Millions to Lose Health Coverage if ACA Tax Credits End

If providing healthcare to more Americans is the goal, the COVID-era tax credits for people buying insurance on the Affordable Care Act (ACA) marketplaces have been a big success.

Enrollment in ACA policies has doubled to a record 24 million since 2021, when Congress approved the credits, which reduced monthly premiums by hundreds of dollars and ensured that health insurance was affordable during the pandemic. The Inflation Reduction Act of 2022 extended the subsidies through the end of this year.

But the tax credits would not be renewed under some budget proposals being considered in the House.

Without them, the Urban Institute has estimated enrollment in ACA policies would decline by more than 7 million and that 4 million of these people would not be able to find an affordable alternative. The toll over the long term could be even higher.

The federal government pays the tax credits directly to insurers, which pass them on to consumers in the form of lower premiums. Although the credits reduce premiums, deductibles are unaffected. As a result, policy holders often are still paying high out-of-pocket costs for their physician visits, tests, surgeries, and treatments.

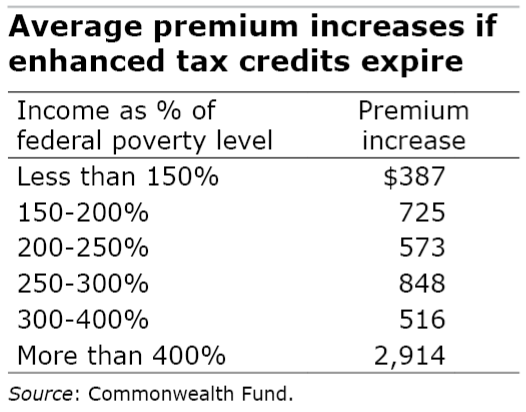

Who in particular would be hurt if Congress does not renew the generous credits? Researchers at the Commonwealth Fund, KFF, and the Urban Institute have looked closely at who would be most affected.

One obvious group would be the many lower-income workers currently paying under $10 a month for marketplace plans. But the credits cut the cost of insurance for working- and middle-class Americans too. The 2021 legislation even extended tax credits to people earning more than 400 percent of the federal poverty level – $62,600 for an individual and $128,600 for a family of four in 2025 – and capped their premiums at 8.5 percent of household income.

If the credits expire at the end of 2025, however, premiums would increase $1,500 a month on average for a 60-year-old couple earning $85,000, KFF estimates. A large share of the people receiving credits are self-employed workers, small business owners, and people who are over 50 but still too young for Medicare.

Other vulnerable groups are Blacks and Hispanics, who disproportionately rely on the tax credits that drove down their premiums – gains that would be reversed if premiums rise. Young adults may also drop their coverage if they deem the cost as too high, possibly destabilizing a market that benefits from higher enrollment by younger, healthier people.

Residents in rural communities and in the 10 states that have not expanded Medicaid are also disproportionately dependent on ACA insurance – both for the coverage itself and for the support it provides to local healthcare economies.

If the tax credits expire, causing a surge in premiums, 2.5 million people are likely to drop their insurance in the 10 non-expansion states – Alabama, Florida, Georgia, Kansas, Mississippi, South Carolina, Tennessee, Texas, Wisconsin, and Wyoming – the Urban Institute says. This compares with 1.5 million people who would lose coverage in the other 40 states that did expand Medicaid.

In expansion states, health insurance is more accessible to lower-income workers because the ACA also increased the income cap on Medicaid eligibility to 138 percent of the poverty level for states that agree to increase Medicaid enrollment. In the non-expansion states, the cap has remained at the poverty level, pushing more people into private policies on the ACA marketplaces.

But here’s the rub about the tax credits: they are a more than $10 billion budget item. The question facing Congress is whether they’re willing to allow a sharp rise in millions of constituents’ monthly insurance premiums.

Squared Away writer Kim Blanton invites you to follow us @SquaredAwayBC on X. To stay current on our blog, join our free email list. You’ll receive an email each week – with a link to the week’s article – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Basic health care should be a right, not a privilege. Even with the ACA in force, tens of millions of Americans lack health insurance, and the planned cuts will greatly increase this number. Call and write your federal rep and senators and demand they reject this planned cut.

First of all, some facts. This is how the expansion affected the required premiums:

Pre-ARPA vs. ARPA-Expanded Subsidy Table

Up to 150% FPL 2.07% 0% (Fully subsidized)

150% – 200% FPL 4.14% – 6.52% 0% – 2%

200% – 250% FPL 6.52% – 8.33% 2% – 4%

250% – 300% FPL 8.33% – 9.83% 4% – 6%

300% – 400% FPL 9.83% 6% – 8.5%

Above 400% FPL No subsidy 8.5% max of income

So I have trouble in getting to Urban’s numbers.

Second, apart from the cost to the taxpayer, all this largesse erodes the employer sponsored healthcare system. Employers get subsidies for providing insurance to low wage workers, but these weren’t expanded because the long term goal of the left wing of the Democratic Party is Medicare for all. I don’t know how much of this got incorporated into the Urban model.