A Major Risk Facing Older Americans: The Need for Long-Term Care

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Private long-term care insurance is unlikely to be part of the solution.

One of the greatest health-related risks facing older people is the cost of extensive long-term care to help with activities of daily living such as bathing, dressing, and eating or to deal with dementia or other chronic conditions.

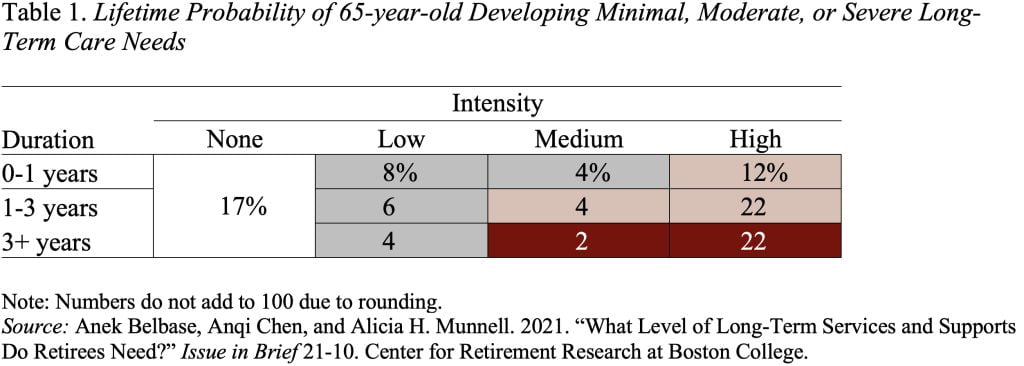

We estimate that roughly one-fifth of 65-year-olds will never require long-term care, while about one-quarter will have severe needs (see white and red shading in Table 1). In between these two extremes, 22 percent will experience minimal needs (gray shading) and 38 percent will experience moderate needs (pink shading).

For those who need care, the costs can be staggering. Current national estimates put the annual per-person cost of nursing home care at $108,000 and home health care at $61,000. Faced with depleting their assets for long-term care – through out-of-pocket expenses or spending down to qualify for Medicaid – some people have opted for private long-term care (LTC) insurance. Indeed, LTC insurance seems like the appropriate product when the risk of extreme need is about 25 percent and the costs are extraordinarily high.

One problem is that the number of companies providing LTC insurance has declined dramatically. This decline reflects the large losses incurred as a result of seriously mispricing the product when it was introduced in the 1970s. The mispricing reflects the fact that the product was new and little data were available to price the risk. In addition, consumers were guaranteed the ability to renew their coverage, often at attractive rates as premium increases require regulatory approval, making it difficult for LTC insurers to adjust their prices quickly. And finally, the long “tail” associated with LTC insurance – premiums paid right away with claims occurring only much later – meant that actual insured experience data did not become available until decades after the initial rollout.

Costs turned out to be much higher than expected because companies:

- Overestimated Lapse Rates. A higher percentage of policyholders retained their LTC insurance policies (and subsequently made claims) than policyholders of other insurance products, in part due to the guaranteed renewal feature.

- Overestimated Mortality Rates. More policyholders reached an older age at which they were likely to file LTC insurance claims, and thus more claims were initiated than had been expected. This outcome reflected both a general rise in population life expectancy and the tendency for those who bought LTC insurance to live longer than average.

- Underestimated Morbidity Rates. More policyholders used LTC insurance benefits at higher rates than initially projected. Again, the outcome reflected both higher morbidity rates generally and adverse selection.

On the income side, interest turned out to be significantly lower than projected by insurers at the time of initial offering.

The combination of underestimating costs and overestimating revenues meant that premium rates were set substantially lower than were needed to sustain policies. Inadequate premiums, in turn, produced substantial financial losses. These losses prompted insurers to ask regulators to authorize increased premium rates and, while some increases were approved, they were generally inadequate to solve the problem.

The impact of the losses on the LTC insurance industry in New York reflects the trends nationwide. As of 2021, while 38 insurance companies were servicing existing LTC insurance policies purchased by New York policyholders, only five offered new LTC insurance products. The number of LTC insurance policies in New York steadily declined from a peak of approximately 754,000 policies in 2002 to only 394,000 in 2020.

The bottom line is that private LTC insurance is unlikely to play a significant role in ameliorating the risks associated with long-term care.

On the supply side, as noted above, only a handful of companies provide the product. On the demand side, an extensive literature has documented numerous reasons why people did not buy the underpriced LTC insurance product when available. Certainly, they would be even less inclined to buy an appropriately-priced product.