Recent Tax Cuts and Spending Hikes Should Not Be Used to Put Social Security and Medicare at Risk

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Deliberately imperiling federal finances should not be an excuse to cut programs for older Americans.

It was unsurprising to many when the Treasury announced in mid-October that the federal budget deficit rose 17 percent in Fiscal Year 2018. This increase reflected the tax cut and subsequent spending hikes enacted in the past year. Contrary to the advertising, tax cuts do not pay for themselves. This increase in the deficit is harmful for any number of reasons, but the one I worry about the most is using rising deficits as an excuse for cutting Social Security and Medicare – the bedrock programs for older Americans.

The rising deficits are particularly annoying because the country did not need any fiscal stimulus nine years into one of the longest recoveries on record. Economic expansions are usually times when the deficit declines. When the unemployment rate drops, more people earn money, which causes tax revenues to rise; and fewer people use public programs such as unemployment insurance and food stamps, which causes expenditure growth to slow.

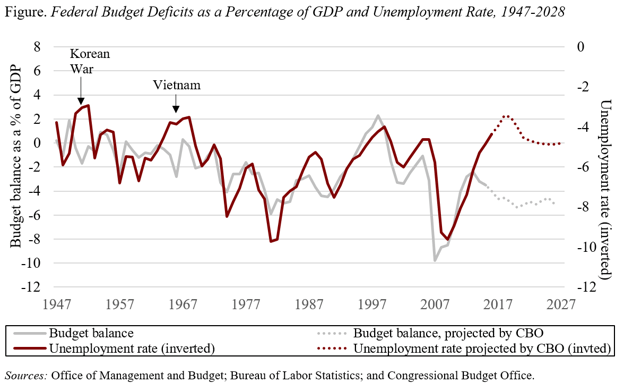

As shown in the Figure, an updated version of a chart released by Goldman Sachs earlier this year, deficits and the unemployment rate have historically moved in the same direction. The only exceptions were during the Korean and Vietnam wars. During peacetime since World War II, the budget deficit and the unemployment rate have largely moved in lock step. This pattern has been broken due, in part, to the tax cut approved in December of 2017 and the spending bills passed in February and March of 2018. The Congressional Budget Office estimates that these, and other, legislative changes will add about $2.7 trillion to the debt over the next 10 years. The unemployment rate and the deficit are moving in different directions.

We are in uncharted territory. In an extended boom, our budget should be in balance. We need to eliminate current deficits to relieve pressure on interest rates, to ensure resources are available for countercyclical fiscal policy the next time the economy stumbles, and to properly finance the programs we have decided to provide. The current pattern is crazy, and willful bad behavior should not be used as an excuse to cut valuable programs for older Americans like Social Security and Medicare.