Black Homeowners Build Less Wealth than White Counterparts

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

New study examines whether gap for older homeowners due to low down payments or slower appreciation.

Houses are very important. For most families, their house is the single largest asset outside the benefits promised from Social Security. The problem is that Black families are less likely to own homes and, when they do, they see lower wealth accumulation compared to White homeowners. A recent study by Center researchers focuses on the second issue – the fate of Black families who do become homeowners. Specifically, what share of the housing wealth gap among older Black and White homeowners is due to disparities at the time of first purchase, and what share is due to slower appreciation over the course of homeownership?

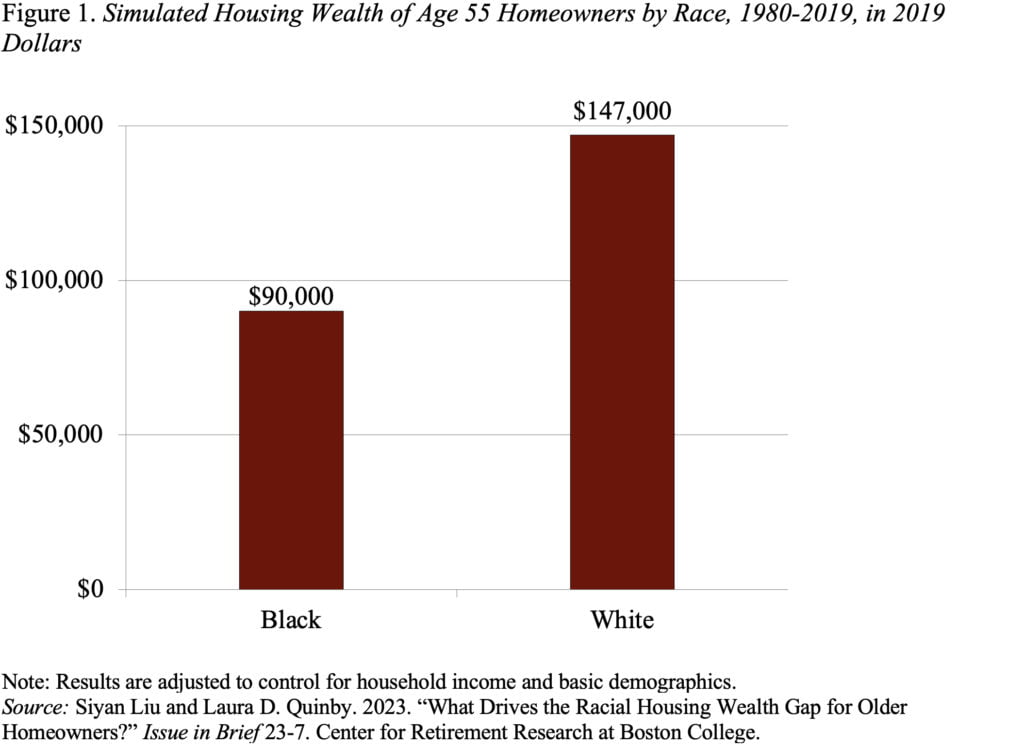

The study uses the Panel Study of Income Dynamics (PSID) to look at the experience of Black and White households who buy their first home between 1980-2000 and follows them through 2019, limiting the sample to those who are still homeowners at age 55. The goal is to compare Black and White homeowners who, based on their own socioeconomic characteristics, might seem equally well situated to accumulate housing wealth. The results show that after controlling for income and basic demographics, Black homeowners approaching retirement have only 61 percent of the housing wealth held by older White homeowners (see Figure 1).

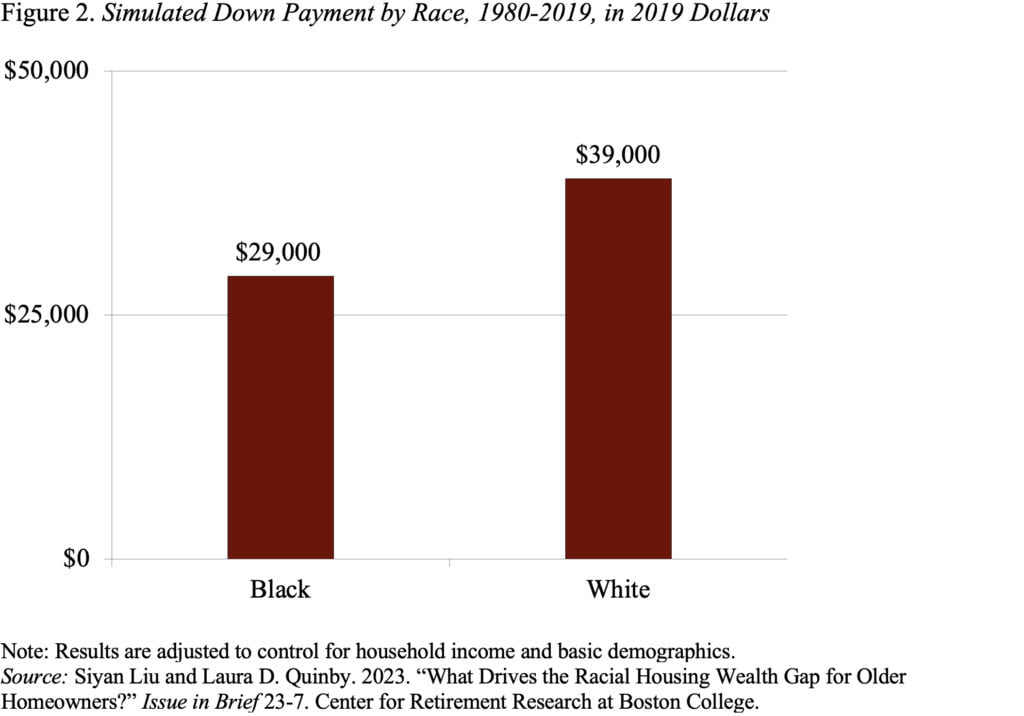

To understand the drivers of this gap, the authors begin by comparing the down payments for Black households and their otherwise-similar White counterparts. It turns out that the down payments of Black homebuyers, who are less likely to receive assistance from parents, are only 67 percent of those of Whites (see Figure 2). As a result, Black households are constrained to buying less expensive first homes than White households.

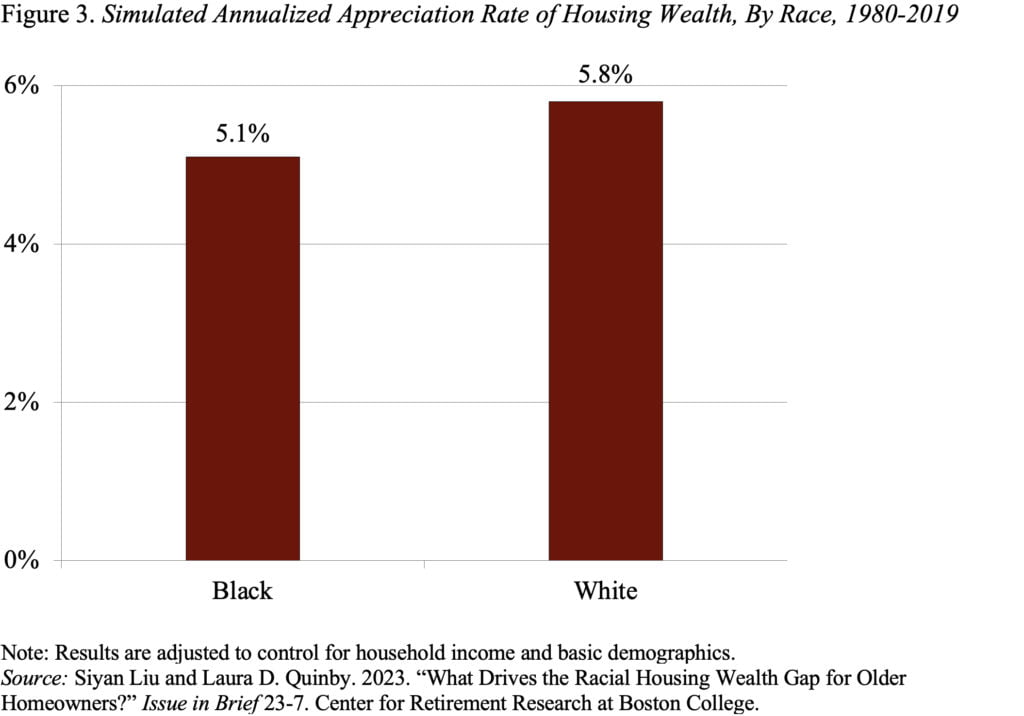

Not only do Black homeowners start from a weaker position, but their housing wealth also grows more slowly over time (see Figure 3). Compounding a 0.7-percentage-point disadvantage over decades makes a big difference.

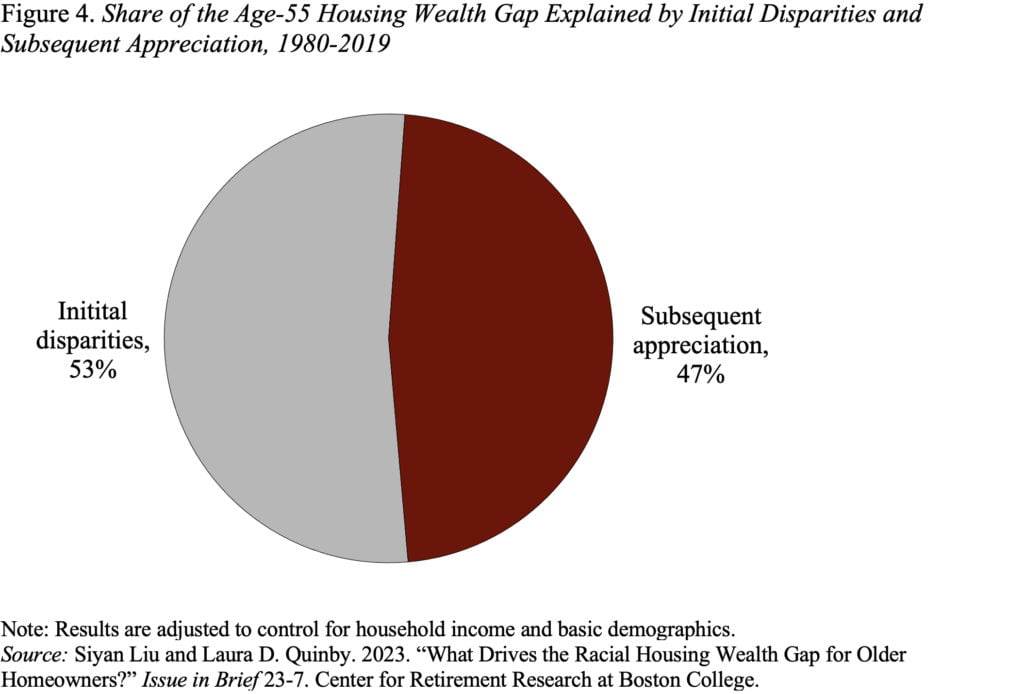

The question is the relevant importance of the down payment versus the rate of appreciation in explaining the housing wealth gap. One way to answer that question is to consider how large the gap would have been had Black households started off with the same down payment as White households, but then subsequently earned their actual, lower appreciation rate. Figure 4 presents the results. While, the exact share is sensitive to how the thought experiment is framed, both the down payment and the slower appreciation play a significant role.

In short, Black families start with a smaller down payment, see less appreciation as residential segregation pushes them into less-expensive neighborhoods with limited public investment and slower appreciation, and are less likely to upgrade their starter homes to larger, more expensive houses with faster appreciation.