High vs Low Incomes: How Retirement Outlooks Diverge

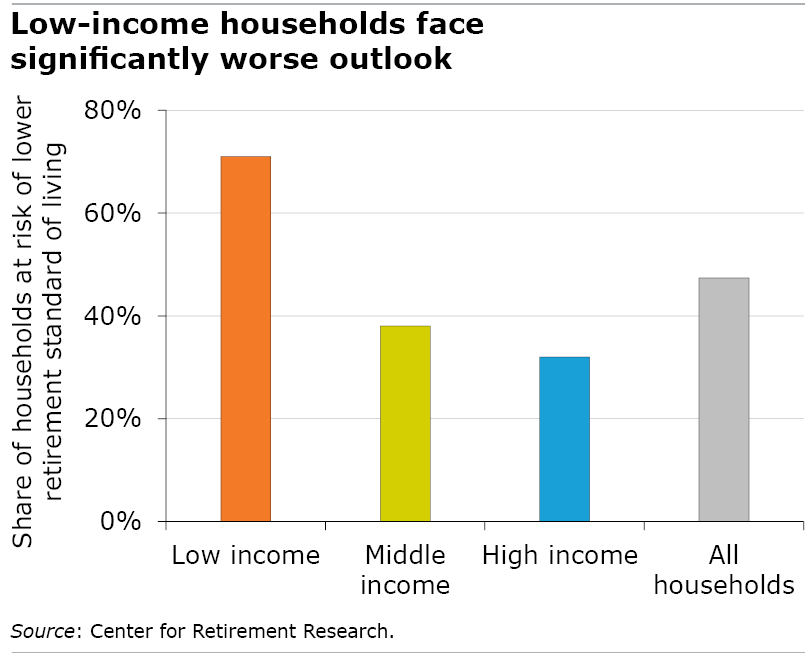

Roughly three out of four low-income households might not have enough money to maintain even their modest standard of living after they retire.

This sobering finding comes in a refinement by the Center for Retirement Research of its periodic look at workers’ retirement prospects.

The center’s researchers use the data in the Federal Reserve’s periodic Survey of Consumer Finances to estimate how workers are doing. And time after time, they arrive at a similar conclusion: in the 2019 survey, roughly half of all working households were at risk of falling at least 10 percent short of the income they’ll need to maintain their current living standard in retirement.

But a second analysis of the 2019 data split the households into three different income groups. To better reflect real-world decisions about when people usually retire, the researchers used a different age for when each group signs up for Social Security – instead of the assumption in the prior estimate that everyone signs up at 65.

Studies have shown that low-income workers retire fairly early. So, rather than 65, the analysis assumed they would start their Social Security at 62, highlighting that 71 percent are in a precarious financial situation.

The age for the middle-income older households increased from 65 to 66, which put just 38 percent at risk of a future drop in their living standard. Predictably, even fewer in the high-income group are at risk – 32 percent – using 67, rather than 65, since they tend to delay their Social Security.

Starting their retirement benefits so early worsens low-income workers’ financial prospects for two reasons. It cuts the size of their monthly Social Security checks, and it shortens their careers, slightly reducing the money they would’ve had if they’d worked longer. Increasing the claiming age for high-income workers significantly increases their Social Security income and the already considerable financial resources they take into retirement.

The estimates for each income group don’t mean that the original, aggregate estimate is wrong. In fact, the new analysis using different claiming ages gets a similar overall result as the original 2019 calculation: 47 percent of all working households are at risk of a lower standard of living.

The advantage of assessing each income group’s risk separately is a more accurate picture and one that exposes the degree to which low-income workers are vulnerable.

Squared Away writer Kim Blanton invites you to follow us @SquaredAwayBC on X, formerly known as Twitter. To stay current on our blog, join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

Is there data showing why lower-income workers retire early? Our group of higher-income earners deliberately extended careers to assure a better chance of maintaining our standard of living. Curious if this is a consideration for lower-earning workers or if health is a major factor in retiring at 62.

Low earners tend to be in physically demanding jobs that get harder with age while high earners are more often in office jobs that can be maintained even as one’s joints stiffen and muscles are weaker. Also, low earners have more health problems and poorer health insurance, making retirement often obligatory rather than a matter of choice. Finally, low earners are less likely to have pensions or 401k’s to supplement their Social Security. As a rich country, we are failing at supplying a basic safety net.

Can there be definitions of:

Low Income

Middle Income

High Income ?

Michael – A good question, and I should’ve included the income information in the blog!

In the case of single households, making less than $35,000 is considered low income; $35,000-$60,000 is middle income; and more than $60,000 is high income. The ranges for couples are less than $75,000; $75,000-$135,000; and more than $135,000 for high income.