanic and negatively related to net worth and education.3Bea and Taylor Poppe (2020). In short, dying without a will may be fine for the majority of families headed by a married couple or for many single individuals, but it can result in the wrong outcome when the intended beneficiaries are not related by blood, marriage, or formal adoption.

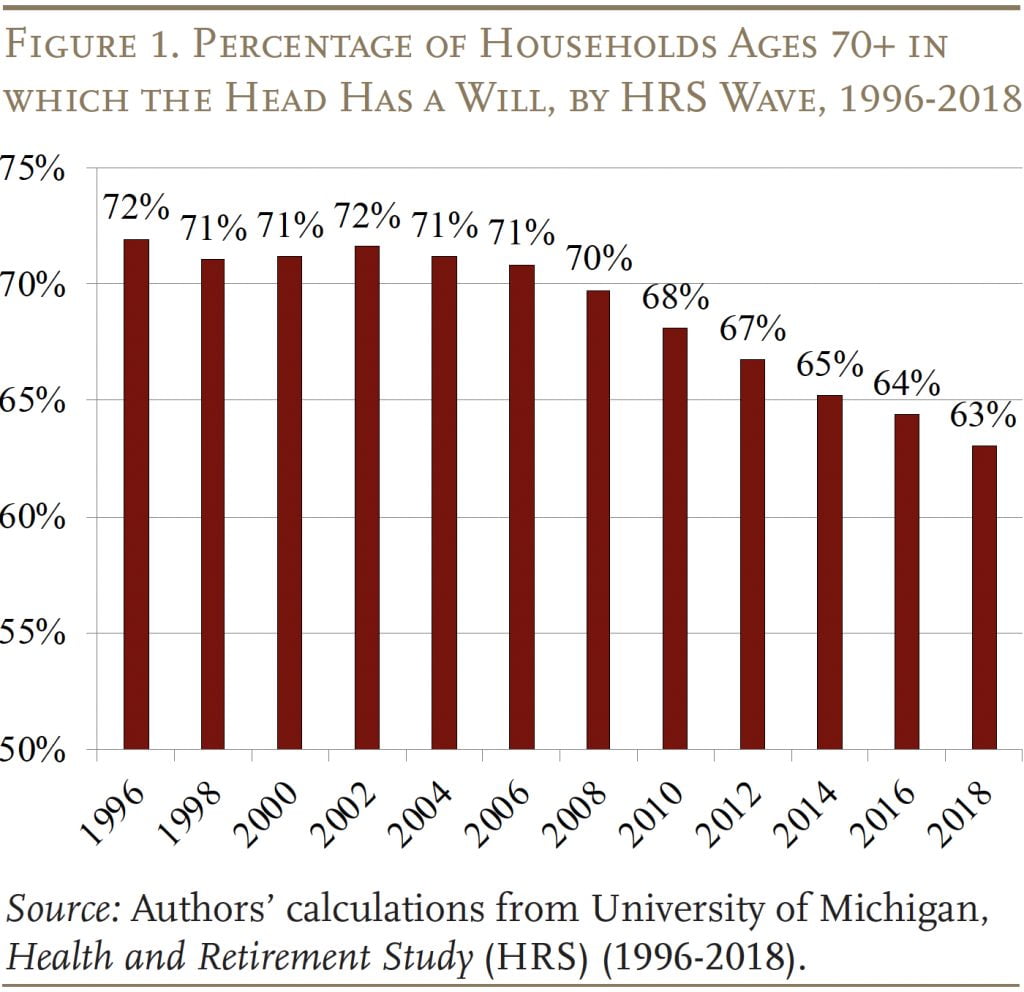

Dying intestate is a particular problem when the estate is modest and the largest asset is the home.4See Wright (2020) and Strand (2010). The risk is that the home descends to multiple heirs, and all the tenants in common must coordinate and obtain consent from fractional owners before maintaining or selling the property. If the intended beneficiaries are living in the decedent’s home, the distribution to a large number of beneficiaries could result in the forced sale of the property and leave them homeless. Despite the importance of wills for preserving the value of a bequest, above and beyond their importance in transmitting it to intended heirs, only about two-thirds of households ages 70+ have a will, and that percentage has been declining over time (see Figure 1).

Data and Methods

The analysis of bequests and bequest expectations across years is based on data from the HRS for 1992-2018. The HRS is a panel survey that follows Americans over age 50 and their spouses over time, interviewing them every two years.

The HRS tracks several variables of interest. Importantly for this analysis, the survey elicits respondent self-reported probabilities of leaving a bequest of at least $10,000, $100,000, and $500,000. The survey also asks whether a respondent has received an inheritance at any point (and how much that inheritance was worth) and whether a respondent has a will. Respondents are also asked about a wide array of socioeconomic and demographic characteristics, including asset holdings and household structure. The HRS also conducts proxy exit interviews that provide information about actual estate execution for panel members who have died.5Some proxy respondents do not include the value of a decedent’s residence in their reported estate valuation. To correct for this omission, we have added the value of the primary residence from the final pre-death HRS wave to the value of the total estate for decedents whose exit interview indicates that they owned their home at time of death and whose reported estate did not include the value of their home.

The HRS data are first used in regressions to examine the relationship between the likelihood of having received an inheritance, the likelihood of having a will, and the self-reported probabilities of leaving a bequest, controlling for socioeconomic factors including race, wealth, education, sex, age, marital status, and health. The role of race is of particular interest; respondents are separated into racial/ethnic groups: non-Hispanic White, non-Hispanic Black, Hispanic, and non-Hispanic other.

After these preliminary equations, the HRS exit interviews are used to study the link between intended and realized bequests, with a focus on race/ethnicity and the role of wills. This analysis involves estimating the following equation:

Bequest amount = ƒ(Race/ethnicity, Will, Socioeconomic controls, Bequest expectations)

The dependent variable is an indicator for leaving a total estate of at least $10,000, $100,000, or $500,000. The independent variables include the race/ethnicity of the individual, whether the individual has a will, and a series of socioeconomic characteristics that are likely not influenced by the adoption of a will: gender, age, marital status, living children, education, and having received an inheritance.6These variables are all measured at the time of the last wave preceding death. The regressions further include year-of-death fixed effects, to account for the fact that nominal economic growth makes the target amounts vary over time in real terms and in likelihood.

The equation also includes the respondent’s self-reported probability of leaving an estate of at least $10,000, $100,000, and $500,000. With this probability held constant, a positive coefficient on, for example, Black would indicate that Black respondents are more likely to fall short of fulfilling expectations than their White counterparts. Similarly, with respect to wills, a negative sign indicates that if two individuals, one with a will and one without, have the same self-reported probability of leaving a target amount, the respondent with a will is more likely to achieve that goal.

Socioeconomic Factors, Bequest Intentions, and Wills

To set the stage, the first results show the relationship between race and ever having received an inheritance. Then, the relationship between having received an inheritance and the likelihood of having a will is reported. Finally, the relationship between socioeconomic characteristics and expectations of leaving a bequest are discussed, as well as how these characteristics relate to having a will.

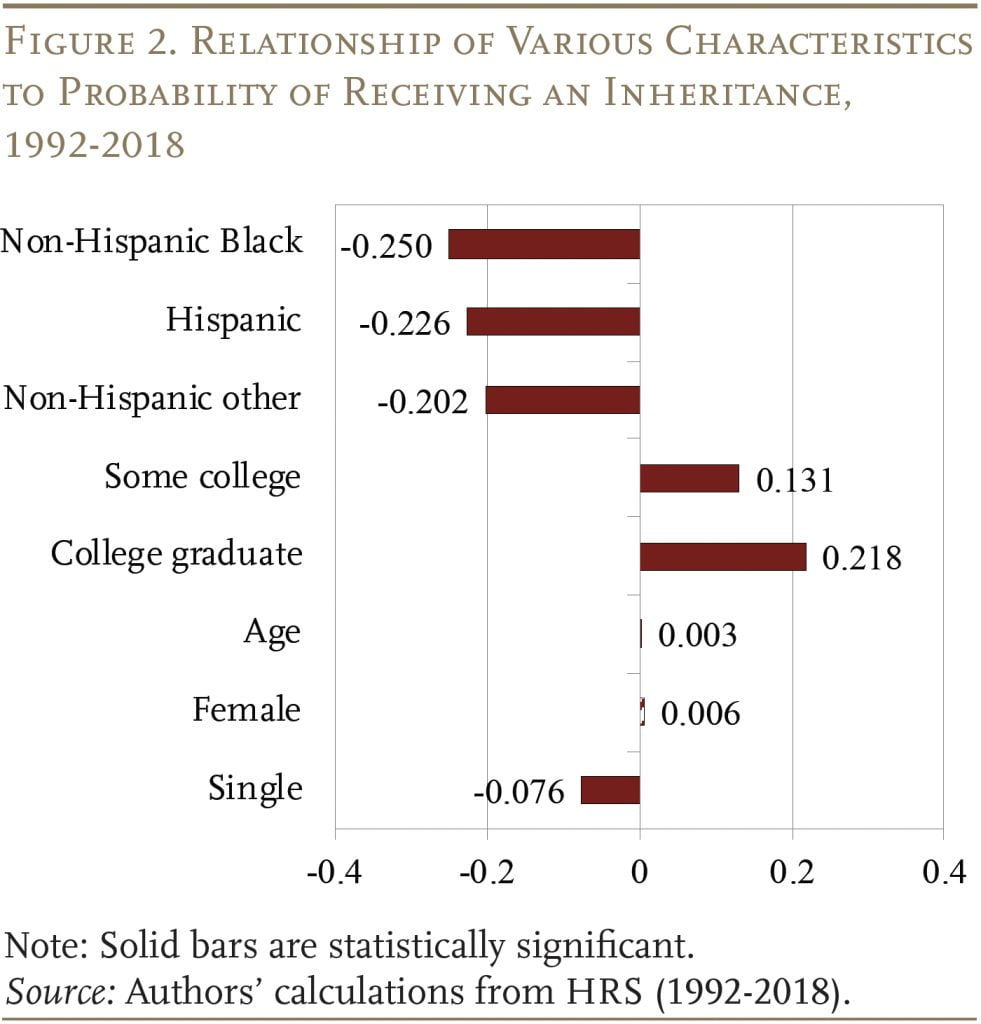

Figure 2 presents estimates on the likelihood of individuals to have ever received an inheritance through their final wave in the HRS. Black, Hispanic, and other minority respondents are significantly less likely to report ever having received an inheritance than White respondents, controlling for education, age, gender, and marital status.

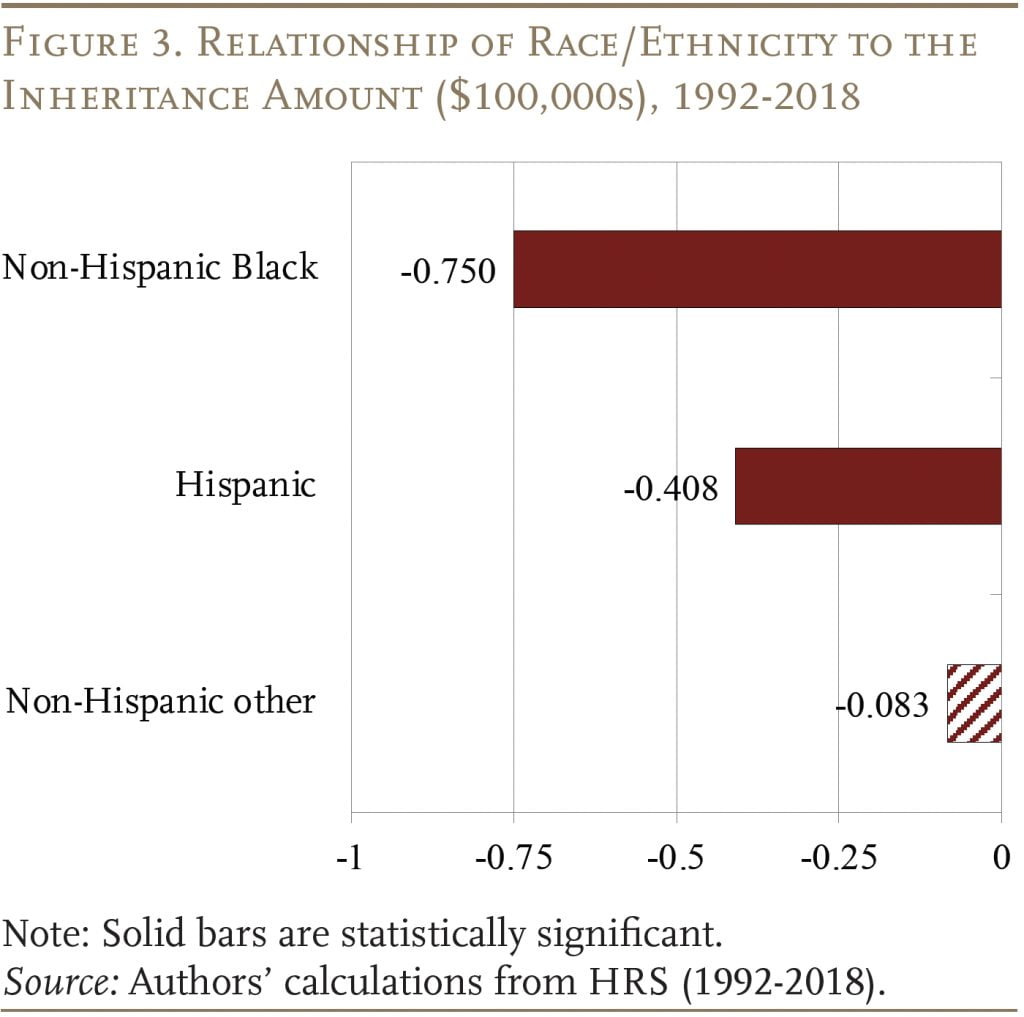

Repeating the analysis – including controls – for the subset of individuals who have reported receiving an inheritance shows that, relative to Whites, Black and Hispanic recipients receive less (see Figure 3).

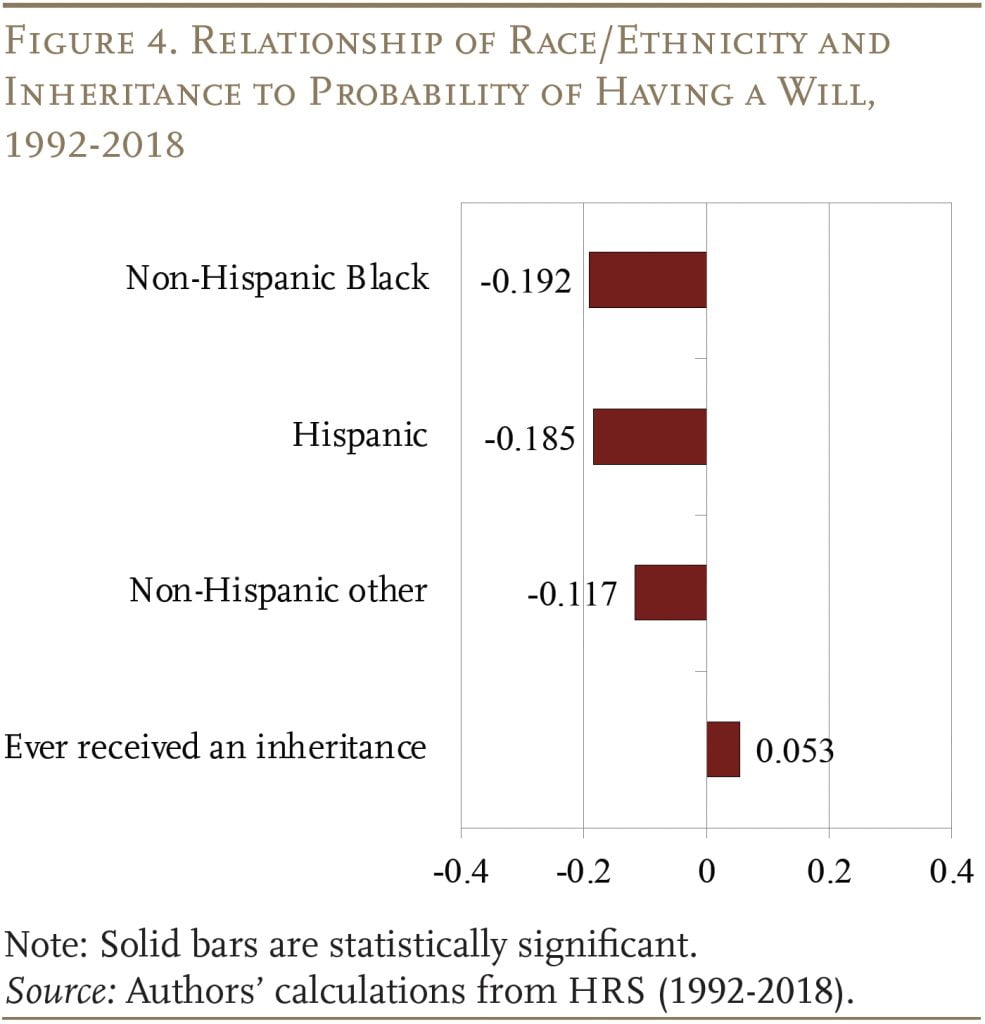

Figure 4 shows that having received an inheritance is related to having a will, even controlling for race/ethnicity (shown), as well as education, wealth, children, age, gender, marital status, and health (not shown).

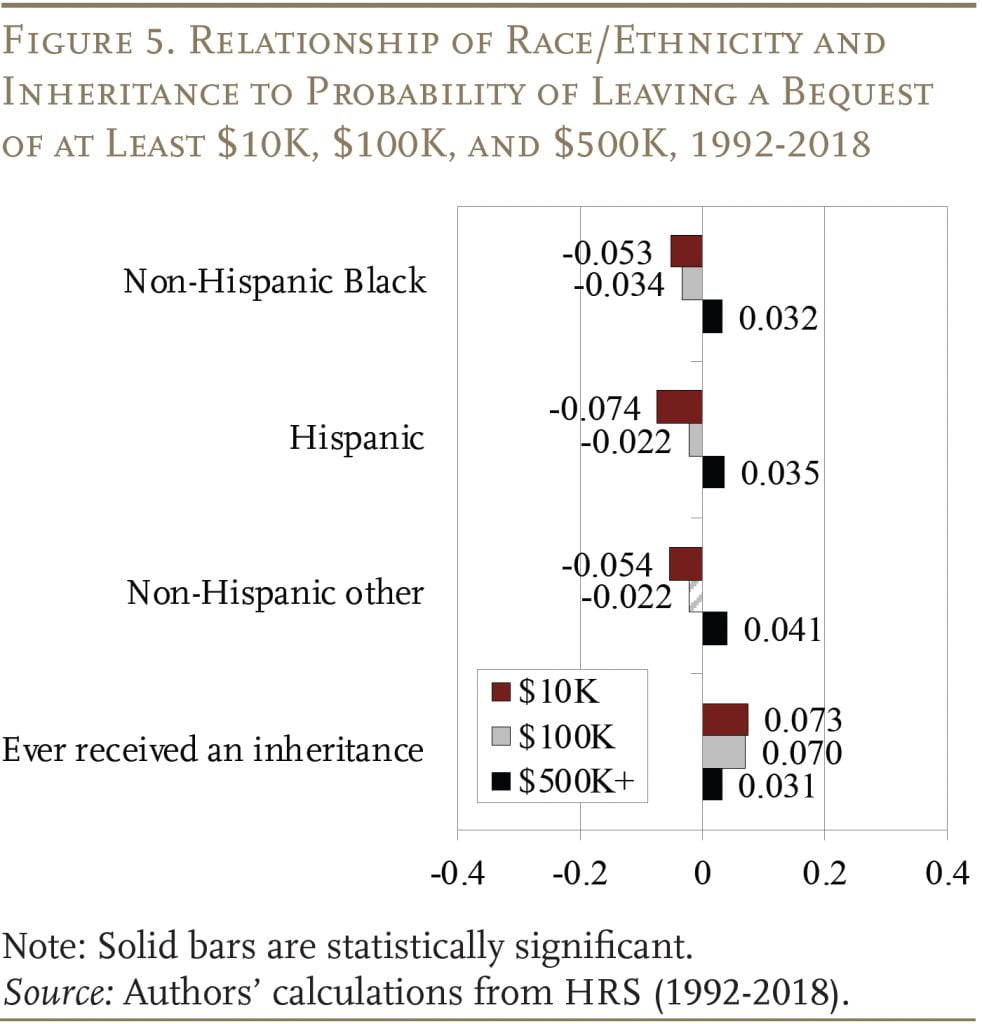

The main goal is to document the factors related to leaving a bequest, particularly surrounding racial disparities. Figure 5 presents these results. The bars show the relationship between race/ethnicity and having received an inheritance to planning to leave a bequest of at least $10,000, $100,000, and $500,000, respectively. For example, a Non-Hispanic Black individual is about 5 percentage points less likely to expect to leave a bequest of at least $10,000 than a White respondent.

The results are generally consistent across bequest amounts. Having received an inheritance increases the likelihood of leaving bequests of all amounts, and non-White respondents report lower expected probabilities of leaving moderate bequests. This sign flips, however, for bequests of at least $500,000. One possible explanation is that non-White individuals who are very successful feel a strong obligation to ensure that assets are left to their family.

These results regarding both wills and bequest intentions reflect individuals’ plans to leave a legacy. The next section turns to the question of whether these intentions are achieved, whether wills help in this process, and whether the process varies by race.

Bequest Expectations vs Realized Bequests

By 2018, the HRS included around 3,250 individuals who had been surveyed at some point and subsequently died, and whose proxy informants could provide information about the ultimate dispositions of estates. Given the characteristics of the respondents who have actually died and, of those, which respondents’ proxies are capable of reporting total estate size, the sample is substantially different from the full sample of final interviews used above. For example, compared to the full sample, the share of Black respondents is low, the share with a will is high, and the age is older. Nevertheless, the analysis of exit interviews is valid for assessing the impact of wills, although the estimates of the will coefficient are likely a lower bound relative to a sample that was not winnowed down so much.

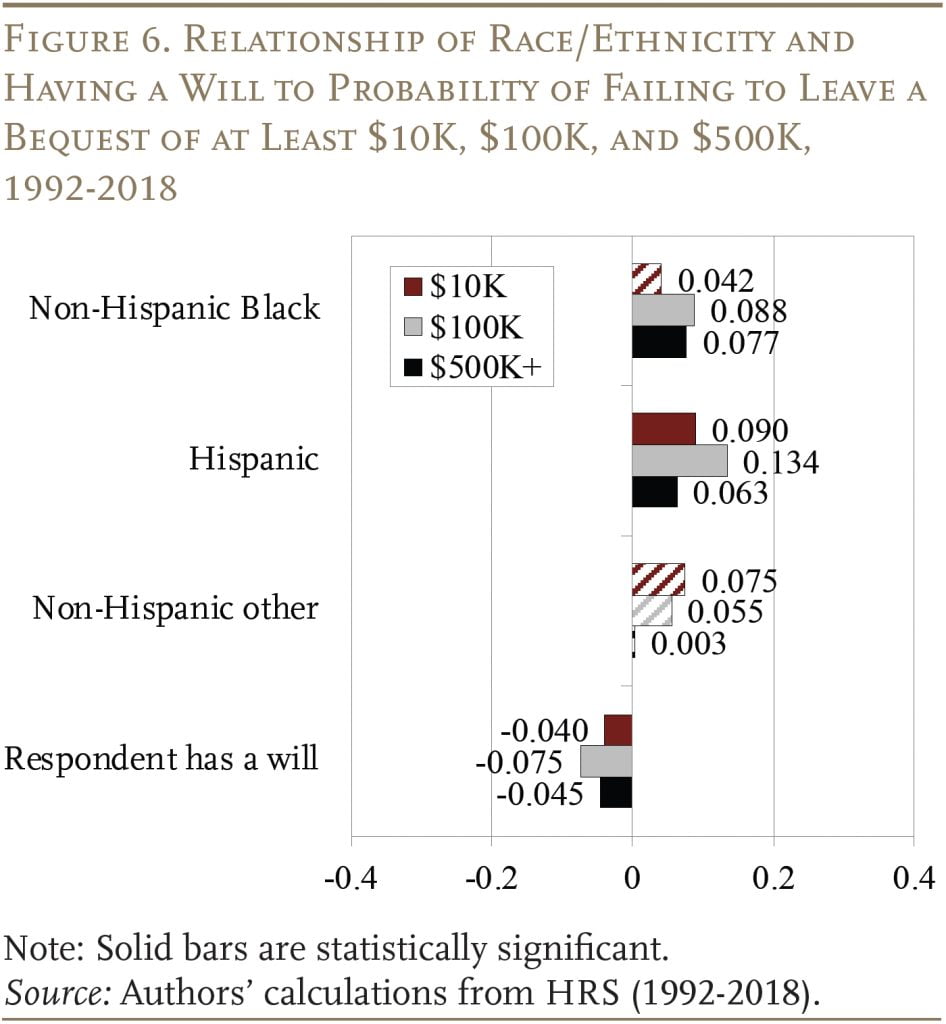

The results show the likelihood of failing to leave a total estate of at least $10,000, $100,000, and $500,000, respectively, conditional on the self-reported expectation of leaving at least the target amount and the socioeconomic controls noted above. Across all target bequest levels, the expectation of meeting that target is strongly predictive of actually doing so.

The results are shown in Figure 6. In terms of race/ethnicity, for the $10,000 target, only Hispanic ethnicity is significantly related to a lower likelihood of leaving the target bequest, while the Black indicator is not predictive of failing to achieve the targeted bequest. However, the latter coefficient goes in the anticipated direction, with Black decedents more likely to fall short of their goal. The relatively weak significance of the Black coefficient is unsurprising given the modesty of the goal. Turning to the $100,000 and $500,000 targets, Black and Hispanic decedents are less likely to meet their target. For these larger bequests, both coefficients are statistically significant. Strikingly, though, across race and ethnicity, those with wills are less likely to fall short of their expected bequests at each of the target amounts.

These results underscore the racial gap in bequests, since even for those with the same expectation of leaving a bequest, Black and Hispanic decedents fail to meet their targets more often. This finding is particularly alarming, given that Black and Hispanic respondents have both much lower expectations of leaving substantial bequests to begin with and are less likely to have a will. The good news is that wills seem to mitigate such failures, either by preserving value postmortem or by shifting behavior throughout life, such as lowering consumption to guarantee bequest goals are met.

Conclusion

Having a will is important for the many households whose circumstances are not adequately addressed in state default inheritance laws. Wills are particularly valuable when the major bequeathable asset would likely decline in value from being split among multiple owners, as default laws tend to do. Nevertheless, a large and growing share of individuals do not have a will.

This analysis shows that the rate of intestacy is especially high among Black and Hispanic individuals, even after controlling for a wide array of demographic and socioeconomic characteristics. Relatedly, these individuals are also less likely to expect to leave bequests of meaningful size. Finally, the evidence suggests that Black and Hispanic decedents, conditional on how likely they thought achieving a certain bequest size was, are less likely to achieve that goal. However, having a will is related to a greater likelihood of attaining bequest goals, offering a potential route for improving this situation.

References

Aubry, Jean-Pierre, Alicia H. Munnell, and Gal Wettstein. 2023. “Wills, Wealth, and Race.” Working Paper 2023-10. Chestnut Hill, MA: Center for Retirement Research at Boston College.

Bea, Megan and Emily Taylor Poppe. 2020. “Marginalized Legal Categories: Social Inequality, Family Structure, and the Laws of Intestacy.” Law and Society Review 55(2): 252-272.

Manning, Wendy D., Susan L. Brown, and J. Bart Stykes. 2015. “Trends in Births to Single and Cohabiting Mothers, 1980–2013.” Paper FP-15-03. Bowling Green, OH: Bowling Green State University, National Center for Family & Marriage Research.

Pilkauskas, Natasha V., Mariana Amorim, and Rachel E. Dunifon. 2020. “Historical Trends in Children Living in Multigenerational Households in the United States: 1870-2018.” Demography 57(6): 2269-2296.

Smock, Pamela J. and Christine R. Schwartz. 2020. “The Demography of Families: A Review of Patterns and Change.” Journal of Marriage and Family 82: 9-34.

Strand, Palma Joy. 2010. “Inheriting Inequality: Wealth, Race, and the Laws of Succession.” Oregon Law Review 89: 453-504.

University of Michigan. Health and Retirement Study, 1992-2018. Ann Arbor, MI.

Wright, Danaya C. 2020. “What Happened to Grandma’s House: The Real Property Implications of Dying Intestate.” University of California Davis Law Review 53(5): 2603-2640.

Endnotes

- 1Aubry, Munnell, and Wettstein (2023).

- 2See Smock and Schwartz (2020); Manning, Brown, and Stykes (2015); and Pilkauskas, Amorim, and Dunifon (2020).

- 3Bea and Taylor Poppe (2020).

- 4See Wright (2020) and Strand (2010).

- 5Some proxy respondents do not include the value of a decedent’s residence in their reported estate valuation. To correct for this omission, we have added the value of the primary residence from the final pre-death HRS wave to the value of the total estate for decedents whose exit interview indicates that they owned their home at time of death and whose reported estate did not include the value of their home.

- 6These variables are all measured at the time of the last wave preceding death. The regressions further include year-of-death fixed effects, to account for the fact that nominal economic growth makes the target amounts vary over time in real terms and in likelihood.