Do Financial Professionals Recommend Annuities?

The brief’s key findings are:

- While annuities offer retirees guaranteed lifetime income, few people have them.

- A new survey asked financial professionals about the value of annuities for their clients.

- The results suggest that financial professionals are concerned that many of their clients could deplete their savings too quickly.

- But the majority of them do not recommend annuities to their clients and, when they do, many clients do not take the advice.

- These findings point to both the promise and limitations of reliance on financial professionals to guide clients to greater use of annuities.

Introduction

The rate of ownership of annuities in the United States is low, with only about 10 percent of older Americans having a commercial annuity. Researchers have offered many potential rationales as to why people approaching retirement have so little interest in annuities. However, a largely overlooked issue is how financial professionals view annuities and how their recommendations may affect the purchase of annuities among their clients.

This brief, which is based on a recent survey, investigates how financial professionals perceive longevity risk and the value of annuities for their clients. The findings suggest that most financial professionals are aware that some of their clients may outlive their resources. Nevertheless, the vast majority of professionals rarely recommend buying an annuity. Hence, financial professionals are currently doing little to encourage people approaching retirement to purchase annuities.

The discussion proceeds as follows. The first section provides some background. The second section describes the survey. The third section presents the findings. The fourth section discusses their implications. The final section concludes that financial professionals are concerned about their clients’ longevity risk and may be a source of untapped potential to increase annuity take-up.

Background

The small market for private sector annuities in the United States has confounded academics and policymakers for decades. Numerous hypotheses for the low demand have been advanced, all revolving around the many reasons that individuals may not want to annuitize.1For an overview of the literature, see Arapakis and Wettstein (2023a). However, recent work suggests that many individuals would buy an annuity if the process were simple, but are prevented from doing so by the real-world complexity of the task.2Arapakis and Wettstein (2023b).

Much of that complexity involves a series of small hurdles, which together could stymie even a motivated potential annuity buyer. For example, knowing a product like an annuity even exists is not trivial. Survey evidence suggests that even among relatively wealthy households (over $100,000 in financial assets) near or in retirement, more than a third were not familiar with lifetime income products, and another 40 percent were only somewhat familiar. These estimates probably overstate familiarity for the population as a whole, since respondents often dislike admitting ignorance, and these wealthier respondents are more likely to be acquainted with annuities than their less affluent counterparts.

Financial professionals could help by explaining what annuities are, who sells them, how to contact providers, and how to prepare for actually signing a contract. All these steps could get individuals who need no convincing to simply take the concrete steps between a desire for lifetime income and actually acquiring it. The recent survey suggests that about half the population with over $100,000 in financial assets would like to buy a lifetime income product at the prevailing price. Furthermore, professionals could explain the value of annuities to those with less than $100,000 in assets who might be on the fence. The question is: do professionals do any of these things?

The Survey

The survey, conducted by Greenwald Research in June of 2023, questioned 400 financial professionals about the topics they discuss with their clients and the recommendations they make. It also asked them multiple questions about their clients’ longevity, whether they recommend annuities, what type of annuities they are most likely to recommend, and whether their clients follow their advice.

Financial professionals were selected based on the following characteristics. First, they had over $30 million under management. Second, they had more than three years of professional experience. Third, they made recommendations themselves to their clients. Fourth, over 50 percent of their income came from financial planning, investments, life insurance, and related products and services with individual clients, as opposed to employee benefits or other group products, health insurance, and property/casualty insurance. Fifth, they had more than 75 clients.

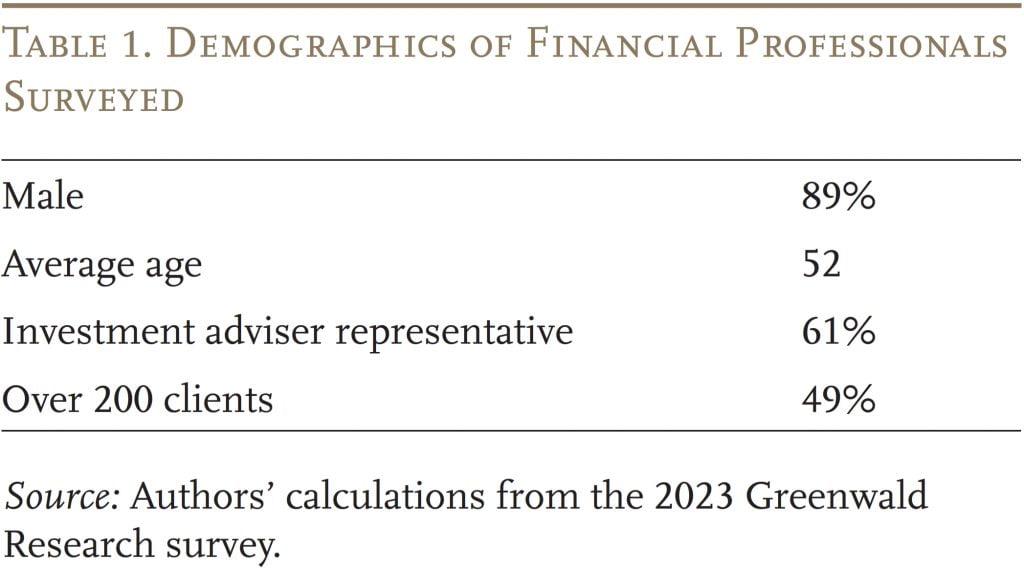

Table 1 shows the sample’s summary statistics. The professional participants are overwhelmingly male, and their average age is 52. Approximately half advise over 200 clients.

Results

The survey suggests that financial professionals know that their clients might live to very old ages and outlive their resources. Roughly 76 percent of financial professionals discuss the chance of living to advanced old age, such as age 95, with their clients. Regarding longevity risk, the survey indicates that more than 90 percent of them are at least somewhat concerned that their clients will deplete their savings.

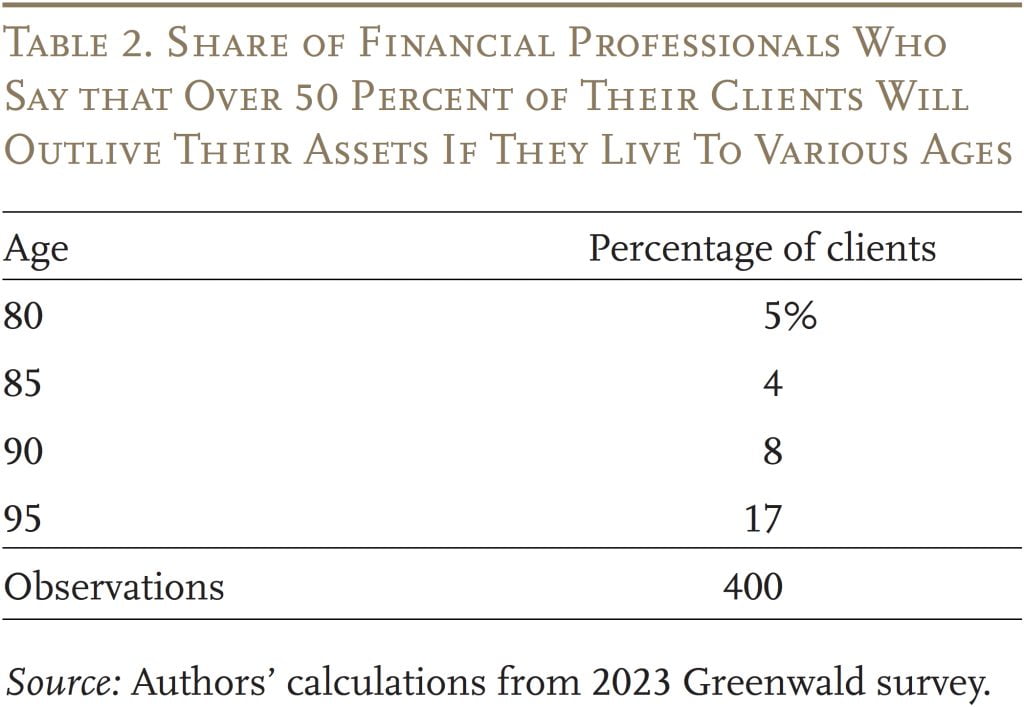

The survey also asked financial professionals to estimate the percentage of their clients that will outlive their assets if they live to certain ages. The responses show that 17 percent of financial professionals believe that more than half of their clients will outlive their resources if they live to age 95 (see Table 2). In actuality, nationwide about 10 percent of clients will live to 95, and face the severe consequences of exhausting their resources.3About 10 percent of individuals age 65 will survive past age 95, among those with over $100,000 in financial assets. This population is the one most likely to use the services of a financial professional. Note, further, that individuals who visit financial professionals have significantly more wealth than the average American, which has offsetting implications. On the one hand, a greater proportion will live to 95; on the other hand, their higher asset levels can serve as a buffer.

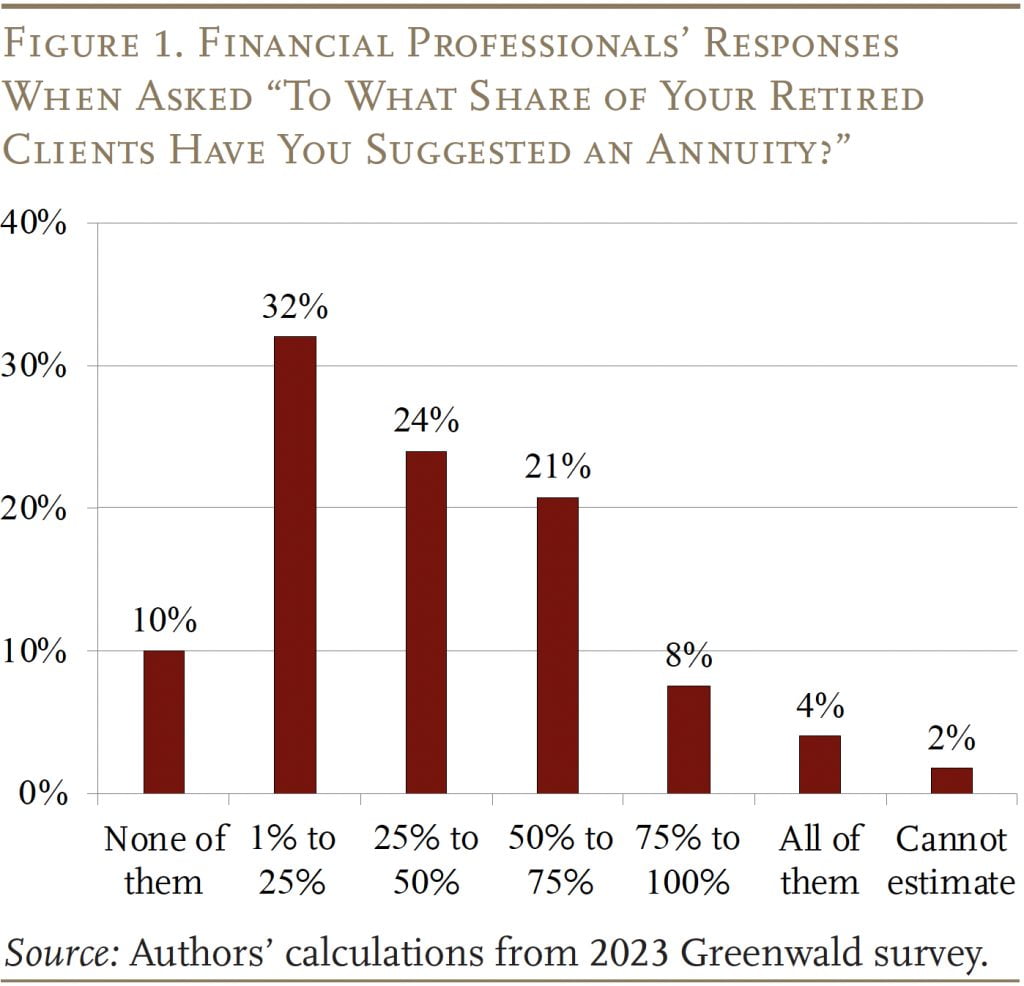

With respect to protecting against longevity risk, the survey also asked the financial professionals how often they recommend buying an annuity. Figure 1 shows that approximately two-thirds of professionals recommend an annuity to less than half of their clients. More than two-fifths recommend an annuity with guaranteed lifetime income to less than a quarter of their clients.4Most professionals who do suggest annuitization recommend variable annuities with a guaranteed income rider. These annuities simultaneously address concerns for low returns compared to an index, and potential bequest motives. The second most likely category is fixed indexed annuity with a lifetime income rider. Finally, deferred, immediate, and other types comprise most of the rest of the suggestions.

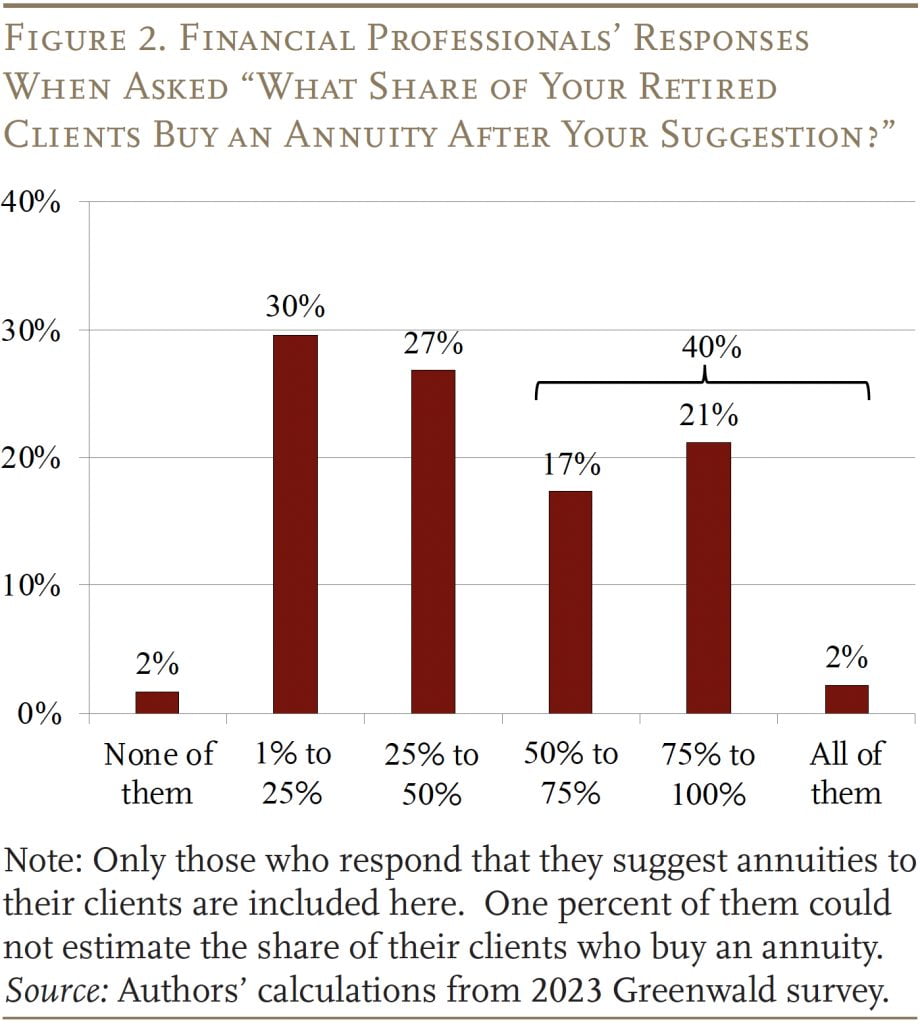

Finally, when financial professionals do suggest annuities, 40 percent believe that most of their clients follow their suggestions (see Figure 2).

Discussion

The survey suggests that financial professionals are aware of their clients’ longevity risk and discuss this topic with them. Thus, the fact that most professionals do not typically recommend any annuitization is surprising. Part of the reason may be that the bulk of clients do not tend to follow such advice when given.

Hence, the survey points to both the promise and the limitations of reliance on financial professionals to guide clients to greater use of annuities with guaranteed lifetime income. Professionals could be much more proactive in recommending annuitization. A substantial minority of clients would follow such advice if it were offered, particularly if the advice were accompanied by guidance on how to go about acquiring an annuity.

Furthermore, the results from previous analyses suggest that financial professionals have untapped potential in increasing annuity take-up. Since roughly half of those who can afford to annuitize (those with over $100,000 in financial assets) indicate they would buy an annuity if the process were simple, professionals can play a role in facilitating such transactions to serve both their clients’ needs and their desires.

Conclusion

The results of the survey suggest that financial professionals are deeply concerned about many of their clients’ ability to manage longevity risk. Nevertheless, the majority of financial professionals do not typically recommend annuity products to their clients. Among those who do, many report that their clients do not follow their recommendation. This finding suggests that financial professionals seem to have the ability to influence only a modest portion of their clients.

The results also point to areas for further research: how should professionals identify which clients would be receptive to annuities? And would certain messaging approaches (e.g., saying “lifetime income” rather than naming a specific financial product) work better than others to convince those clients who are on the fence? Overall, however, the lowest-hanging fruit is likely helping the clients who already are open to annuities achieve their existing lifetime income goals.

References

Arapakis, Karolos and Gal Wettstein. 2023a. “Longevity Risk: An Essay.” Special Report. Chestnut Hill, MA: Center for Retirement Research at Boston College.

Arapakis, Karolos and Gal Wettstein. 2023b. “How Much Do People Value Annuities and Their Added Features?” Working Paper 2023-18. Chestnut Hill, MA: Center for Retirement Research at Boston College.

Endnotes

- 1For an overview of the literature, see Arapakis and Wettstein (2023a).

- 2Arapakis and Wettstein (2023b).

- 3About 10 percent of individuals age 65 will survive past age 95, among those with over $100,000 in financial assets. This population is the one most likely to use the services of a financial professional.

- 4Most professionals who do suggest annuitization recommend variable annuities with a guaranteed income rider. These annuities simultaneously address concerns for low returns compared to an index, and potential bequest motives. The second most likely category is fixed indexed annuity with a lifetime income rider. Finally, deferred, immediate, and other types comprise most of the rest of the suggestions.